/Norfolk%20Southern%20Corp_%20train-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $66.6 billion, Norfolk Southern Corporation (NSC) is a leading transportation company that operates one of the largest freight rail networks in the eastern United States. Through its subsidiary, Norfolk Southern Railway Company, it provides rail transportation for a wide range of raw materials, intermediate products, and finished goods, including agricultural, chemical, industrial, and automotive commodities.

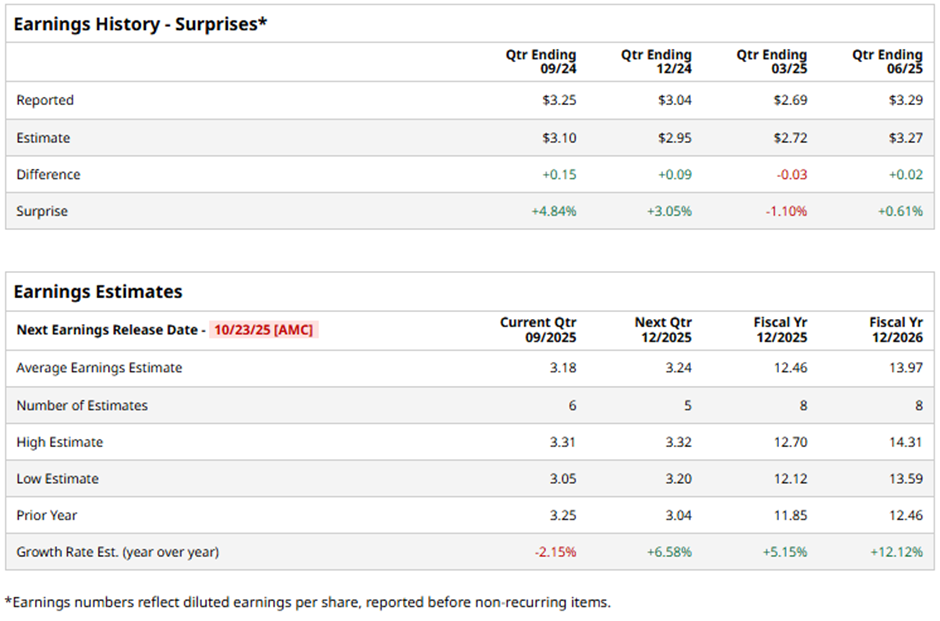

The Atlanta, Georgia-based company is expected to release its fiscal Q3 2025 results after the market closes on Thursday, Oct. 23. Ahead of this event, analysts project Norfolk Southern to report an adjusted EPS of $3.18, a 2.2% decline from $3.25 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the railroad operator to report adjusted EPS of $12.46, up 5.2% from $11.85 in fiscal 2024. Looking forward, adjusted EPS is projected to grow 12.1% year-over-year to $13.97 in fiscal 2026.

NSC stock has soared nearly 22% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 17.4% return and the Industrial Select Sector SPDR Fund's (XLI) 14.8% gain over the same period.

Despite Norfolk Southern’s better-than-expected Q2 2025 adjusted EPS of $3.29, its shares fell over 3% on Jul. 29 because revenue of $3.11 billion missed estimates. Additionally, concerns over higher operating expenses, including a double-digit rise in minerals and other costs, further dampened market sentiment.

Analysts' consensus view on NSC stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, six suggest a "Strong Buy" and 15 provide a "Hold" rating. This configuration is less bullish than three months ago, with 11 analysts suggesting a "Strong Buy."

The average analyst price target for Norfolk Southern is $310, indicating a potential upside of 4.5% from the current levels.