/Allegion%20plc%20HQ%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Dublin, Ireland-based Allegion plc (ALLE) is a security company that offers mechanical and electronic security products, including locks, hinges, door closers, exit devices, steel doors and frames, access control systems, smart locking, and related workforce security software & services. Valued at a market cap of $15.2 billion, the company is expected to announce its fiscal Q3 earnings for 2025 in the near future.

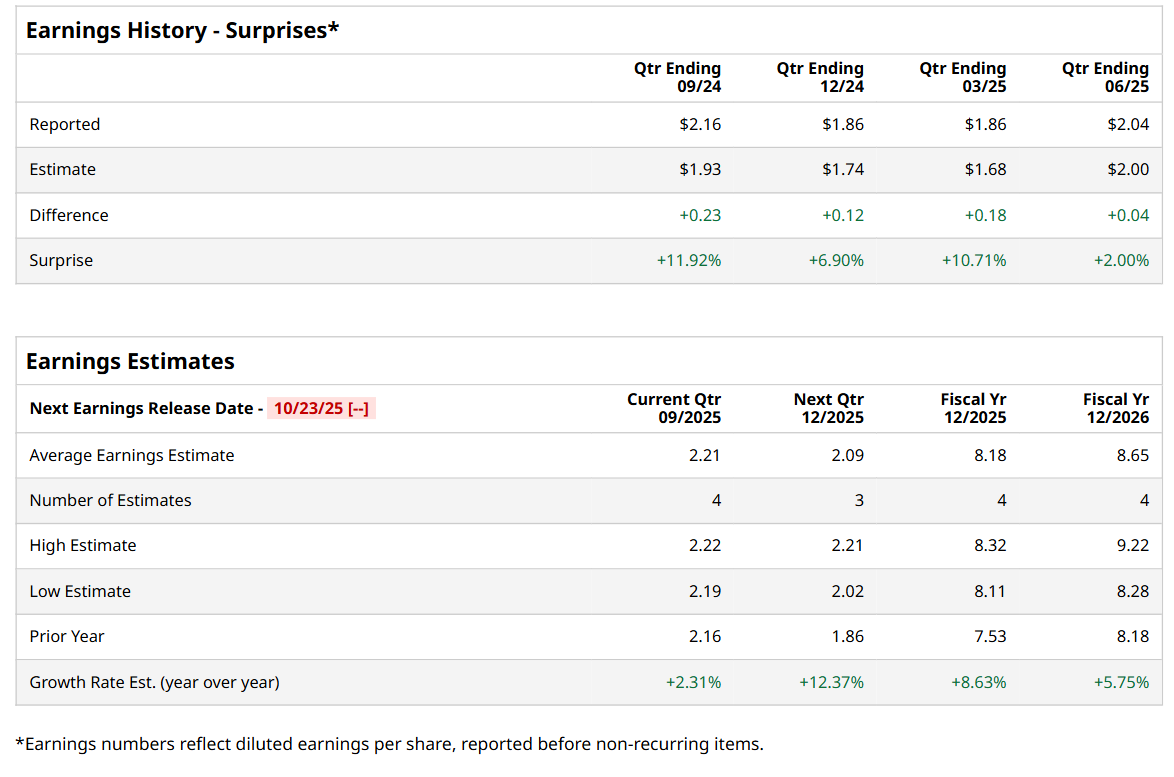

Before this event, analysts expect this security company to report a profit of $2.21 per share, up 2.3% from $2.16 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.04 per share in the previous quarter topped the consensus estimates by 2%.

For the current fiscal year, analysts expect Allegion to report a profit of $8.18 per share, up 8.6% from $7.53 per share in fiscal 2024. Its EPS is expected to further grow 5.8% year-over-year to $8.65 in fiscal 2026.

