/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

San Jose, California-based Cisco Systems, Inc. (CSCO) designs, manufactures, and sells Internet Protocol-based networking and other products for the communications and information technology industries. With a market cap of $279.2 billion, the company offers enterprise network security, software development, data collaboration, cloud computing, and other related services. The technology giant is expected to announce its fiscal first-quarter earnings for 2026 in the near future.

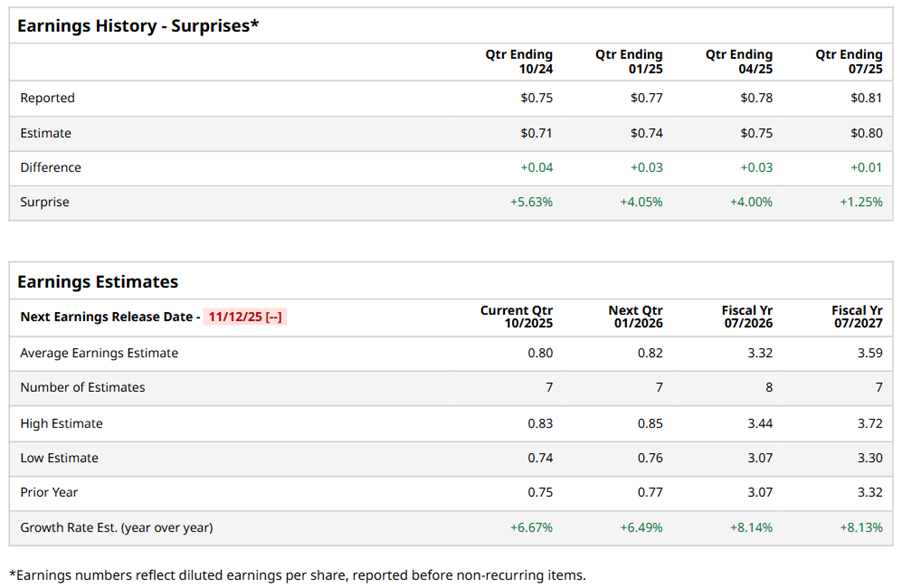

Ahead of the event, analysts expect CSCO to report a profit of $0.80 per share on a diluted basis, up 6.7% from $0.75 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CSCO to report EPS of $3.32, up 8.1% from $3.07 in fiscal 2025. Its EPS is expected to rise 8.1% year over year to $3.59 in fiscal 2027.

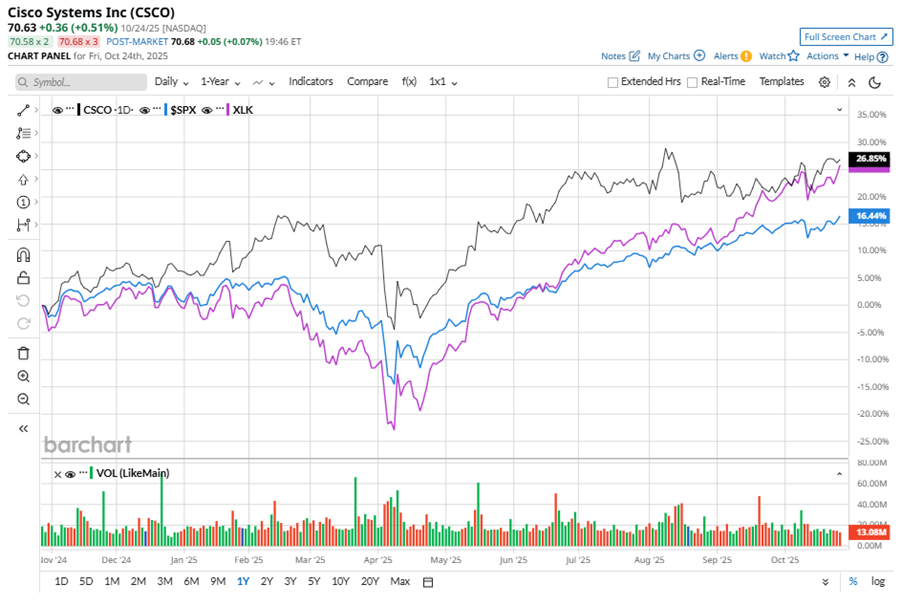

CSCO stock has outperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 26.2% during this period. However, it underperformed the Technology Select Sector SPDR Fund’s (XLK) 28.1% gains over the same time frame.

Cisco's strong performance is driven by its shift to subscription revenues, now over half of total revenue, bolstered by the Splunk acquisition. The company is integrating AI across its product portfolios and seeing strong demand for AI infrastructure solutions. Cisco's security business is growing, with new customers added for Secure Access, XDR, and Hypershield. The partnership with NVIDIA Corporation (NVDA) is expanding its AI-ready data center solutions, positioning Cisco for continued growth in AI and security.

On Aug. 13, CSCO shares closed down more than 1% after reporting its Q4 results. Its adjusted EPS of $0.99 topped Wall Street expectations of $0.97. The company’s revenue was $14.7 billion, beating Wall Street's $14.6 billion forecast. CSCO expects full-year adjusted EPS in the range of $4 to $4.06, and revenue between $59 billion and $60 billion.

Analysts’ consensus opinion on CSCO stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 12 give a “Hold.” CSCO’s average analyst price target is $76.58, indicating a potential upside of 8.4% from the current levels.