/M%20%26%20T%20Bank%20Corp%20site%20and%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $31.3 billion, M&T Bank Corporation (MTB) is a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association. It provides a wide range of retail, commercial, and institutional banking products and services across several U.S. states and the District of Columbia.

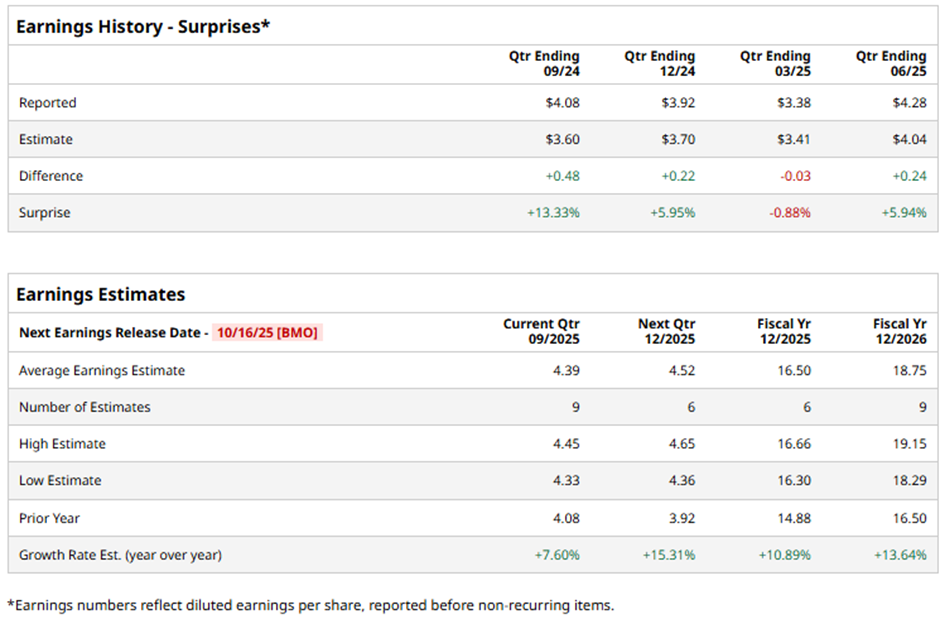

The Buffalo, New York-based company is expected to announce its fiscal Q3 2025 results before the market opens on Thursday, Oct. 16. Ahead of this event, analysts expect M&T Bank to report an adjusted EPS of $4.39, up 7.6% from $4.08 in the year-ago quarter. However, the company has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect M&T Bank to report an adjusted EPS of $16.50, up 10.9% from $14.88 in fiscal 2024. In addition, EPS is anticipated to grow 13.6% year-over-year to $18.75 in fiscal 2026.

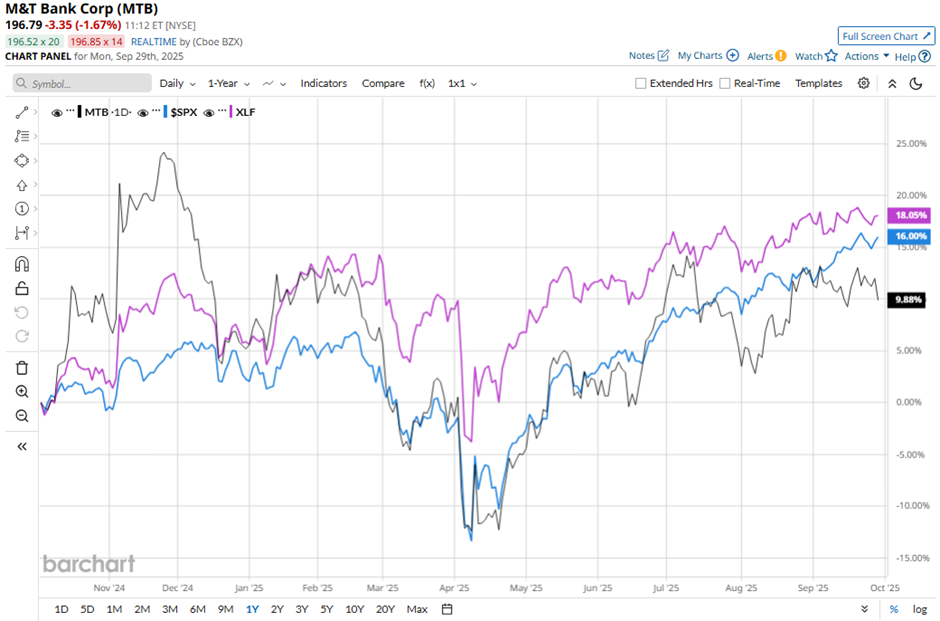

Shares of M&T Bank have risen 12.7% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.3% gain and the Financial Select Sector SPDR Fund's (XLF) 19.3% return over the period.

Despite beating expectations with Q2 2025 adjusted EPS of $4.28, M&T Bank shares fell 2.4% on Jul. 16. Net interest income declined to $1.72 billion, while deposits slipped to $164.5 billion. Rising expenses of $1.34 billion and continued margin headwinds overshadowed the earnings beat, dampening investor sentiment.

Analysts' consensus view on MTB stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 22 analysts covering the stock, 11 recommend "Strong Buy," two suggest "Moderate Buy," eight indicate “Hold,” and one has a "Strong Sell."

The average analyst price target for M&T Bank is $221.33, indicating a potential upside of 12.5% from the current levels.