With a market cap of $8.7 billion, Conagra Brands, Inc. (CAG) is a leading North American packaged foods company with a diverse portfolio of iconic brands such as Birds Eye, Healthy Choice, Slim Jim, Reddi-wip, and Marie Callender’s. Operating across four segments: Grocery & Snacks; Refrigerated & Frozen; International; and Foodservice, the company delivers innovative food products tailored to evolving consumer preferences.

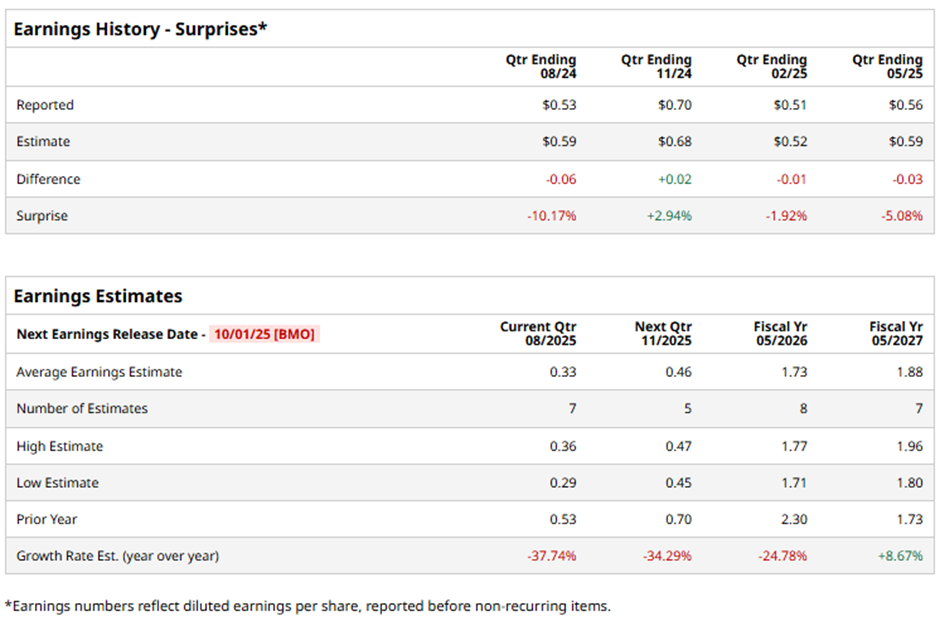

The Chicago, Illinois-based company is slated to announce its Q1 2026 results before the market opens on Wednesday, Oct. 1. Analysts expect Conagra Brands to report adjusted EPS of $0.33 for the quarter, down 37.7% from $0.53 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2026, analysts forecast CAG to report an adjusted EPS of $1.73, representing a 24.8% decrease from $2.30 in fiscal 2025. However, adjusted EPS is anticipated to grow 8.7% year-over-year to $1.88 in fiscal 2027.

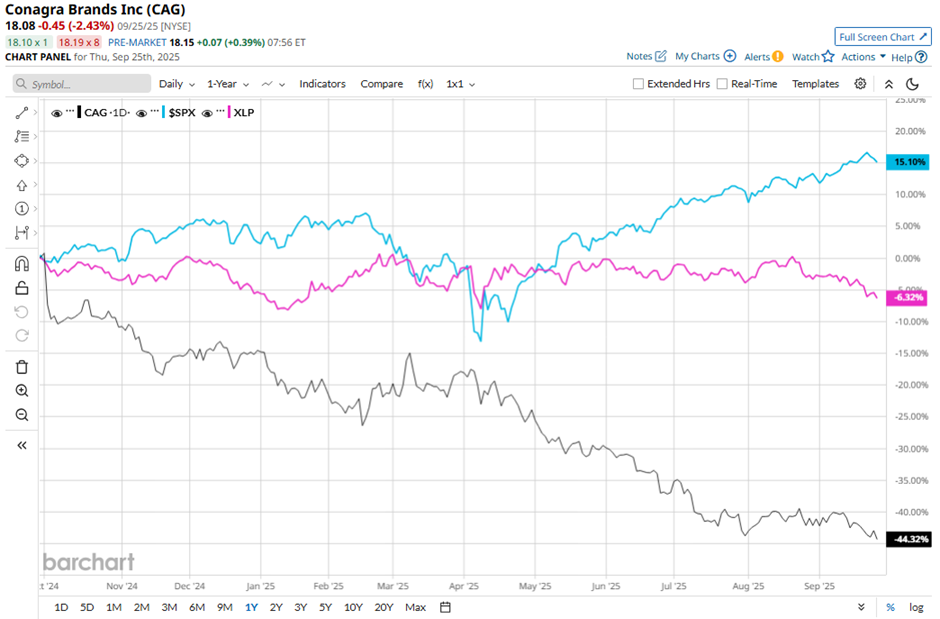

Shares of Conagra Brands have dropped over 44% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.4% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.9% decline over the same period.

Shares of CAG fell 4.4% on Jul. 10 after the company posted weak Q4 2025 results, with adjusted EPS of $0.56 missing the consensus estimate and falling 8.2% year-over-year. Net sales also disappointed at $2.8 billion, down 4.3% year-over-year and below the expected, pressured by a 3.5% decline in organic sales from lower volumes and softer consumption trends. Adding to investor concerns, management guided for fiscal 2026 adjusted EPS of just $1.70 - $1.85, well below the $2.30 delivered in fiscal 2025.

Analysts' consensus view on CAG stock is cautious, with a "Hold" rating overall. Among 17 analysts covering the stock, two recommend "Strong Buy," 12 suggest "Hold," one advises "Moderate Sell," and two "Strong Sells." The average analyst price target for Conagra Brands is $20.47, indicating a potential upside of 13.2% from the current levels.