/Centene%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Saint Louis, Missouri-based Centene Corporation (CNC) operates as a healthcare enterprise, providing programs and services to under-insured and uninsured families, commercial organizations, and military families. With a market cap of $18.5 billion, Centene operates through Medicaid, Medicare, Commercial, and Other segments.

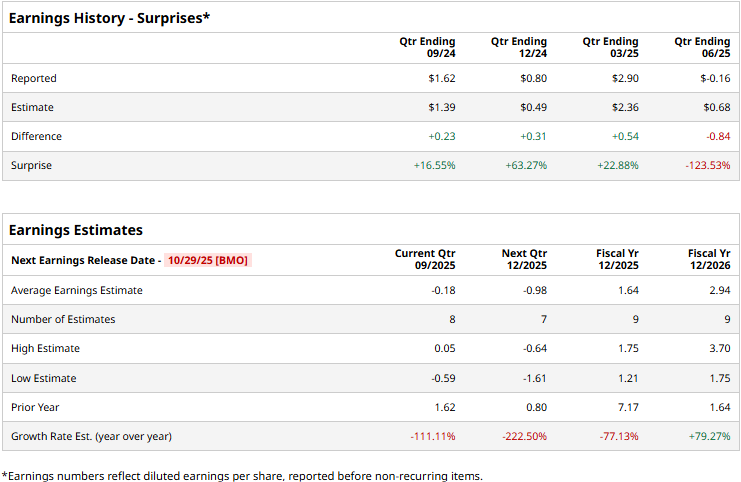

The healthcare giant is set to release its third-quarter results before the markets open on Wednesday, Oct. 29. Ahead of the event, analysts expect CNC to deliver a non-GAAP loss of $0.18 per share, significantly down from the profit of $1.62 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

For the full fiscal 2025, CNC’s non-GAAP EPS is expected to come in at $1.64, down 77.1% from $7.17 in 2024. While in fiscal 2026, its earnings are expected to surge 79.3% year-over-year to $2.94 per share.

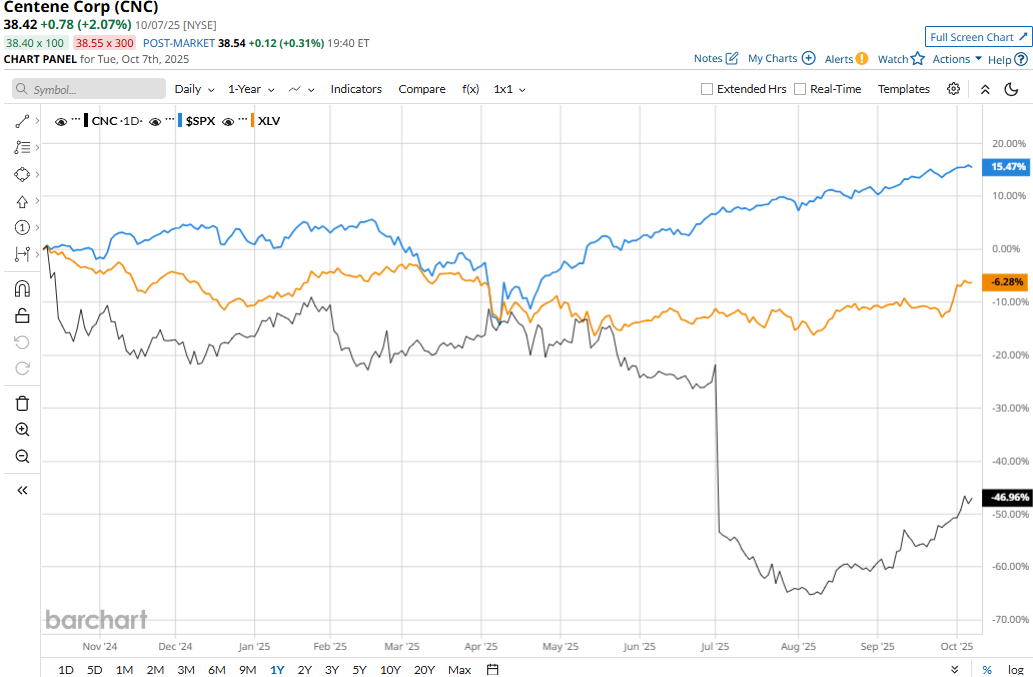

CNC stock prices have plummeted 46.3% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 4.5% dip and the S&P 500 Index’s ($SPX) 17.9% surge during the same time frame.

Centene’s stock prices plummeted 40.4% in a single trading session on Jul. 2 after the company withdrew its 2025 earnings guidance on Jul. 1, citing unexpected enrollment trends and rising patient costs. The healthcare plans provider, which primarily serves Medicaid and ACA markets, slashed its adjusted earnings outlook by $2.75 per share, erasing roughly $1.8 billion in projections. This triggered a sharp sell-off, sending CNC to a new low in recent years. The decision followed internal data from 22 ACA marketplaces showing slower-than-expected membership growth and significantly poorer health status among new enrollees, which disrupted federal reimbursement calculations tied to risk adjustment.

The company also flagged rising medical costs in its Medicaid business, particularly in behavioral health and high-cost drug categories, as additional pressure points. The company is now refilling its 2026 ACA rates to reflect higher morbidity assumptions and plans to implement corrective pricing strategies across most states. These developments have raised broader concerns about the sustainability of ACA economics and investor confidence in managed-care models.

The consensus view on CNC stock remains cautious, with an overall “Hold” rating. Out of the 19 analysts covering the stock, three recommend “Strong Buys,” 14 suggest “Holds,” one advocates “Moderate Sell,” and one gives a “Strong Sell” rating. As of writing, CNC is trading above its mean price target of $34.56.