Valued at a market cap of $12.8 billion, Host Hotels & Resorts, Inc. (HST) is a lodging real estate investment trust that owns a diversified portfolio of luxury and upper-upscale hotels. The Bethesda, Maryland-based company is scheduled to announce its fiscal Q4 earnings for 2025 after the market closes on Wednesday, Feb. 18.

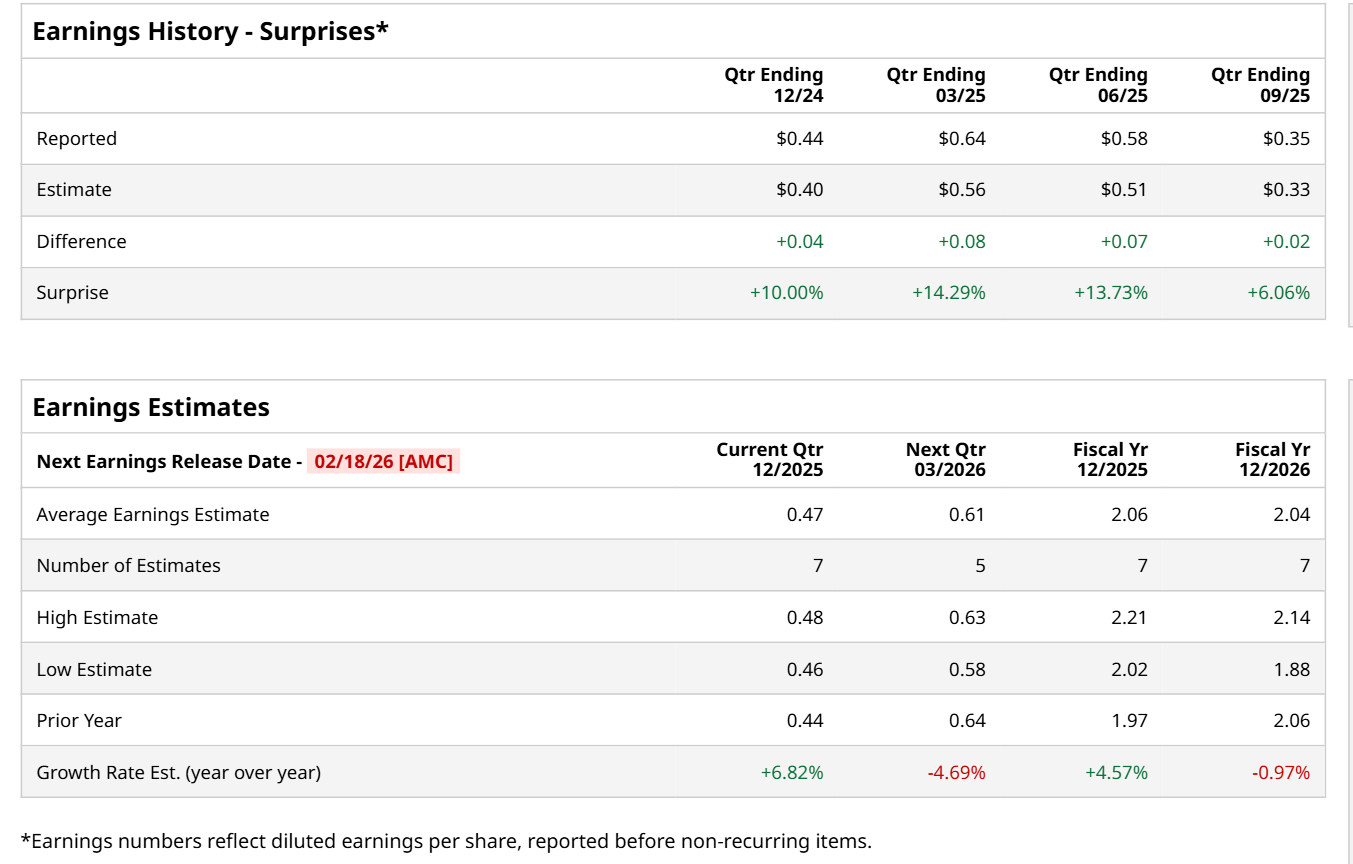

Ahead of this event, analysts expect this lodging REIT to report an FFO of $0.47 per share, up 6.8% from $0.44 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its FFO of $0.35 per share topped the consensus estimates by 6.1%.

For the current fiscal year, ending in December, analysts expect HST to report an FFO of $2.06 per share, up 4.6% from $1.97 per share in fiscal 2024. However, its EPS is expected to decline 1% year-over-year to $2.04 in fiscal 2026.

HST has gained 10.9% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 13.7% return over the same time frame. However, it has outpaced the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 1% uptick over the same time period.

HST reported impressive Q3 results on Nov. 5, and its shares rose 6.9% in the following trading session. The company’s revenue grew marginally year-over-year to $1.3 billion and came in line with the consensus estimates. Meanwhile, its adjusted FFO declined 2.8% from the year-ago quarter to $0.35, but topped analyst expectations of $0.33. Additionally, its comparable hotel total RevPAR reached $335.4 million, driven by strong transient demand.

Wall Street analysts are moderately optimistic about HST’s stock, with an overall "Moderate Buy" rating. Among 19 analysts covering the stock, nine recommend "Strong Buy," one suggests a "Moderate Buy,” and nine advise "Hold.” The mean price target for HST is $19.91, indicating a marginal potential upside from the current levels.