While crude oil, oil products, and natural gas trade in highly liquid CME NYMEX and ICE futures markets, ethanol swaps for delivery in Chicago also trade on the same exchange; however, they are far less liquid than the oil and gas futures. Coal for delivery in Rotterdam, the Netherlands, trades on the Intercontinental Exchange and is also far less liquid than oil and gas futures. Coal prices have been trending lower in 2025, while ethanol swap prices have trended higher since the end of 2024.

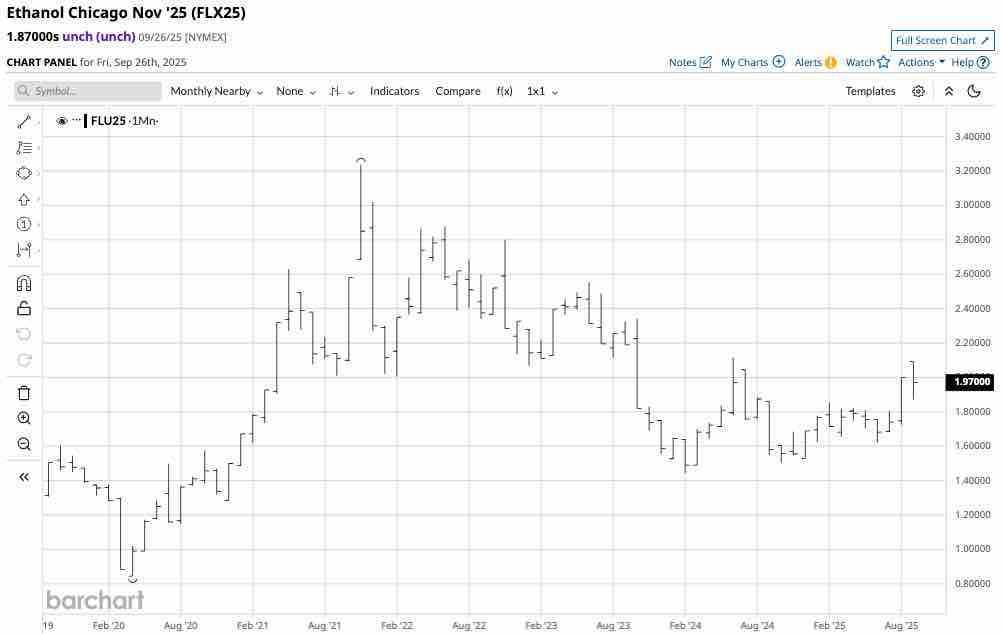

Ethanol trends higher since early 2024

Chicago ethanol swaps reached a low of $0.8450 per gallon wholesale in April 2020 as the global pandemic gripped markets across all asset classes.

The monthly chart highlights ethanol’s over 283% rally to the high of $3.2375 per gallon in November 2021. After a 55.4% decline to the February 2024 low of $1.4450 per gallon, the swap futures have made higher lows and higher highs and were at the $1.87 level in late September 2025.

