Corona, California-based Monster Beverage Corporation (MNST) develops, markets, sells, and distributes energy drink beverages and concentrates. Valued at a market cap of $79.6 billion, the company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

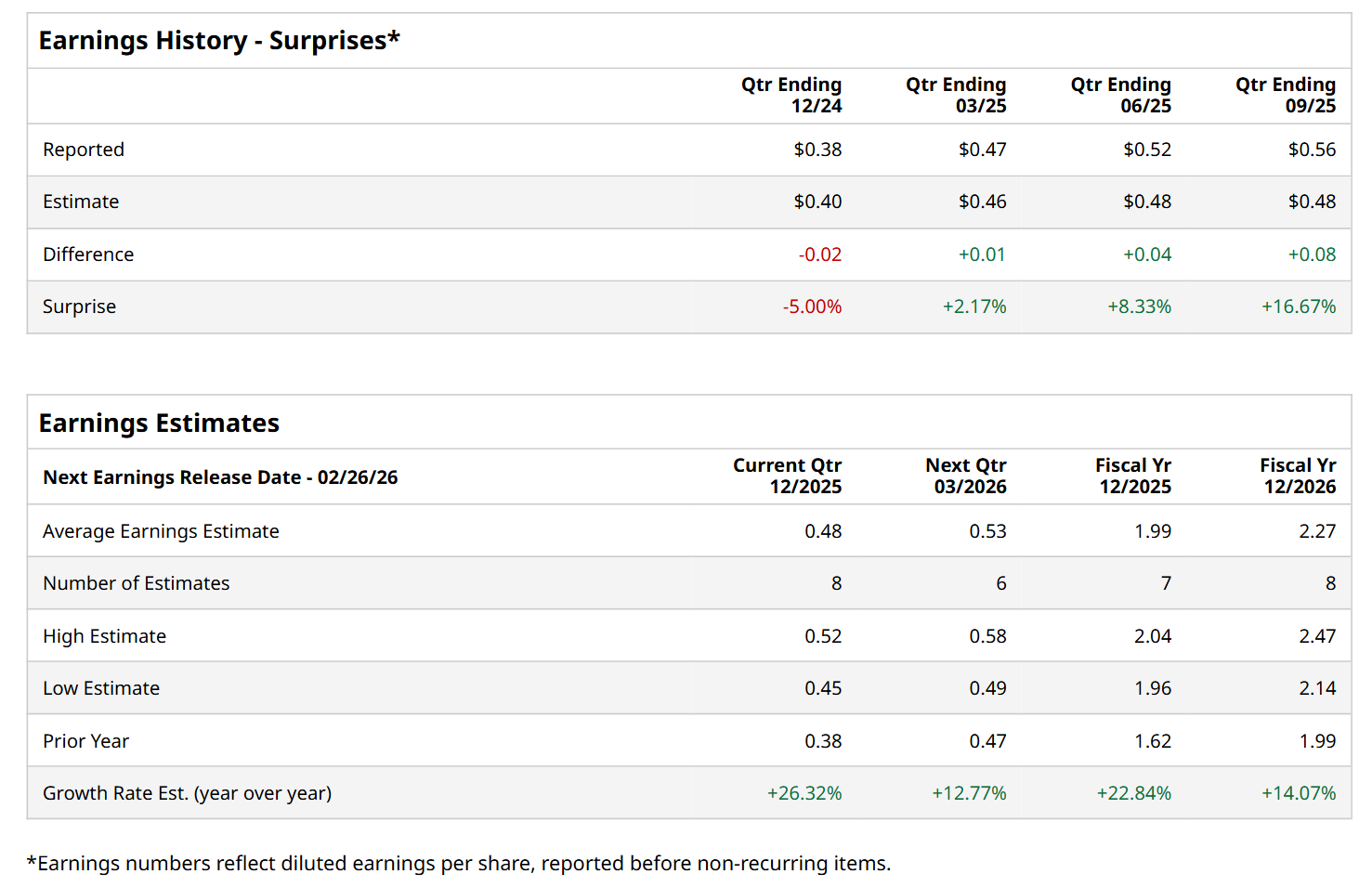

Before this event, analysts expect this beverage company to report a profit of $0.48 per share, up 26.3% from $0.38 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $0.56 per share in the previous quarter exceeded the forecasted figure by 16.7%.

For the current fiscal year, ending in December, analysts expect MNST to report a profit of $1.99 per share, up 22.8% from $1.62 per share in fiscal 2024. Its EPS is expected to further grow 14.1% year-over-year to $2.27 in fiscal 2026.

