/Synchrony%20Financial%20site%20on%20phone-by%20madamF%20via%20Shutterstock.jpg)

Stamford, Connecticut-based Synchrony Financial (SYF) is a premier consumer financial services company that delivers one of the industry's most comprehensive digitally enabled product suites. Valued at $27.7 billion by market cap, the company provides a range of credit products such as credit cards, commercial credit products, and consumer installment loans through programs established with a diverse group of national and regional retailers, local merchants, manufacturers, and more. The consumer credit company is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 15.

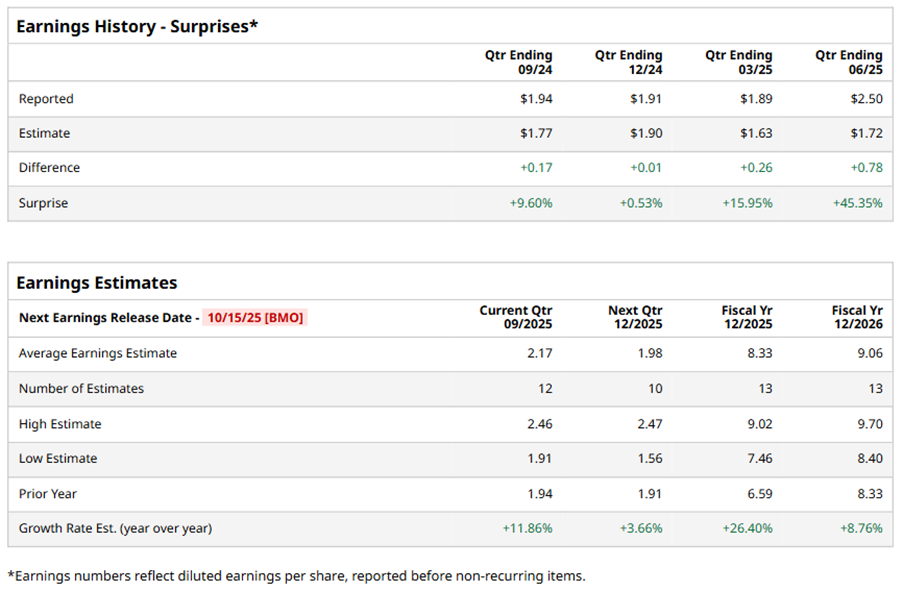

Ahead of the event, analysts expect SYF to report a profit of $2.17 per share on a diluted basis, up 11.9% from $1.94 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect SYF to report EPS of $8.33, up 26.4% from $6.59 in fiscal 2024. Its EPS is expected to rise 8.8% year-over-year to $9.06 in fiscal 2026.

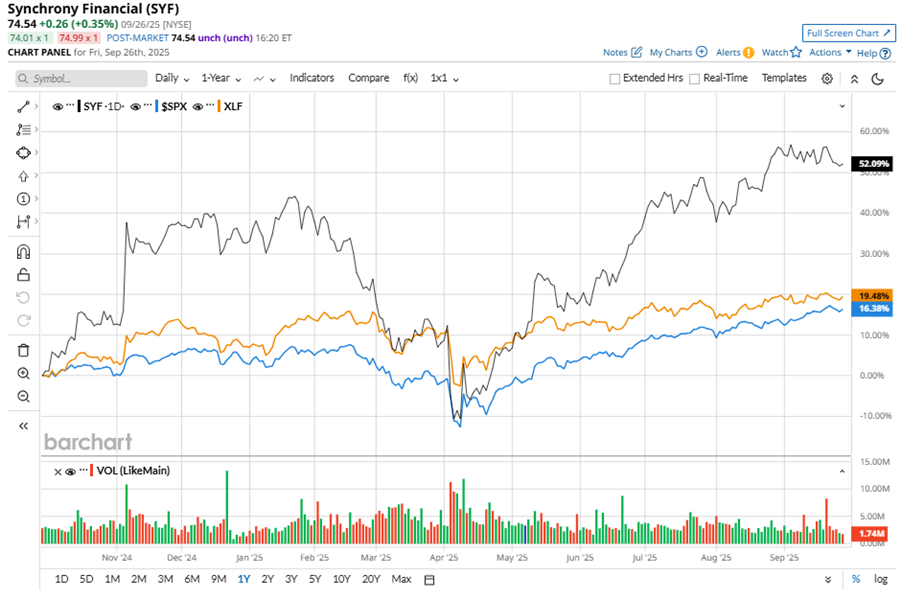

SYF stock has considerably outperformed the S&P 500 Index’s ($SPX) 15.6% gains over the past 52 weeks, with shares up 52% during this period. Similarly, it considerably outpaced the Financial Select Sector SPDR Fund’s (XLF) 19.6% gains over the same time frame.

SYF’s outperformance is driven by its strategic partnership with Dental Intelligence, which integrates CareCredit into the platform to streamline patient financing and enhance administrative efficiency for dental practices. This collaboration simplifies financing conversations and optimizes practice operations, enhancing the patient care experience.

On Jul. 22, SYF shares closed up more than 1% after reporting its Q2 results. Its EPS of $2.50 topped Wall Street expectations of $1.72. The company’s net interest income was $4.52 billion, beating Wall Street forecasts of $4.50 billion.

Analysts’ consensus opinion on SYF stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 25 analysts covering the stock, 14 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 10 give a “Hold.” SYF’s average analyst price target is $79.83, indicating a potential upside of 7.1% from the current levels.