/Global%20Payments%2C%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Valued at a market cap of $20.7 billion, Global Payments Inc. (GPN) is a payment technology and software provider headquartered in Atlanta, Georgia. It enables businesses of all sizes to accept and process payments securely across card, digital, and check-based channels. The company is expected to announce its fiscal Q3 earnings for 2025 on Wednesday, Oct. 29.

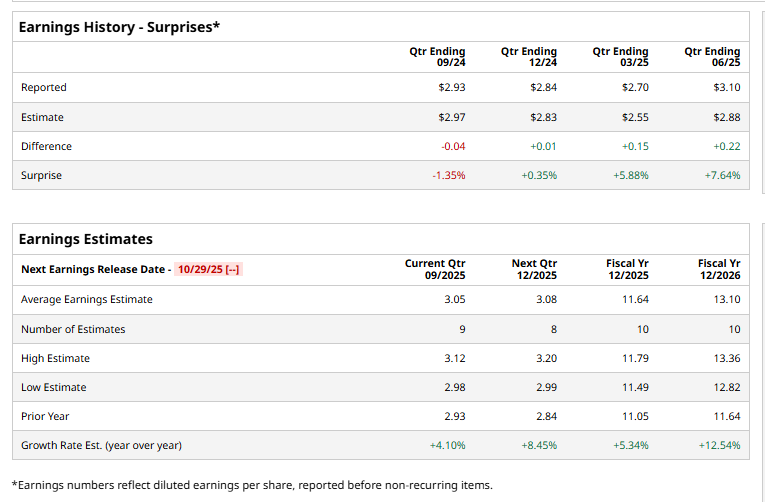

Ahead of this event, analysts expect this payment technology company to report a profit of $3.05 per share, up 4.1% from $2.93 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion.

For fiscal 2025, analysts expect GPN to report a profit of $11.64 per share, up 5.3% from $11.05 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.5% year-over-year to $13.10 in fiscal 2026.

Shares of GPN have declined 15.9% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 14.1% rise and the Technology Select Sector SPDR Fund’s (XLK) 23.9% return over the same time frame.

On Oct. 1, Global Payments shares jumped 2.5% after completing the $1.1 billion sale of its Payroll business to Acrisure. This move, part of a series of strategic divestitures and the planned Worldpay acquisition, aims to sharpen GPN’s focus on becoming a leading pure-play commerce solutions provider.

Wall Street analysts are moderately optimistic about GPN’s stock, with an overall "Moderate Buy" rating. Among 28 analysts covering the stock, 10 recommend "Strong Buy," one indicates a "Moderate Buy," 15 suggest "Hold,” and two advise a “Strong Sell” rating. The mean price target for GPN is $106.61, indicating a 24.6% potential upside from the current levels.