/Chubb%20Limited%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $106.9 billion, Chubb Limited (CB) is a global insurance and reinsurance company that offers a broad suite of insurance products, including commercial and personal property & casualty, personal accident and supplemental health, reinsurance, and life insurance coverage. The Zürich, Switzerland-based company is scheduled to announce its fiscal Q3 earnings for 2025 after the market closes on Tuesday, Oct. 21.

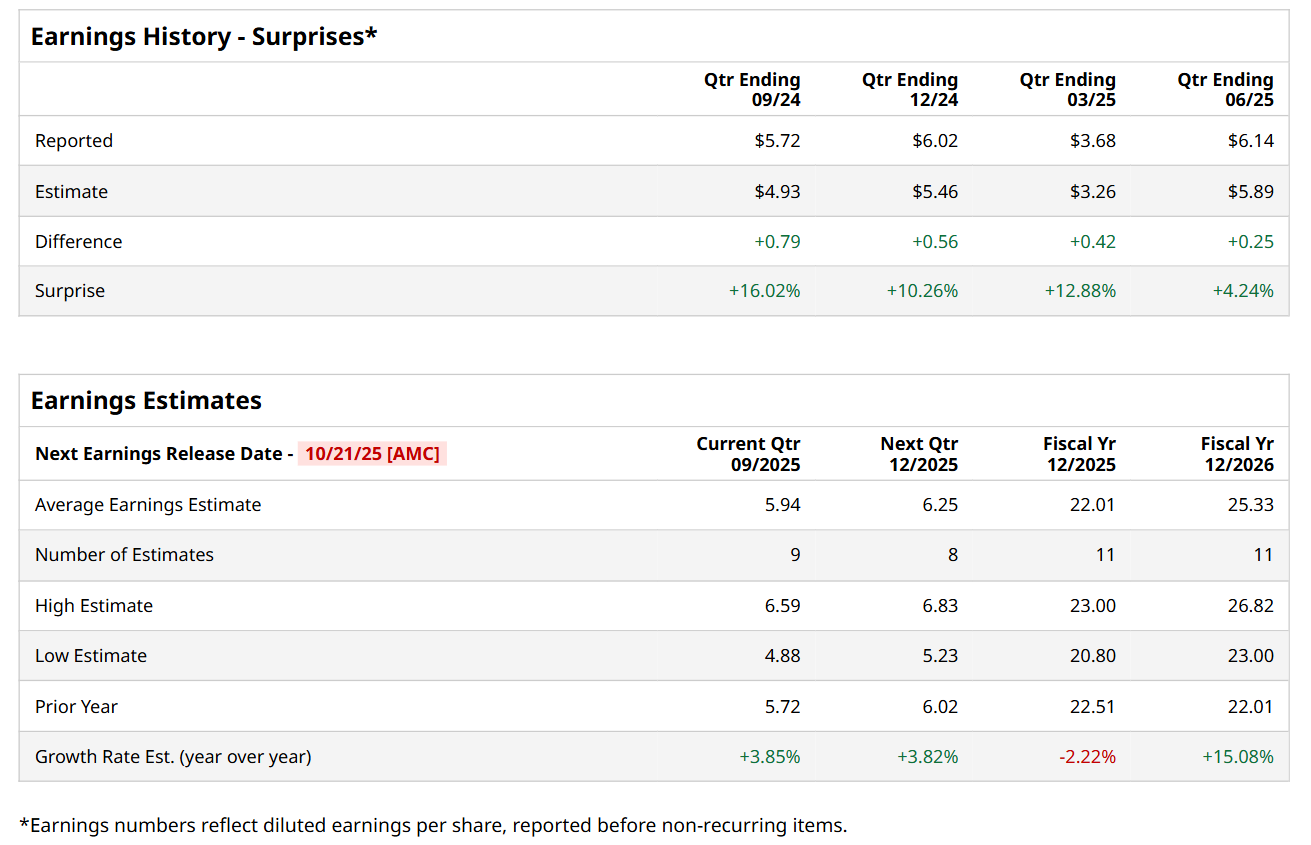

Ahead of this event, analysts expect this insurance company to report a profit of $5.94 per share, up 3.9% from $5.72 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters. In Q2, CB’s EPS of $6.14 exceeded the forecasted figure by 4.2%.

For fiscal 2025, analysts expect CB to report a profit of $22.01 per share, down 2.2% from $22.51 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 15.1% year-over-year to $25.33 in fiscal 2026.

