With a market cap of $6.9 billion, Eastman Chemical Company (EMN) is a global specialty materials company with manufacturing sites in the United States, Europe, and Asia-Pacific. It produces a wide range of chemicals, plastics, and fibers that serve diverse industries such as transportation, construction, electronics, and consumer goods.

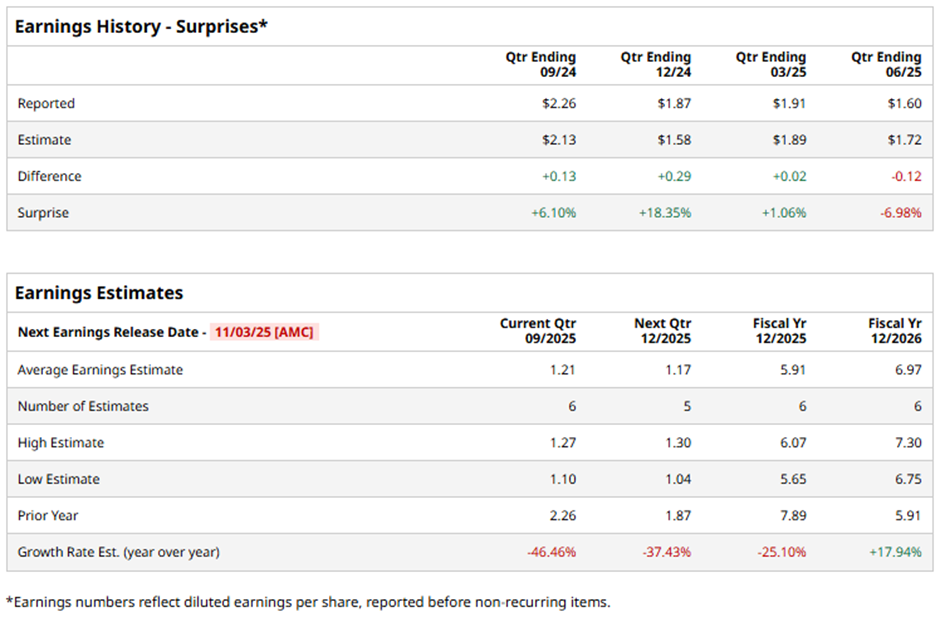

The Kingsport, Tennessee-based company is slated to announce its fiscal Q3 2025 results after the market closes on Monday, Nov. 3. Ahead of this event, analysts expect EMN to report an adjusted EPS of $1.21, a 46.5% decline from $2.26 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the specialty chemicals maker to report adjusted EPS of $5.91, marking a decrease of 25.1% from $7.89 in fiscal 2024. However, adjusted EPS is anticipated to grow 17.9% year-over-year to $6.97 in fiscal 2026.

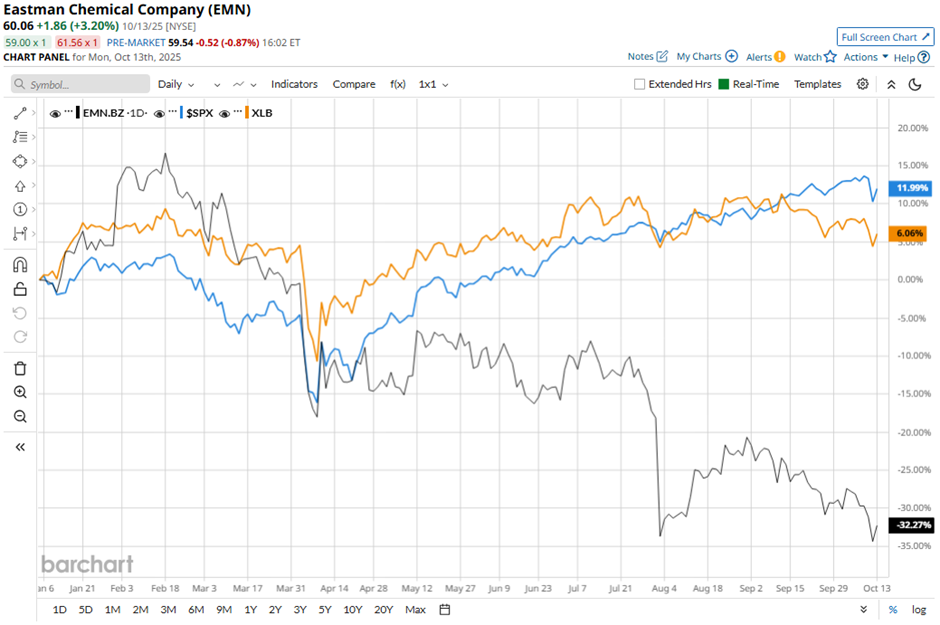

Over the past 52 weeks, shares of Eastman Chemical have dropped 45.7%, underperforming the broader S&P 500 Index's ($SPX) 14.4% gain and the Materials Select Sector SPDR Fund's (XLB) nearly 8% decrease over the same time frame.

Shares of Eastman Chemical tumbled over 19% following its Q2 2025 results on Jul. 31 after the company reported adjusted EPS of $1.60, missing Wall Street’s estimate. Although revenue of $2.29 billion met expectations, the company issued a downbeat Q3 adjusted EPS forecast of $1.25, well below analysts’ projections. Investor sentiment worsened as Eastman announced plans to cut inventory by over $200 million, which is expected to reduce earnings by $75 million - $100 million amid soft demand and U.S. trade policy challenges.

Analysts' consensus view on EMN stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 15 analysts covering the stock, eight suggest a "Strong Buy," two give a "Moderate Buy," four recommend a "Hold," and one has a "Strong Sell." The average analyst price target for Eastman Chemical is $74.40, indicating a potential upside of 23.9% from the current levels.