/Fiserv%2C%20Inc_%20offices-by%20JHVEPhoto%20via%20iStock.jpg)

Milwaukee, Wisconsin-based Fiserv, Inc. (FI) provides payments and financial technology services. Valued at $68.8 billion by market cap, the company provides solutions for customer deposit and loan accounts, digital banking, and financial and risk management. FI also manages card processing, cardless ATM services, and non-card digital payment solutions for financial institutions and corporate clients. The fintech giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 29.

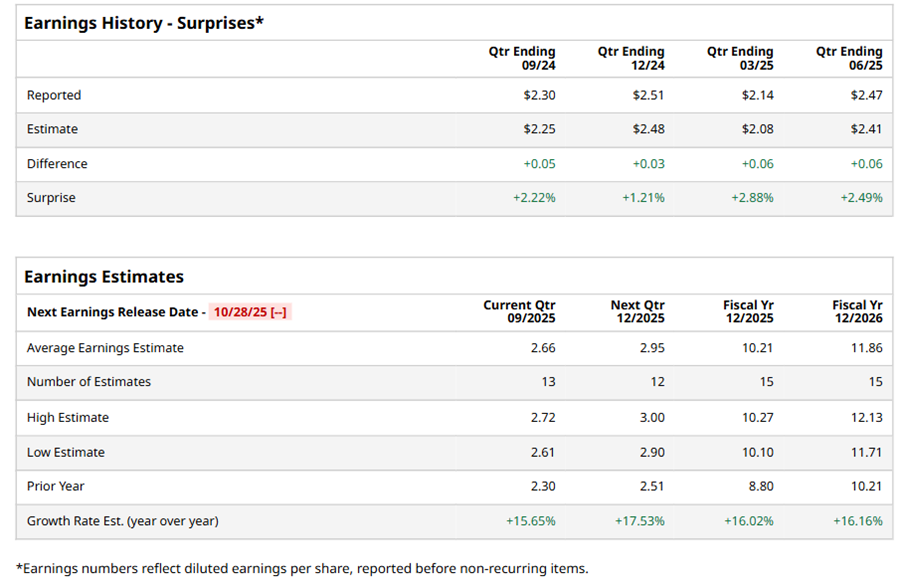

Ahead of the event, analysts expect FI to report a profit of $2.66 per share on a diluted basis, up 15.7% from $2.30 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect FI to report EPS of $10.21, up 16% from $8.80 in fiscal 2024. Its EPS is expected to rise 16.2% year-over-year to $11.86 in fiscal 2026.

FI stock has notably underperformed the S&P 500 Index’s ($SPX) 17.4% gains over the past 52 weeks, with shares down 32.7% during this period. Similarly, it considerably underperformed the Technology Select Sector SPDR Fund’s (XLK) 27.5% gains over the same time frame.

Fiserv shares plummeted 13.9% on Jul. 23 following its Q2 earnings release. The company's revenue rose 8% year-over-year to $5.5 billion, meeting consensus estimates. Its adjusted EPS grew 16% from the year-ago quarter to $2.47, beating analyst expectations by 2.5%. However, slower growth in its Clover payment services platform, driven by seasonal factors and unfavorable year-over-year comparisons, sparked investor concerns, driving the stock down.

Analysts’ consensus opinion on FI stock is bullish, with a “Strong Buy” rating overall. Out of 34 analysts covering the stock, 24 advise a “Strong Buy” rating, four suggest a “Moderate Buy,” five give a “Hold,” and one recommends a “Strong Sell.” FI’s average analyst price target is $184.43, indicating an ambitious potential upside of 45.8% from the current levels.