/Fedex%20Corp%20package-by%20TY%20Lim%20via%20Shutterstock.jpg)

Memphis, Tennessee-based FedEx Corporation (FDX) is the leader in global express delivery services, providing transportation, e-commerce, and business services in the U.S. and internationally. With a market cap of $58.4 billion, FedEx operates through the FedEx Express and FedEx Freight segments.

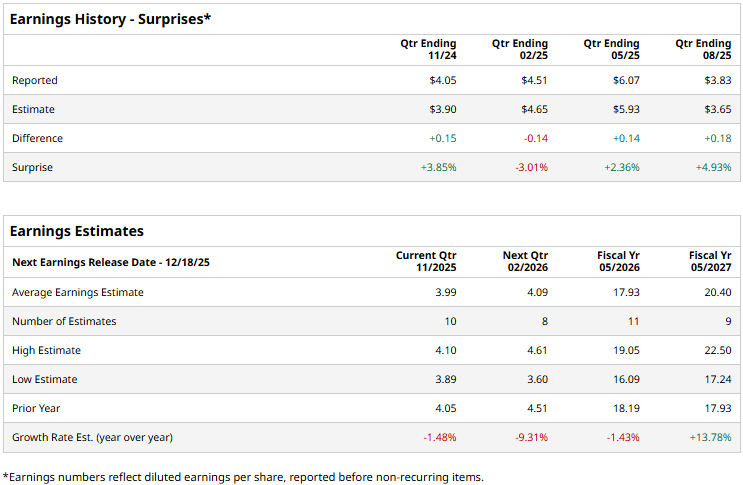

The freight and logistics giant is expected to release its second-quarter results by mid-December. Ahead of the event, analysts expect FedEx to report an adjusted profit of $3.99 per share, down 1.5% from $4.05 per share reported in the year-ago quarter. While the company has missed analysts’ bottom-line estimates once over the past four quarters, it has surpassed the expectations on three other occasions.

For the full fiscal 2026, FDX is expected to report an adjusted EPS of $17.93, down 1.4% from $18.19 in fiscal 2025. While in fiscal 2027, earnings are expected to surge 13.8% year-over-year to $20.40 per share.

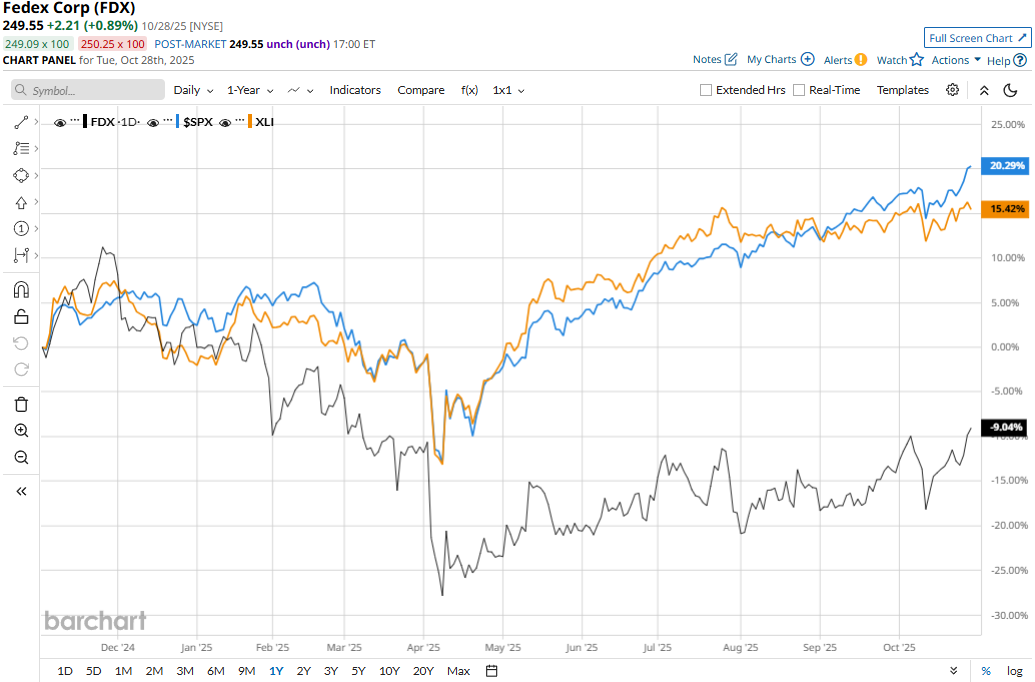

FDX stock prices have declined 9.4% over the past 52 weeks, notably underperforming the Industrial Select Sector SPDR Fund’s (XLI) 13.9% returns and the S&P 500 Index’s ($SPX) 18.3% surge during the same time frame.

FedEx’s stock prices gained 2.3% in the trading session following the release of its better-than-expected Q1 results on Sept. 18. Driven by the solid growth observed in its express segment, the company’s overall topline for the quarter grew 3.1% year-over-year to $22.2 billion, beating the Street’s expectations by 2.2%.

Meanwhile, the company has been focused on improving its operational efficiency by leveraging its extensive network, which moves 17 million packages daily. Its strategic initiatives have led to notable margin improvements. FedEx’s adjusted EPS for the quarter grew 6.4% year-over-year to $3.83, beating the consensus estimates by 4.9%. Further, the company remains committed to reducing its costs by $1 billion permanently from its structural cost reductions.

Analysts remain optimistic about the stock’s prospects. FDX has a consensus “Moderate Buy” rating overall. Of the 30 analysts covering the stock, opinions include 15 “Strong Buys,” two “Moderate Buys,” 11 “Holds,” and two “Strong Sells.” Its mean price target of $264.61 suggests a 6% upside potential from current price levels.