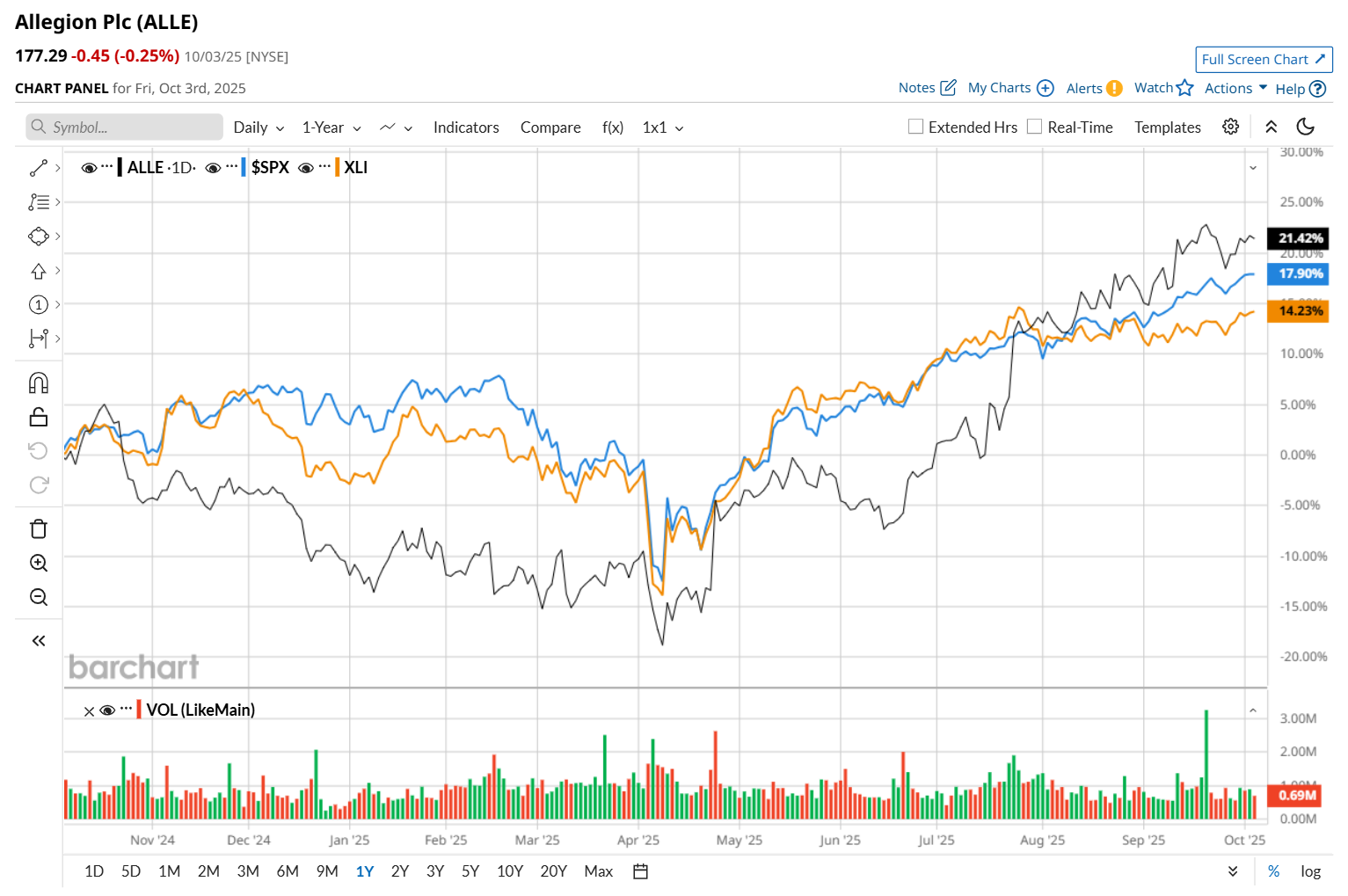

Allegion has rallied 21.5% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 17.8% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% return over the same time frame.

On Jul. 24, shares of Allegion rose 6% after it delivered impressive Q2 results. The company posted revenue of $1 billion, up 5.8% on a reported basis and 3.2% on an organic basis. This top-line figure came in 2% ahead of the consensus estimates. Strong organic growth in its non-residential Americas business, along with positive impact from acquisitions, supported its performance. Moreover, on the earnings front, its adjusted EPS improved 4.1% year-over-year to $2.04, also exceeding analyst expectations by 2%.

Wall Street analysts are moderately optimistic about ALLE’s stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, three recommend "Strong Buy," and eight suggest "Hold.” The mean price target for ALLE is $178.33, indicating a marginal potential upside from the current levels.