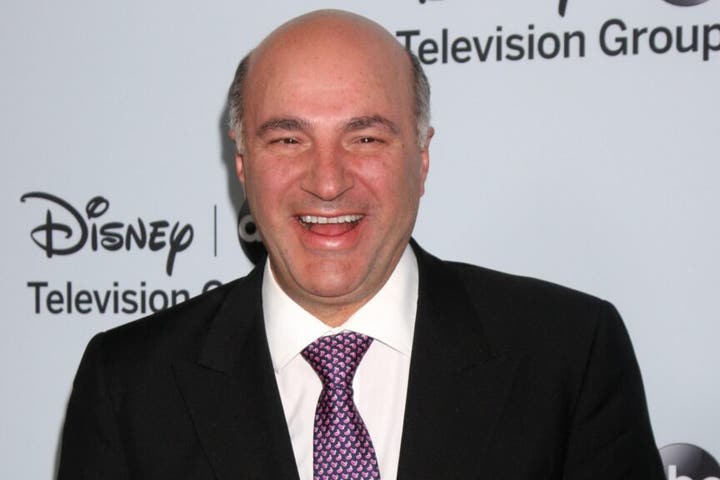

Investor Kevin O’Leary admits that the best portfolio he’s ever come across didn’t belong to a hedge fund manager, but his mother, Georgette O’Leary.

What Happened: Speaking on the Diary of A CEO podcast on Monday, the Shark Tank investor revealed that his mother had managed a personal portfolio for over five decades in absolute secrecy. “She kept her account secret from both of her husbands,” O'Leary said. “She wanted her own independent money.”

Her strategy, he says, was simple, but disciplined. She would take 20% of her paycheck each week, allocating it to two asset classes, “stocks that paid dividends, large-cap stocks and telco bonds,” he says.

O’Leary notes that her portfolio followed two important rules: she never invested more than 5% in any one stock or bond, and never had more than 20% in any one sector. When a holding exceeded those thresholds, she trimmed it. Most importantly, he says, she never touched the principal, only spending the dividends and interest.

The result? O’leary recalls being shocked after her passing when a lawyer revealed her portfolio. “The performance was extraordinary. It was beyond any hedge fund guy or anything.”

Stunned by what he saw, O'Leary adopted her strategy for his investing. “That's how I'm going to invest for the rest of my life, exactly the way Georgette did.”

Why It Matters: O’leary, popularly referred to as “Mr. Wonderful,” has long held that “it’s impossible to time the market,” not unlike other prominent investors such as Warren Buffett, who has been reiterating similar thoughts for the past several decades.

Instead, O’leary suggests diversifying investments, while holding them through thick and thin. He believes that investors cannot predict the market’s ups and downs, and merely trying to do so can cost them dearly.

His investment philosophy, even today, is deeply inspired by his mother, with every stock or fixed income investment generating yield, which he then uses to support his family's lifestyle and charitable commitments.

Read More:

Photo courtesy: Kathy Hutchins / Shutterstock.com