New York-based Apollo Global Management, Inc. (APO) is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. Valued at $86.9 billion by market cap, the company focuses on investing in yield, hybrid, and equity markets to generate retirement and investment incomes. The private equity giant is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Tuesday, Aug. 5.

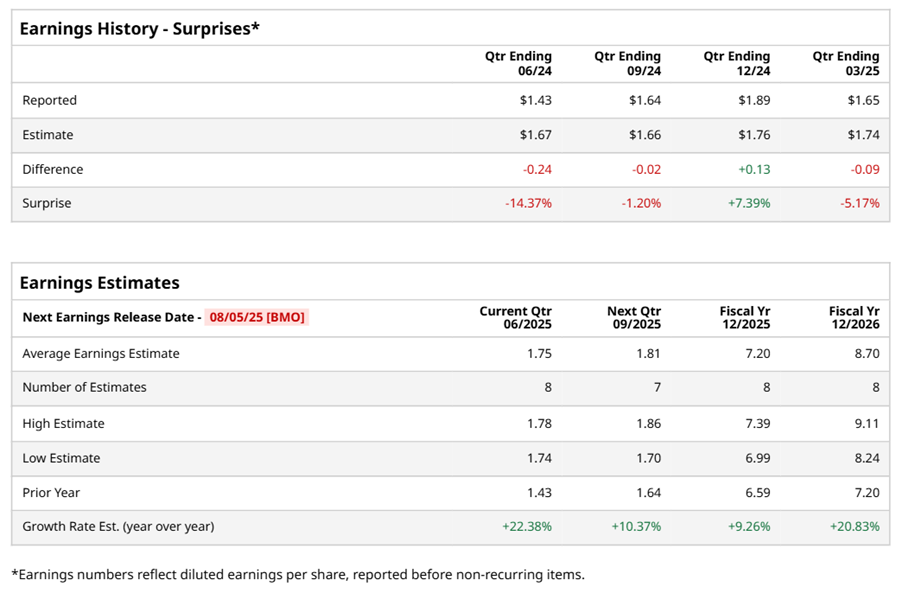

Ahead of the event, analysts expect APO to report a profit of $1.75 per share on a diluted basis, up 22.4% from $1.43 per share in the year-ago quarter. The company missed the consensus estimates in three of the last four quarters while beating the forecast on another occasion.

For the full year, analysts expect APO to report EPS of $7.20, up 9.3% from $6.59 in fiscal 2024. Its EPS is expected to rise 20.8% year-over-year to $8.70 in fiscal 2026.

APO stock has outperformed the S&P 500 Index’s ($SPX) 13.6% gains over the past 52 weeks, with shares up 26.3% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 21.4% gains over the same time frame.

APO is partnering with major banks, including JPMorgan Chase & Co. (JPM) and The Goldman Sachs Group, Inc. (GS), to increase liquidity in the private credit market. This collaboration aims to actively syndicate and trade investment-grade private debt, allowing for faster origination of larger loans. By enhancing liquidity and accessibility, APO is poised to attract both institutional and individual investors, driving growth in the private credit market. This initiative is part of APO's strategy to expand its credit trading footprint and solidify its position as a key player in shaping the future of private credit trading.

On May 2, APO shares closed down more than 1% after the company reported its Q1 results. Its revenue stood at $5.5 billion, down 21.2% year-over-year. The company’s adjusted EPS increased 5.8% year-over-year to $1.82.

Analysts’ consensus opinion on APO stock is bullish, with an overall “Strong Buy” rating. Out of 21 analysts covering the stock, 16 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” APO’s average analyst price target is $164.63, indicating a potential upside of 8.3% from the current levels.