Workday, Inc. (WDAY) is an enterprise cloud software company that develops and delivers on-demand applications for financial management, human capital management, analytics and planning to organizations worldwide. The company’s platform helps businesses streamline core functions such as accounting, payroll, workforce management and reporting across industries including technology, healthcare, education and government. Workday is headquartered in Pleasanton, California, and has a market cap of almost $50 billion.

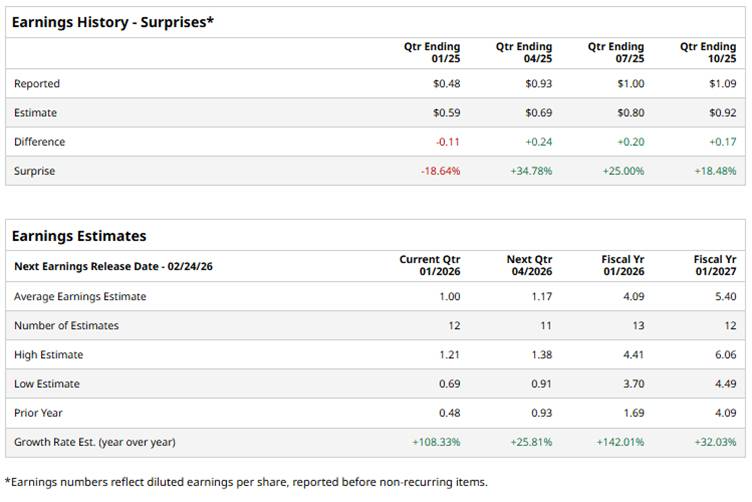

The software company is expected to announce its fiscal fourth-quarter earnings for 2026 in the near term. Ahead of the event, analysts expect WDAY to report a profit of $1.00 per share on a diluted basis, up 108.3% from $0.48 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect WDAY to report EPS of $4.09, up 142% from $1.69 in fiscal 2025. Its EPS is expected to rise 32% year-over-year to $5.40 in fiscal 2027.

WDAY has underperformed the S&P 500 Index’s ($SPX) 13.3% gains over the past 52 weeks, with shares down 26.7% during this period. Similarly, it underperformed the State Street Technology Select Sector SPDR ETF’s (XLK) 21.2% gains over the same time frame.

Workday’s shares have been sliding largely due to broader weakness in enterprise software stocks, as investors rotate away from software and towards other sectors. WDAY recently hit a 52-week low of $180.83 on Jan. 20, reflecting persistent caution around its growth trajectory, even though recent earnings beat expectations. Additionally, competitive worries around AI and slower-than-expected subscription revenue growth have clouded near-term sentiment, keeping the stock under pressure.

Analysts’ consensus opinion on WDAY is cautiously bullish, with a “Moderate Buy” rating overall. Out of 42 analysts covering the stock, 26 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and 13 give a “Hold.” WDAY’s average analyst price target is $273.61, indicating a potential upside of 49.5% from the current levels.