I last wrote about crude oil on Barchart on August 14, where I concluded:

Crude oil is leaning lower in August 2025, with the odds of a challenge to the 2025 lows rising. However, the volatile Middle East could turn the bear into a bull in the blink of an eye. Trading in crude oil rather than investing, could be optimal over the coming weeks and months. The August 15 meeting between Presidents Trump and Putin could cause significant price volatility in the crude oil market.

The nearby November NYMEX crude oil futures contract settled $61.47 on August 13, with November NYMEX gasoline futures at $1.8554, and November NYMEX heating oil futures, which serves as a proxy for distillate fuels, at $2.2266 per gallon wholesale. Oil and oil product prices have moved slightly higher from the mid-August levels, but could be heading lower over the coming weeks and months as the energy markets move toward winter.

OPEC+ continues to increase production to retain market share

At the most recent OPEC+ meeting, the international petroleum cartel agreed to further increase output from October. However, Saudi Arabia, the leading cartel member, is attempting to regain market share by slowing the pace of increases because of weakening global demand.

According to Jorge Leon, a former OPEC official and currently an analyst at Rystad, “The barrels may be small, but the message is big. The increase is less about volumes and more about signaling- OPEC+ is prioritizing market share even if it risks softer prices.”

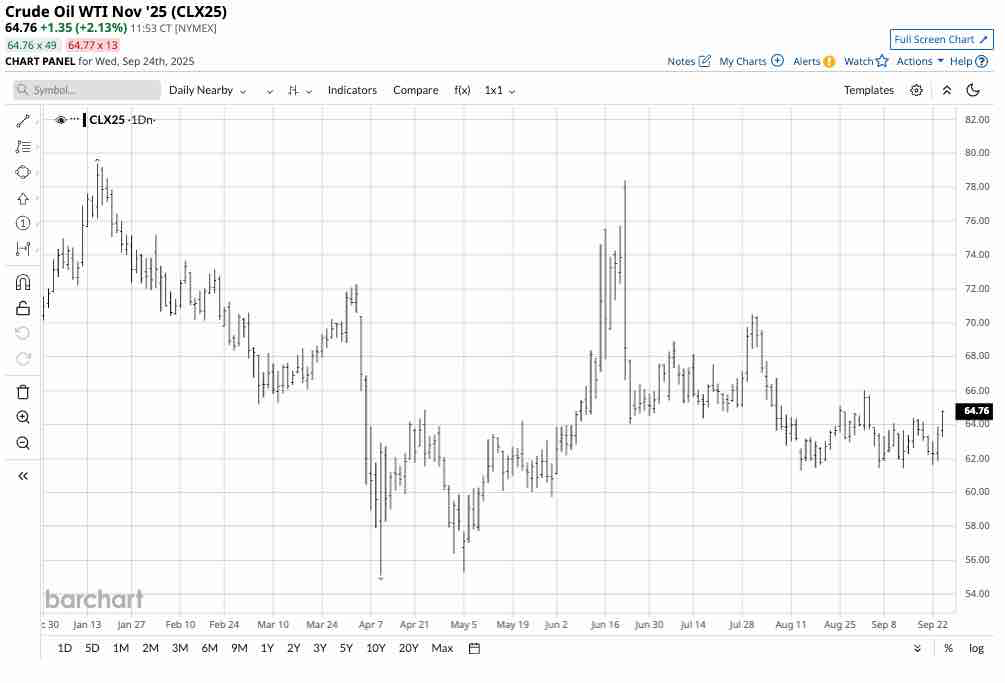

The daily year-to-date continuous NYMEX crude oil futures chart illustrates the energy commodity has been in a 2025 range from $55.12 to $79.39 per barrel. At the $64.75 level in September, NYMEX crude oil futures are closer to the bottom end of this year’s trading range.

U.S. energy policy favors lower prices

OPEC+ is attempting to maintain its pricing dominance with increasing U.S. output on the horizon. U.S. energy policy underwent a 180-degree shift in January 2025 as President Trump’s “drill-baby-drill” and “frack-baby-frack” approach to fossil fuels replaced the Biden administration’s green energy initiatives, which had inhibited fossil fuel production and consumption in favor of alternative and renewable energy sources to combat climate change.

The bottom line is that increased U.S. petroleum production, which achieves energy independence and turns the U.S. into a competing exporter, will limit OPEC+’s dominance. Moreover, increasing oil output that lowers prices could keep inflationary pressures in check, leading to lower interest rates, a critical goal for the Trump administration.