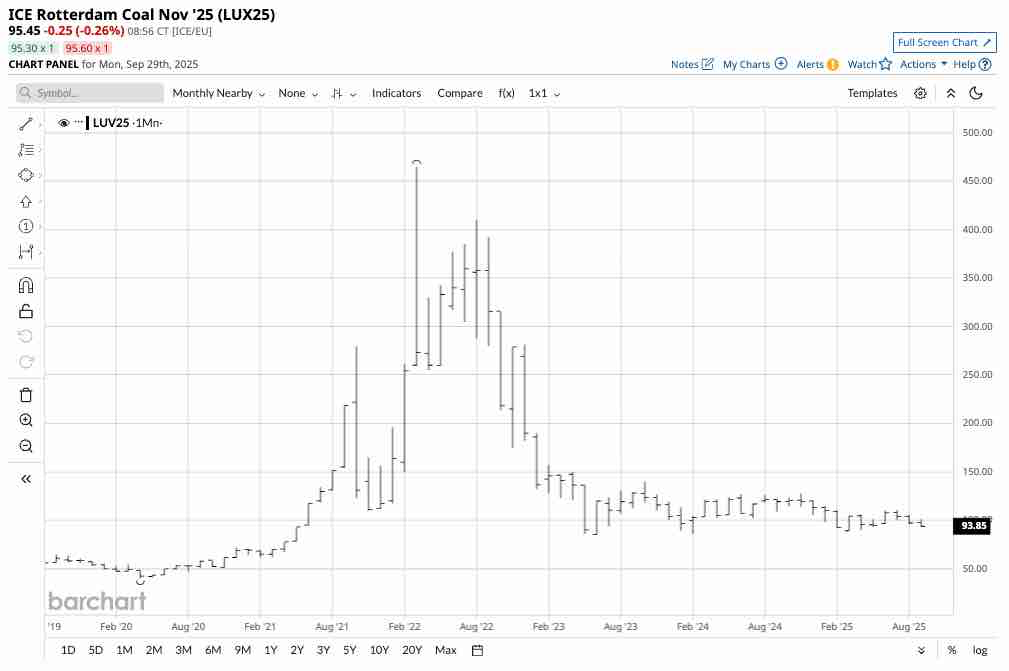

Coal is in a mostly sideways trend with a bearish bias

Coal futures prices for delivery in Rotterdam, the Netherlands, reached a pandemic-inspired low of $40.30 per metric ton in April 2020.

The monthly chart illustrates the Rotterdam coal futures’ 1,054% explosive rally to a high of $465 per ton in March 2022 when Russia invaded Ukraine, pushing energy prices to highs. Since then, coal has been in a bearish trend, falling to a low of $85 in June 2023, and has been trading in a sideways bearish consolidation trend between $86 and $127.85 per ton since July 2023.

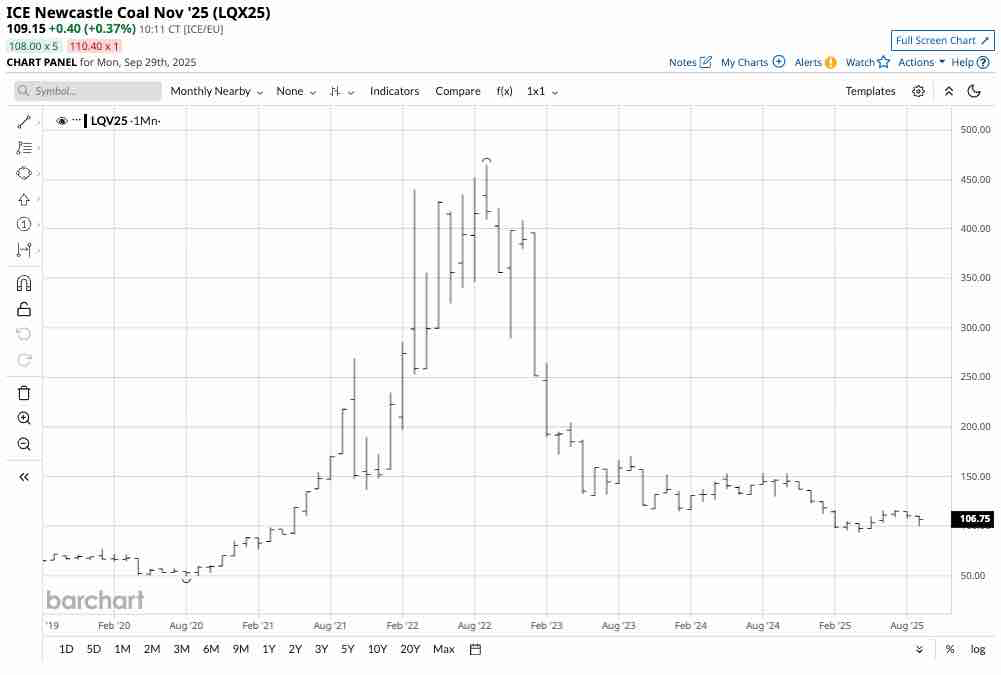

The monthly chart of coal for delivery in Newcastle, Australia, displays a similar price pattern to the Rotterdam coal futures.

