Houston, Texas-based APA Corporation (APA) is an energy company engaged in the exploration, development, and production of natural gas, crude oil, and natural gas liquids. With a market cap of $8.1 billion, APA’s operations span the United States, Egypt, and the North Sea.

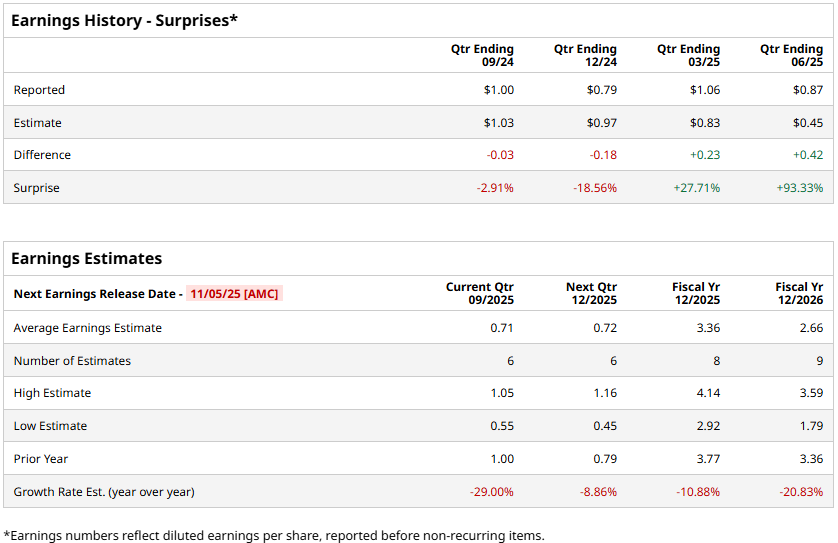

The energy major is gearing up to announce its third-quarter results after the markets close on Wednesday, Nov. 5. Ahead of the event, analysts expect APA to report an adjusted EPS of $0.71, down a staggering 29% from $1.00 reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates twice over the past four quarters, it has missed the projections on two other occasions.

For the full fiscal 2025, APA is expected to deliver earnings of $3.36 per share, marking a notable 10.9% decline from $3.77 per share reported in fiscal 2024. While in fiscal 2026, its earnings are expected to further drop by 20.8% year-over-year to $2.66 per share.

APA stock prices have dropped 10.1% over the past 52 weeks, notably underperforming the Energy Select Sector SPDR Fund’s (XLE) 3.8% dip and the S&P 500 Index’s ($SPX) 15.1% returns during the same time frame.

APA’s stock prices soared 7.8% in a single trading session following the release of its robust Q2 results on Aug. 6. The company reported production of 465,000 barrels of oil equivalent (BOE) per day during the quarter, exceeding its guidance. Overall, its topline came in at $2.6 billion, beating the consensus estimates by a massive 26.1%. Moreover, the company reported net cash provided by operating activities of $1.2 billion and adjusted EBITDAX of $1.3 billion, above Street expectations. Moreover, APA's adjusted EPS of $0.87 surpassed the consensus estimates by a staggering 93.3%, boosting investor confidence.

Nonetheless, analysts remain cautious about APA’s longer-term prospects. The stock maintains a consensus “Hold” rating overall. Of the 29 analysts covering the stock, opinions include four “Strong Buys,” one “Moderate Buy,” 21 “Holds,” one “Moderate Sell,” and two “Strong Sells.” As of writing, the stock is trading slightly below its mean price target of $24.78.