Technical levels to watch in NYMEX crude oil futures

The year-to-date daily NYMEX crude oil chart for November delivery highlights a bearish trend with the energy commodity near its first technical support level.

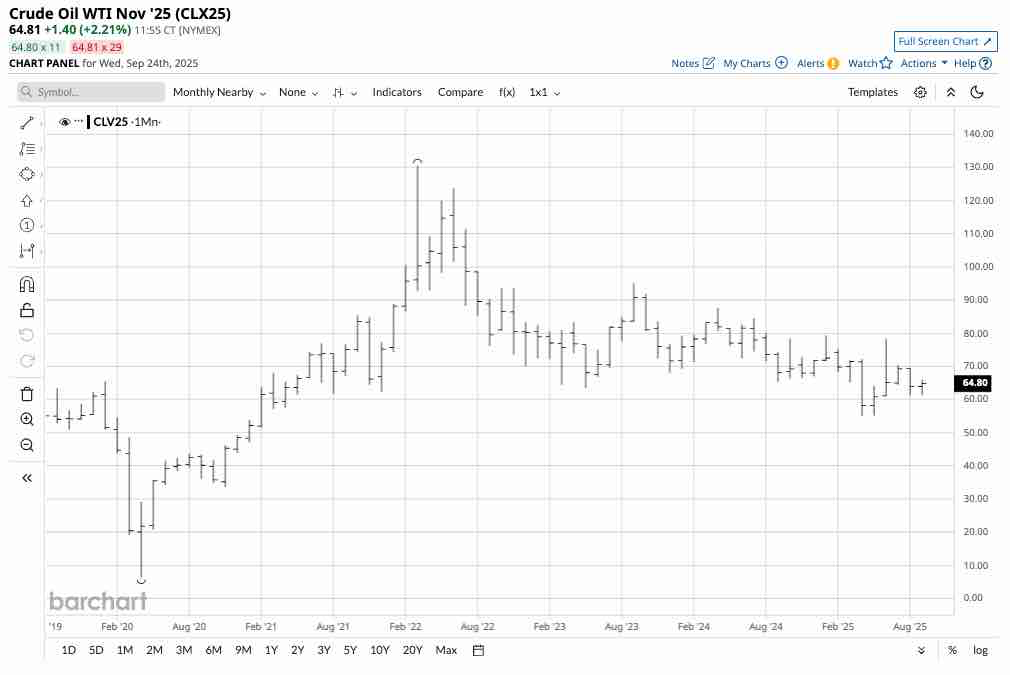

The monthly chart highlights that the first technical support level for November WTI futures is at the August 19 low of $61.29 per barrel level, with short-term resistance at the early September high of $66.03 per barrel.

Crude oil’s path of least resistance will determine the direction of oil product prices.

