/Raymond%20James%20Financial%2C%20Inc_%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Saint Petersburg, Florida-based Raymond James Financial, Inc. (RJF) provides private client group, capital markets, asset management, banking, and other services. Valued at $32.9 billion by market cap, the company offers its services to individuals, corporations, and municipalities in the U.S., Canada, and Europe. The leading diversified financial services company is expected to announce its fiscal fourth-quarter earnings for 2025 on Wednesday, Oct. 22.

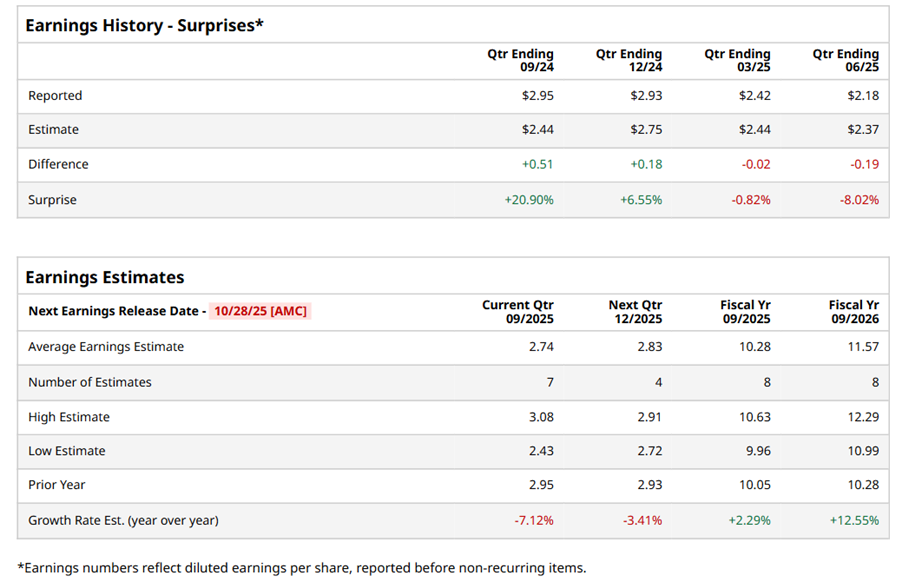

Ahead of the event, analysts expect RJF to report a profit of $2.74 per share on a diluted basis, down 7.1% from $2.95 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect RJF to report EPS of $10.28, up 2.3% from $10.05 in fiscal 2024. Its EPS is expected to rise 12.6% year-over-year to $11.57 in fiscal 2026.

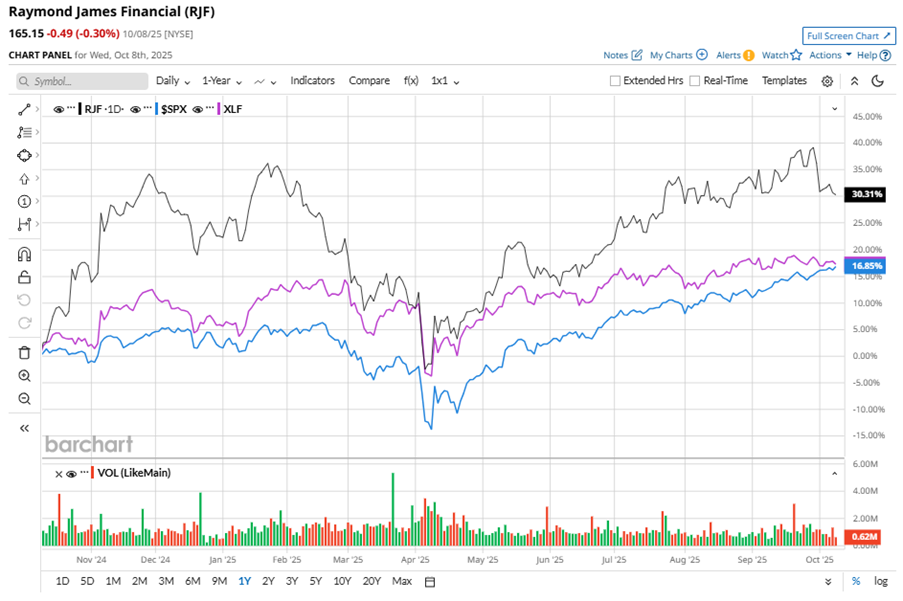

RJF stock has outperformed the S&P 500 Index’s ($SPX) 17.4% gains over the past 52 weeks, with shares up 32.2% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 18% gains over the same time frame.

RJF's outperformance is driven by strong investment banking and trading businesses, as well as impressive asset management performance. Strategic acquisitions have also boosted financials, and the company's investment banking pipeline remains robust.

On Jul. 23, RJF reported its Q3 results, and its shares closed up more than 3% in the following trading session. Its revenues stood at $3.4 billion, up 5.3% year-over-year. The company’s adjusted EPS declined 8.8% from the year-ago quarter to $2.18.

Analysts’ consensus opinion on RJF stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 15 analysts covering the stock, four advise a “Strong Buy” rating, and 11 give a “Hold.” RJF’s average analyst price target is $179.69, indicating a potential upside of 8.8% from the current levels.