/Bank%20Of%20New%20York%20Mellon%20Corp%20phone%20and%20website-%20by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at $77.2 billion by market cap, The Bank of New York Mellon Corporation (BK) provides a comprehensive range of financial services. Headquartered in New York, it is recognized as the world’s largest custodian bank and securities services provider. The financial titan is set to release its fiscal 2025 third-quarter earnings before the market opens on Thursday, Oct. 16.

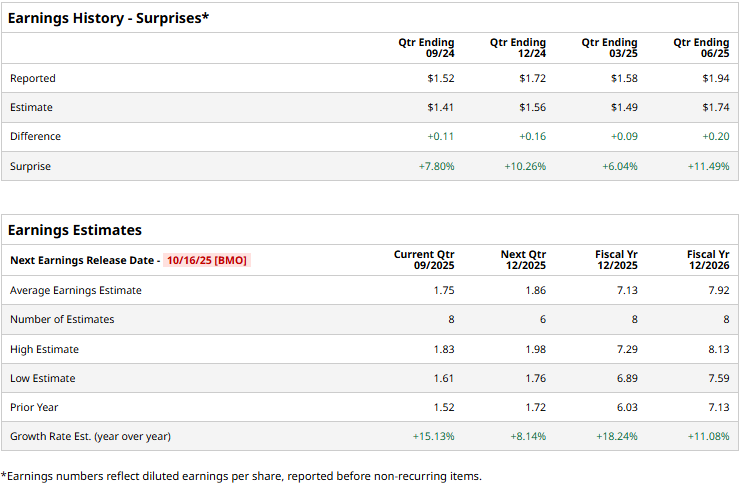

Ahead of the event, analysts expect BK to report a profit of $1.75 per share on a diluted basis, up 15.1% from $1.52 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect BK to report EPS of $7.13, up 18.2% from $6.03 in fiscal 2024. Looking further, its EPS is likely to improve 11.1% year over year to $7.92 in fiscal 2026.

BNY Mellon stock has delivered a standout performance over the past 52 weeks, surging 53.2%, well ahead of the S&P 500 Index's ($SPX) 15.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the same time frame.

On Sept. 17, BNY Mellon shares gained 1.4% following the company’s announcement that it will lower its Prime Lending Rate by 25 basis points, from 7.50% to 7.25%, effective Thursday, Sept. 18, 2025.

Analysts’ consensus opinion on BK stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 18 analysts covering the stock, eight advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and seven give a “Hold.”

While BK currently trades above the mean price target of $105.09, its Street-high price target of $130 represents a 5.3% upside potential from the current market price.