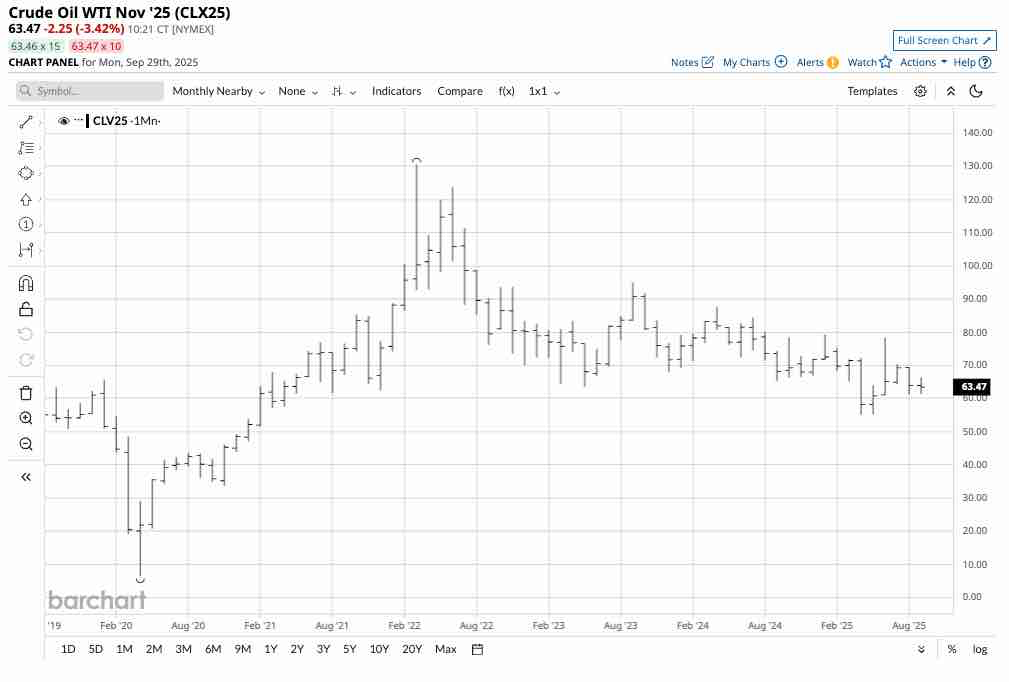

Coal and ethanol reflect the price action in crude oil, which has a bearish bias

While coal and ethanol are energy commodities, crude oil remains the primary energy source that powers the world. Therefore, the prices of coal and ethanol correlate with those of petroleum.

The monthly chart shows a similar pattern to ethanol swaps and Rotterdam and Newcastle coal prices, with NYMEX crude oil prices falling to a pandemic-inspired low in April 2020, recovering to a high in March 2022, and trading in a range between $55.12 and under $80 per barrel in 2025. While ethanol displays a slightly bullish bias, coal and petroleum prices have a marginally bearish bias.

U.S. energy policy and OPEC+ influence coal and ethanol- China and India burn lots of coal

U.S. energy policy underwent a 180-degree shift in January 2025 when the Trump administration took over from the Biden administration. After four years of addressing climate change through supporting alternative and renewable fuels and inhibiting fossil fuel production and consumption, President Trump has embraced a “drill-baby-drill” and “frack-baby-frack” approach to oil, gas, and coal to support U.S. energy independence, reduce prices to combat inflation, and make the U.S. a leading petroleum and gas exporter. The Trump administration’s energy policy approach has kept pressure on crude oil prices. A decline in EV demand has supported ethanol, as gasoline-powered vehicles will benefit from the lack of an EV mandate.

Meanwhile, the two most populous countries, India and China, continue to burn coal to generate power or electricity. Therefore, Rotterdam and Newcastle coal prices could be close to bottoms at the current price levels.

Levels to watch in Rotterdam/Newcastle coal and Chicago ethanol swaps

Technical support and resistance levels for the coal and ethanol swap markets on the monthly charts are as follows:

- Ethanol: Monthly support is at the June 2025 low of $1.6225, with resistance at the June 2024 high of $2.1150 per gallon wholesale levels.

- Rotterdam coal: Monthly support is at the June 2023 low of $85.00, with resistance at the November 2024 high of $127.85 per ton.

- Newcastle coal: Monthly support is at the April 2025 low of $93.25, with resistance at the May 2024 high of $153.50 per ton.

U.S. tariffs, energy policy, Chinese economic growth or contraction, and fundamental supply and demand factors will determine the path of least resistance of ethanol and coal prices over the coming months. Ethanol faces the offseason for demand, while coal is moving into the peak season for demand in the Northern Hemisphere as heating demand rises during winter.

Crude oil is a highly liquid market in the futures arena, whereas ethanol and coal futures have far less open interest and daily volumes, which increases the odds of price volatility.