Houston, Texas-based Halliburton Company (HAL) provides products and services to the energy industry worldwide. With a market cap of $21.2 billion, the company operates in two segments, Completion and Production, and Drilling and Evaluation. The energy company is slated to report its fiscal 2025 Q3 earnings before the market opens on Tuesday, Oct. 21.

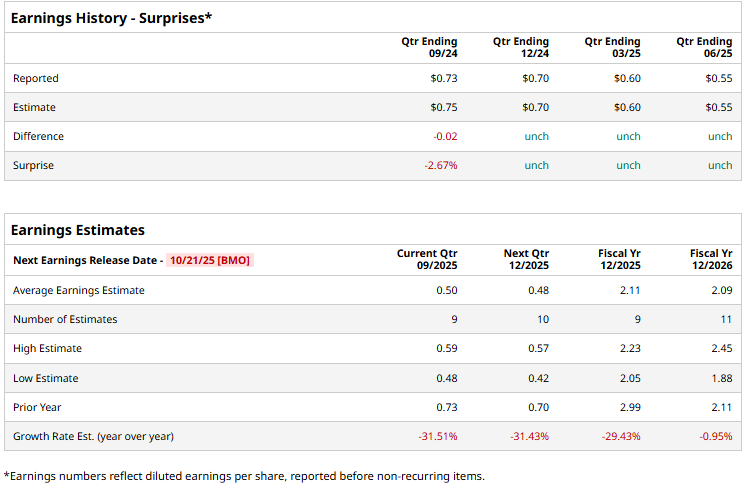

Ahead of this event, analysts expect the company to report a profit of $0.50 per share, down 31.5% from $0.73 per share in the year-ago quarter. The company has matched the Street’s bottom-line projections in three of the past three quarters, while missing on one occasion.

For fiscal 2025, analysts expect HAL to report a profit of $2.11, down 29.4% from $2.99 in fiscal 2024.

HAL stock has declined 18.4% over the past 52 weeks, underperforming the Energy Select Sector SPDR Fund’s (XLE) 2.5% decline and the S&P 500 Index’s ($SPX) 17.6% uptick during the same time frame.

On Oct. 2, Halliburton shares dropped more than 2%, weighed down by a sharp decline in crude oil prices to a 4-month low.

Wall Street analysts are moderately optimistic about HAL’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 14 recommend "Strong Buy," two suggest “Moderate Buy,” eight advise “Hold,” and one “Strong Sell.” HAL’s average analyst price target of $27.39 indicates a potential upside of 12.3% from the current levels.