Technical levels to watch in NYMEX gasoline futures

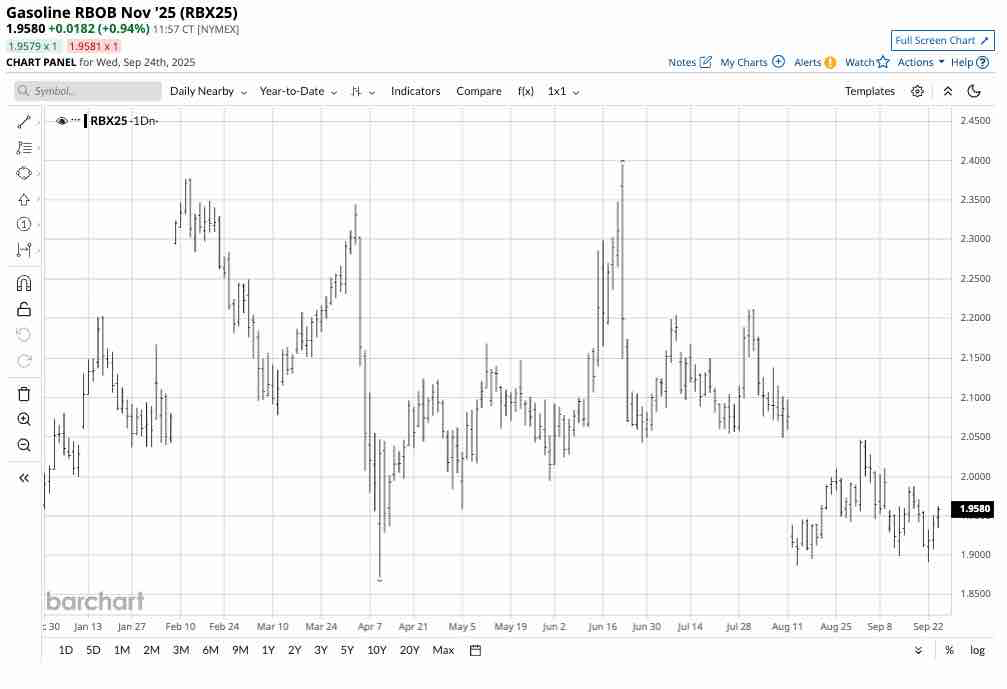

Gasoline is a seasonal fuel. Prices tend to peak during spring and summer and decline during late fall and winter as poor weather conditions cause drivers to put fewer miles on their odometers.

As the 2025 daily chart of NYMEX November gasoline futures illustrates, the price has declined below $2 per gallon in late September as the offseason for demand has started. Technical support is at the April 2025, low of $1.8720 with the first resistance level at the September 2, 2025, high of $2.0466 per gallon wholesale. The trend in gasoline futures is bearish in late September 2025 as the fuel heads into the low-demand season.

Technical levels to watch in NYMEX heating oil futures

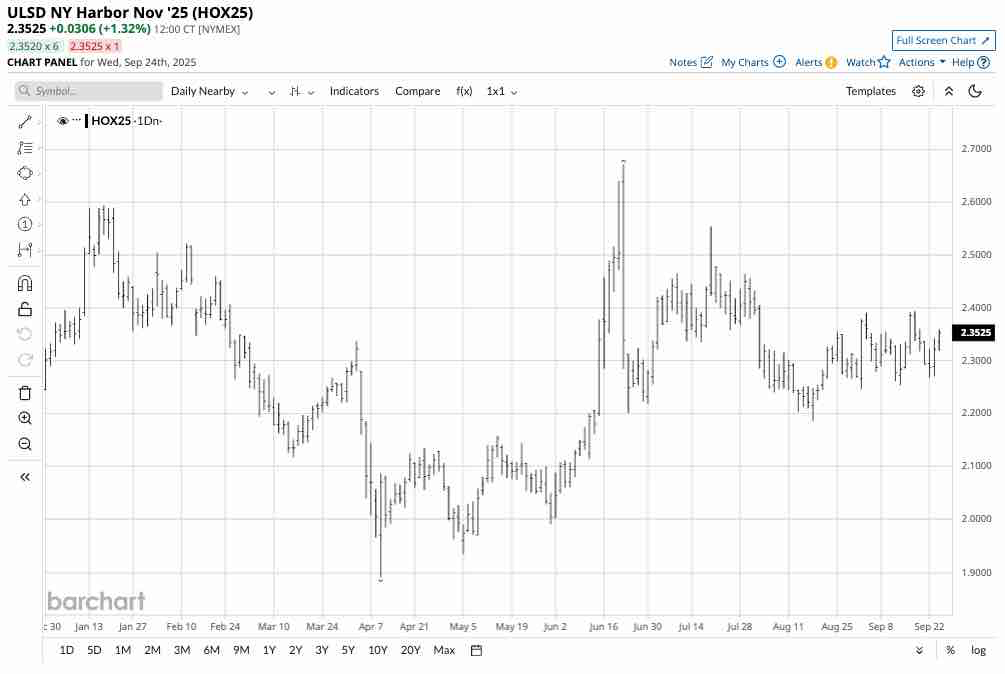

Heating oil is a proxy for other distillates, including jet fuel and diesel fuel. Distillate futures prices tend to have far less seasonality than gasoline futures.

The daily year-to-date chart of NYMEX heating oil futures shows at around $2.35 per gallon in late September, technical support is at the August 18, 2025, low of $2.1862 per gallon, with the first resistance level at the September 17, 2025, high of $2.3933 per gallon wholesale.

Geopolitical events, particularly in the Middle East, always have the potential to cause substantial price volatility in the crude oil and oil product futures markets. However, as the markets head towards October and beyond, OPEC+’s production increases and U.S. energy policy continues to support lower prices for the energy commodities that continue to power the world.