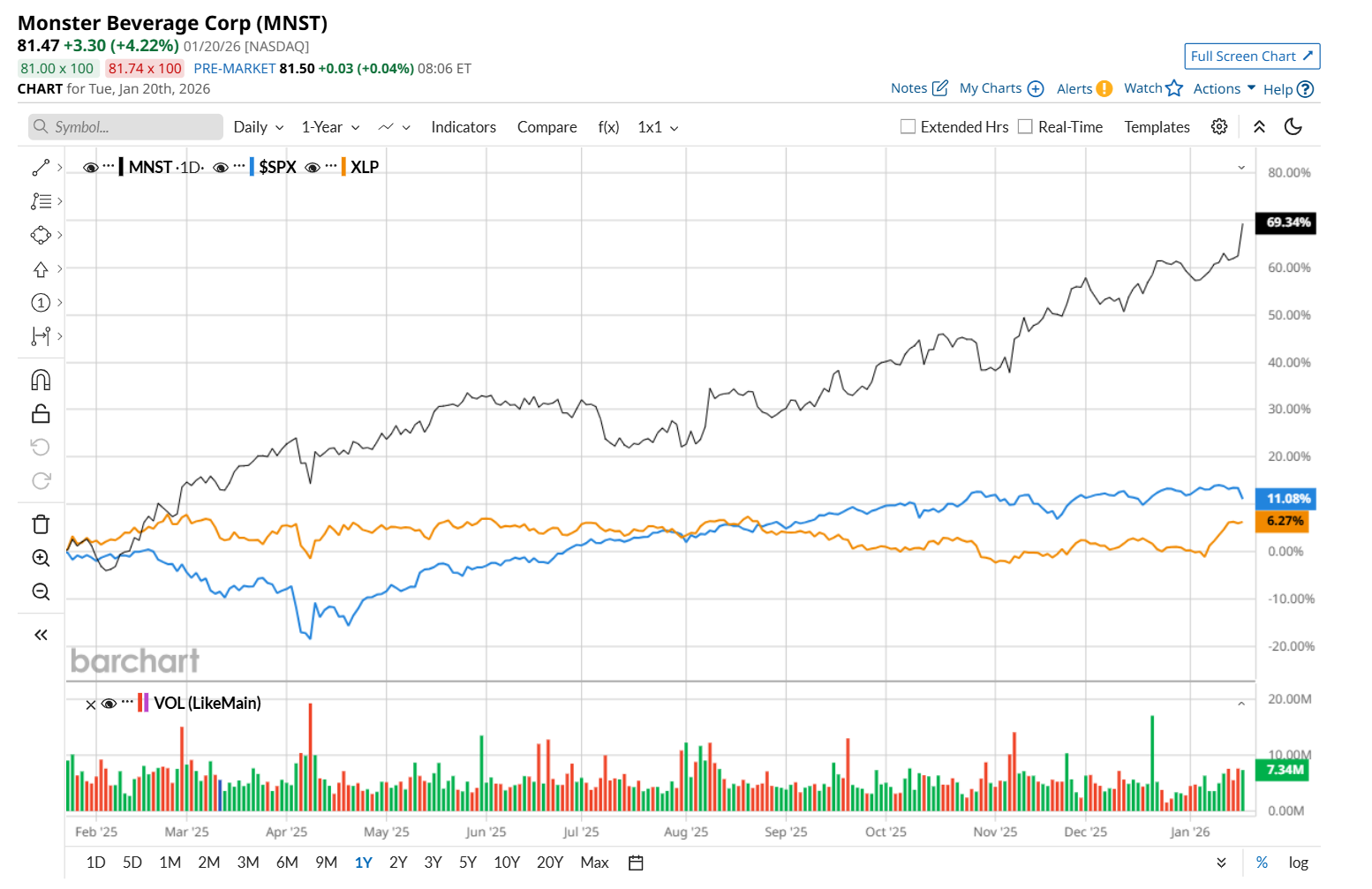

MNST has soared 64.9% over the past 52 weeks, notably outperforming both the S&P 500 Index's ($SPX) 13.3% return and the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 6.6% uptick over the same time period.

On Nov. 6, MNST delivered better-than-expected Q3 results, sending its shares up 5.2% in the following trading session. Due to solid demand for its energy drinks, the company posted record revenue of $2.2 billion, up 16.8% from the year-ago quarter and 4.3% ahead of analyst estimates. Moreover, its adjusted EPS increased 36.6% from the year-ago quarter to $0.56, handily surpassing consensus estimates by 16.7%.

Wall Street analysts are moderately optimistic about MNST’s stock, with an overall "Moderate Buy" rating. Among 23 analysts covering the stock, 12 recommend "Strong Buy," one suggests a "Moderate Buy,” and 10 indicate "Hold.” While the company is trading above its mean price target of $80.14, its Street-high price target of $90 suggests a 10.5% potential upside from the current levels.