/Autodesk%20Inc_%20Portland%20office-by%20hapabapa%20via%20iStock.jpg)

With a market cap of $64.9 billion, Autodesk, Inc. (ADSK) is a leading American software company headquartered in San Francisco, California. Best known for its flagship product AutoCAD, Autodesk specializes in software solutions for design, engineering, architecture, construction, manufacturing, and media and entertainment industries.

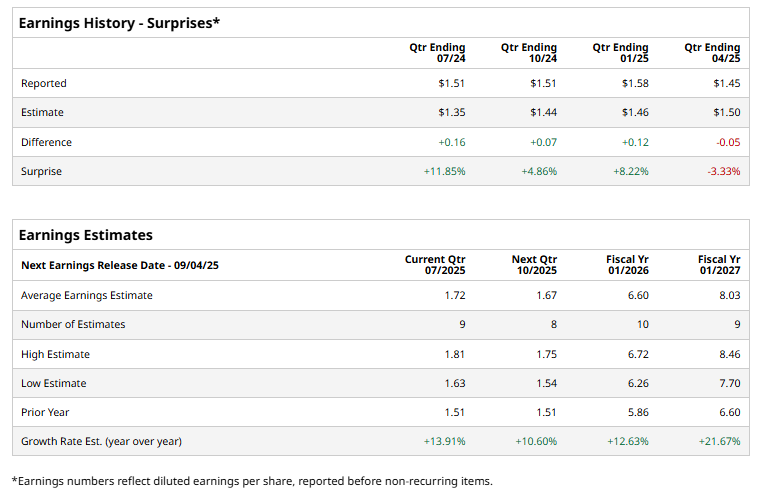

The software company is expected to unveil its Q2 2026 earnings on Thursday, Sept. 4. Ahead of this event, analysts expect ADSK to post adjusted earnings of $1.72 per share, reflecting a growth of 13.9% from $1.51 per share reported in the same quarter last year. In addition, the company has surpassed Wall Street's bottom-line estimates in three of the past four quarters, while missing on another occasion.

For the current year, analysts forecast Autodesk to report an adjusted EPS of $6.60, marking an increase of 12.6% from $5.86 reported in fiscal 2025. Moreover, in fiscal 2027, its earnings are expected to grow 21.7% year-over-year to $8.03 per share.

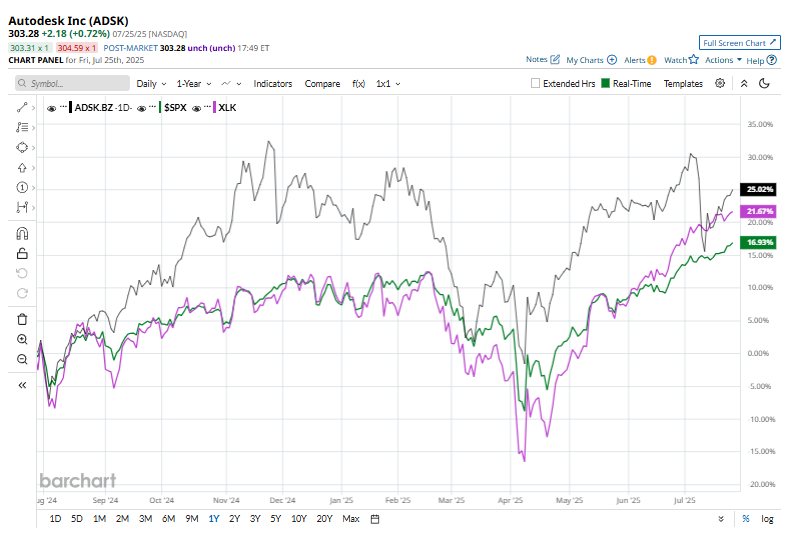

ADSK stock has surged 25.2% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 18.3% gain and the Technology Select Sector SPDR Fund’s (XLK) 22.7% return during the same period.

On Jul. 14, Autodesk shares rose over 5% after the company announced plans to use its growing free cash flow for organic growth, strategic acquisitions, and ongoing share buybacks.

Analysts' consensus view on ADSK stock remains highly bullish, with a "Strong Buy" rating overall. Out of 27 analysts covering the stock, opinions include 20 "Strong Buys," one "Moderate Buy," and six "Holds.” Its mean price target of $338.85 suggests an 11.7% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.