With a market cap of $16.6 billion, Essex Property Trust, Inc. (ESS) acquires, develops, redevelops, and manages multifamily residential properties in key West Coast markets. The company holds ownership interests in 258 apartment communities totaling over 62,000 homes, primarily located across Southern California, Northern California, and the Seattle metropolitan area.

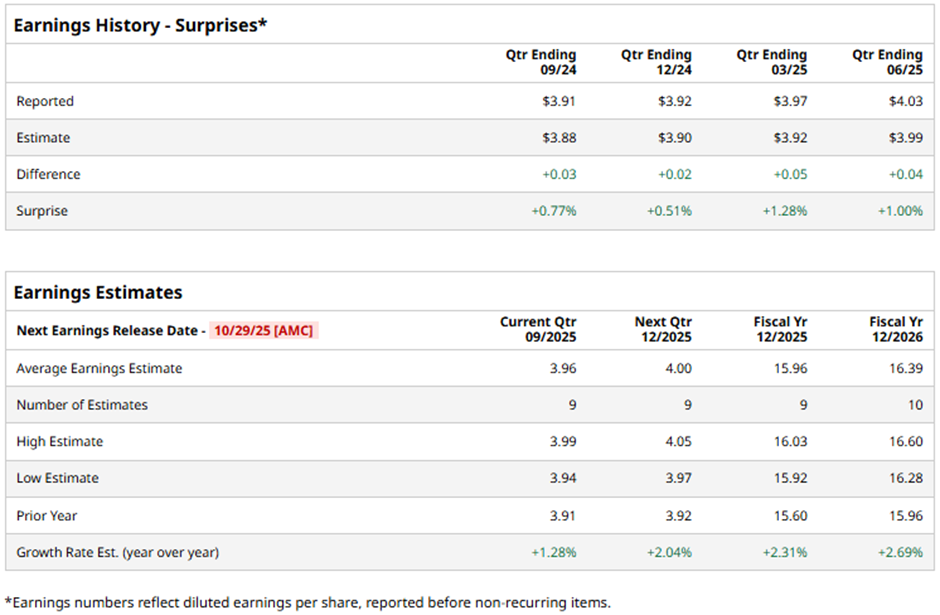

The San Mateo, California-based company is expected to release its fiscal Q3 2025 results after the market closes on Wednesday, Oct. 29. Ahead of this event, analysts project Essex Property to report core FFO of $3.96 per share, a 1.3% rise from $3.91 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts forecast the REIT to report core FFO of $15.96 per share, up 2.3% from $15.60 per share in fiscal 2024. In addition, core FFO is expected to grow 2.7% year-over-year to $16.39 per share in fiscal 2026.

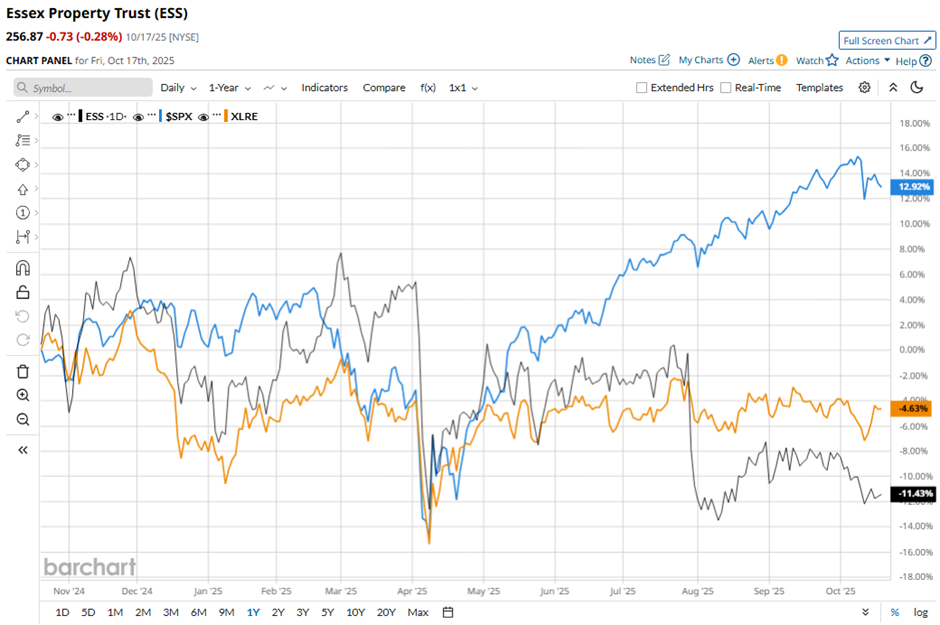

Shares of Essex Property have dipped 13.4% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 13.5% gain and the Real Estate Select Sector SPDR Fund's (XLRE) 5.9% drop over the same time frame.

Despite Essex Property Trust beating Q2 2025 expectations with core FFO of $4.03 per share and revenue of $469.8 million on Jul. 29, shares fell 7.6% the next day. Rising same-property operating expenses of 2.9% and flat occupancy at 96.2% pointed to ongoing margin pressures. Additionally, cash reserves fell to $67.9 million from $107.9 million in the prior quarter, raising concerns

Analysts' consensus view on ESS stock is cautious, with an overall "Hold" rating. Among 28 analysts covering the stock, six suggest a "Strong Buy," two give a "Moderate Buy," 18 recommend a "Hold," and two have a "Strong Sell." The average analyst price target for Essex Property is $291.48, indicating a potential upside of 13.5% from the current levels.