/Cencora%20Inc_%20HQ-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $63.8 billion, Cencora, Inc. (COR) is a leading global healthcare solutions provider. The company sources and distributes pharmaceutical and healthcare products while offering a wide range of logistics, data analytics, and commercialization services to healthcare providers and manufacturers worldwide.

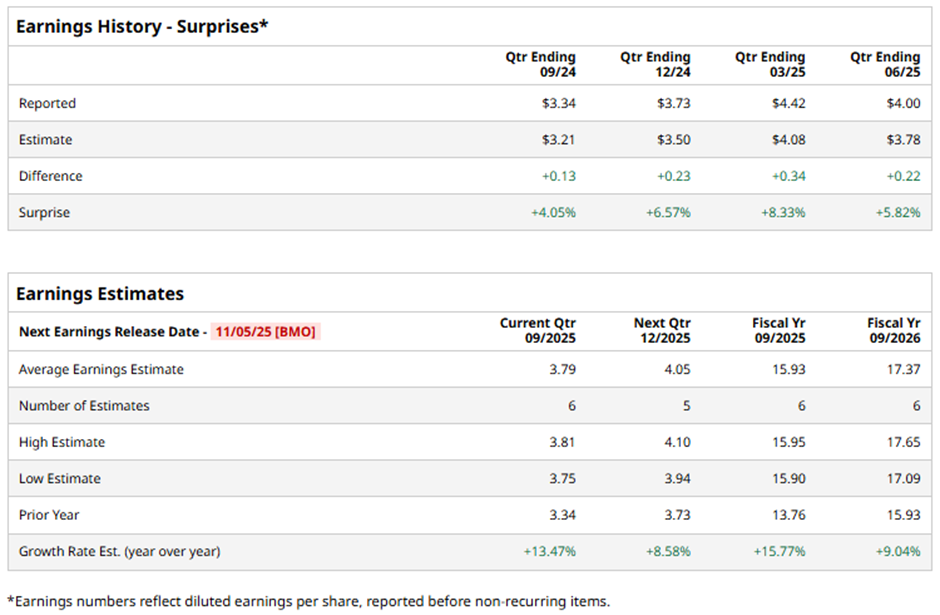

The Conshohocken, Pennsylvania-based company is slated to announce its fiscal Q4 2025 results before the market opens on Wednesday, Nov. 5. Ahead of the event, analysts forecast Cencora to report an adjusted EPS of $3.79, up 13.5% from $3.34 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts project the prescription drug distributor to report adjusted EPS of $15.93, a 15.8% increase from $13.76 in fiscal 2024.

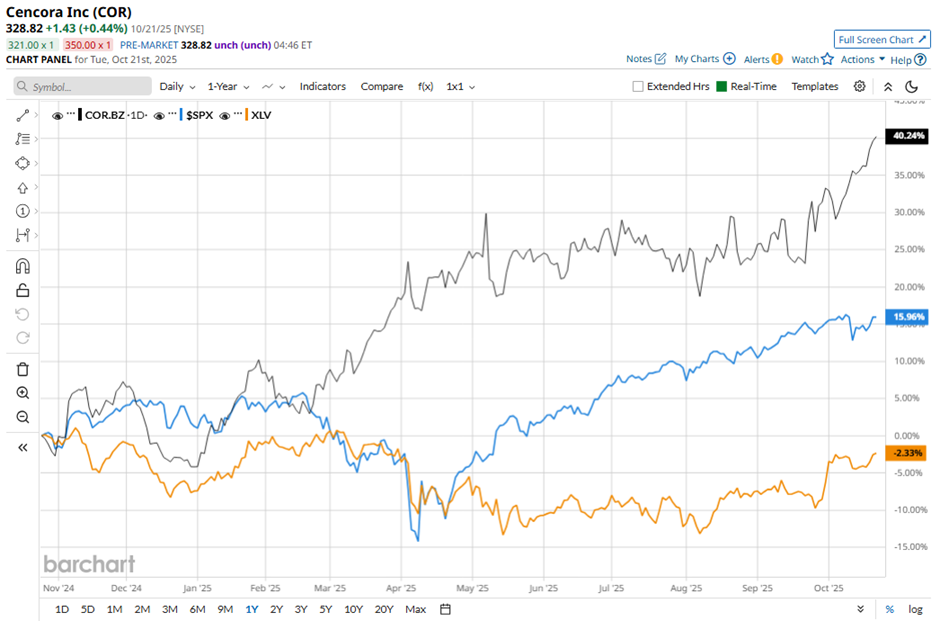

Shares of Cencora have surged over 39% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 15.1% rise and the Health Care Select Sector SPDR Fund's (XLV) 4.1% decline over the same period.

Despite Cencora reporting stronger-than-expected Q3 2025 adjusted EPS of $4 and revenue of $80.66 billion, shares fell 2.9% on Aug. 6. The International Healthcare Solutions segment saw operating income decline 12.9% year-over-year, while higher interest expense of $81.8 million, up $50.5 million, and operating expenses up 17.3% offset some of the gains from strong U.S. growth.

Analysts' consensus rating on COR stock is bullish, with an overall "Strong Buy" rating. Among 15 analysts covering the stock, 11 recommend a "Strong Buy” and four give a "Hold" rating. The average analyst price target for Cencora is $339.71, indicating a potential upside of 3.3% from the current levels.