Shares of Rocket Lab Corp (NASDAQ: RKLB) are trading marginally lower Friday. This week’s volatility was largely attributed to cautious remarks from Federal Reserve Chair Jerome Powell and rising oil prices, creating a risk-off sentiment that has impacted growth sectors, including aerospace.

What To Know: Adding to the pressure is a class-action lawsuit filed against the company, alleging discrepancies related to financial projections and the timeline for its next-generation Neutron rocket. Rocket Lab has since filed a motion to dismiss the suit.

Despite these challenges, the company is highlighting operational progress. CEO Peter Beck recently underscored potential collaborations with NASA for ambitious future missions to Mars and Venus.

This forward-looking strategy is bolstered by the recent opening of Rocket Lab's new Neutron launch complex in Virginia, a critical infrastructure milestone. Investors appear to be weighing the near-term macroeconomic pressures and legal proceedings against the company’s long-term growth catalysts.

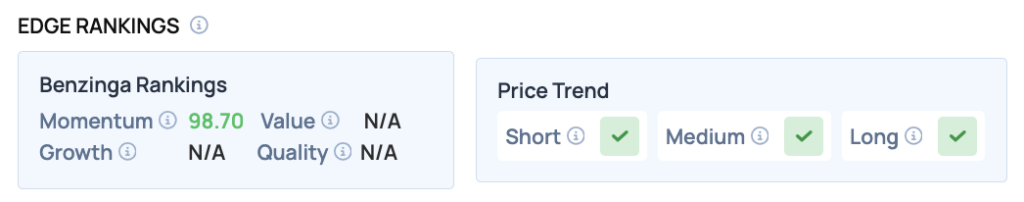

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock shows exceptionally strong momentum with a score of 98.70 and maintains a positive price trend across short, medium and long-term outlooks.

RKLB Price Action: Rocket Lab shares were down 0.28% at $46.50 at the time of publication Friday, according to Benzinga Pro. Over the past month, RKLB has declined about 2.8% versus a 2.3% rise in the S&P 500 and is up roughly 86% year-to-date compared to the index’s 11.8% gain. The stock is trading near its 52-week high of $55.17.

Technical Momentum: Rocket Lab is currently trading at $46.15, slightly below its 50-day moving average of $46.51, indicating a potential short-term bearish sentiment. The stock has shown strong support at the 100-day moving average of $38.18, while the 200-day moving average at $30.73 suggests a longer-term bullish trend.

How To Buy RKLB Stock

By now you're likely curious about how to participate in the market for Rocket Lab – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Rocket Lab, which is trading at $46.27 as of publishing time, $100 would buy you 2.16 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

.png?w=600)