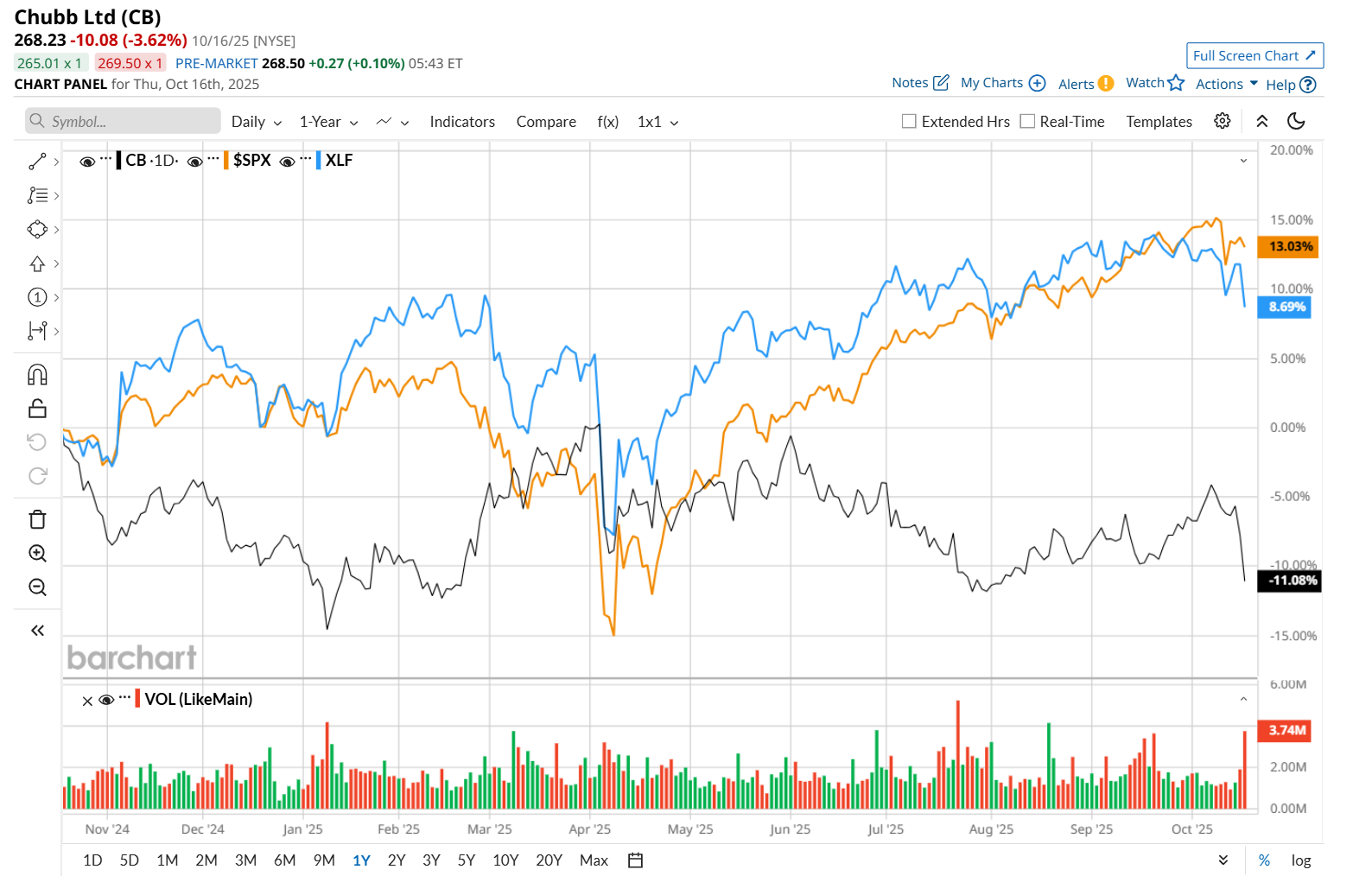

Shares of CB have declined 11.2% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.5% return and the Financial Select Sector SPDR Fund’s (XLF) 9.3% rise over the same time frame.

CB reported solid Q2 results on Jul. 22. The company’s net premiums written advanced 6.3% year-over-year to $14.2 billion. Meanwhile, its core operating EPS of $6.14 improved 14.1% from the year-ago quarter and came in 4.2% ahead of analyst expectations. Yet, its shares plunged 3.1% in the following trading session as investors looked past the earnings beat and reacted more to broader market sentiment.

Wall Street analysts are moderately optimistic about CB’s stock, with an overall "Moderate Buy" rating. Among 25 analysts covering the stock, nine recommend "Strong Buy," one indicates a “Moderate Buy," 13 suggest "Hold,” one advises a "Moderate Sell,” and one suggests a “Strong Sell” rating. The mean price target for CB is $306.04, implying a 14.1% potential upside from the current levels.