/Union%20Pacific%20Corp_%20logo%20on%20side%20of%20train%20car-by%20Joseph%20Creamer%20via%20Shutterstock.jpg)

Omaha, Nebraska-based Union Pacific Corporation (UNP) connects 23 states in the western two-thirds of the country by rail, providing a critical link in the global supply chain. With a market cap of $140.5 billion, Union Pacific ships just about anything: food, forest products, automobiles, agricultural products, coal, chemicals, and more.

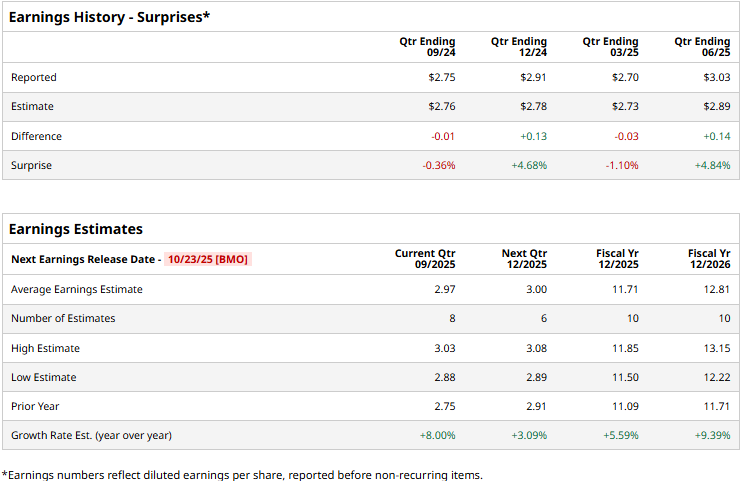

The railroad giant is gearing up to release its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect UNP to report an adjusted profit of $2.97 per share, up 8% from $2.75 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates twice over the past four quarters, while missing the projections on two other occasions.

For the full fiscal 2025, analysts expect UNP to report an adjusted EPS of $11.71, up 5.6% from $11.09 in 2024. In fiscal 2026, its earnings are expected to surge 9.4% year-over-year to $12.81 per share.

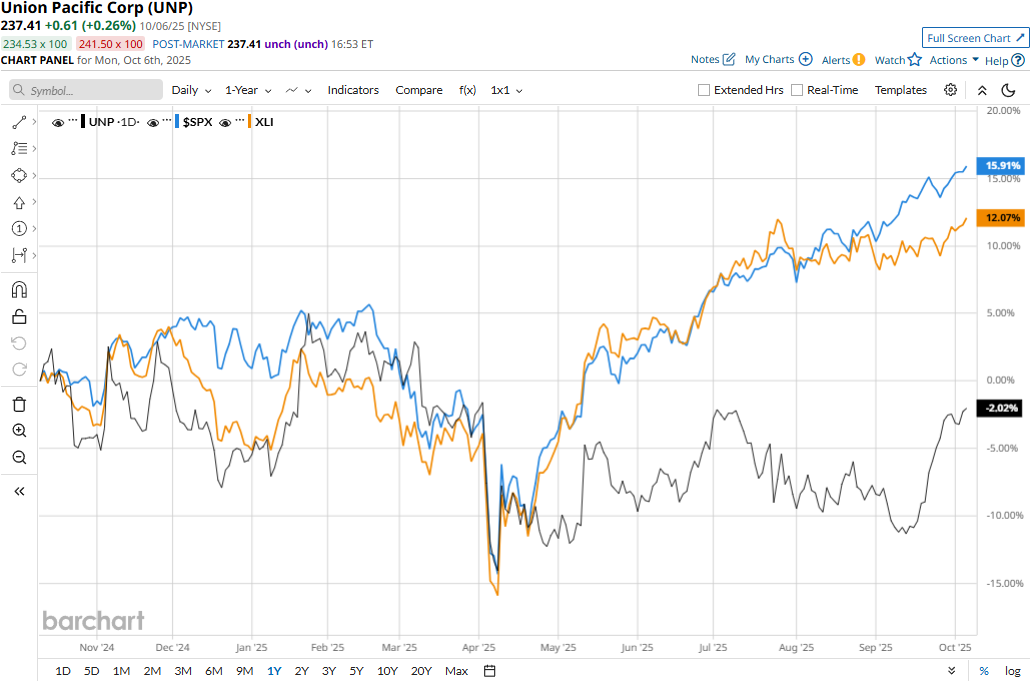

UNP stock prices have observed a marginal 61 bps dip over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.2% surge and the Industrial Select Sector SPDR Fund’s (XLI) 14.5% returns during the same time frame.

Despite delivering better-than-expected results, Union Pacific’s stock prices declined 4.5% in the trading session following the release of its Q2 results on Jul. 24. The company’s operating revenues came in at $6.2 billion, up 2.4% year-over-year, benefitting from higher volume and solid core pricing gains which were partially offset by reduced fuel surcharge, business mix, and lower other revenue. Further, its adjusted net income surged 8.9% year-over-year to $1.8 billion, and its adjusted EPS of $3.03 surpassed the consensus estimates by 4.8%.

Following the initial dip, UNP stock prices maintained a positive momentum for two subsequent trading sessions.

Analysts remain optimistic about the stock’s prospects. UNP maintains a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 15 “Strong Buys,” one “Moderate Buy,” and nine “Holds.” Its mean price target of $263.13 suggests a 10.8% upside potential from current price levels.