Shares of Rocket Companies Inc (NYSE:RKT) are rising Wednesday afternoon after the Federal Reserve announced a quarter-point cut to its benchmark interest rate, bringing it to a range of 4.00% to 4.25%. This marks the fourth consecutive rate cut, signaling a more accommodating monetary policy that could boost the housing market.

Why It Matters: For a mortgage-heavy business like Rocket, this is welcome news. Lower interest rates translate directly to more affordable borrowing costs for consumers, which is likely to spur an increase in both new home purchases and refinancing activities.

The Fed’s updated projections, which forecast further rate cuts over the next two years, suggest a sustained positive environment for the mortgage industry. The central bank also revised its 2025 real GDP growth forecast upward, from 1.6% to 1.8%, indicating a resilient economy.

This combination of lower rates and economic strength is a powerful tailwind for RKT, and investors have responded favorably, sending the stock higher on the news.

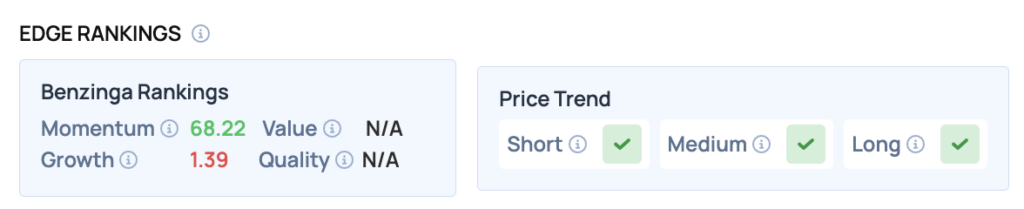

Benzinga Edge Rankings: Underscoring this positive market reaction, RKT shows a strong Momentum score of 68.22, reflecting the stock’s recent upward price movement.

Benzinga Edge stock rankings give you four critical scores to help you identify the strongest and weakest stocks to buy and sell.

Price Action: According to data from Benzinga Pro, RKT shares are trading higher by 2.77% to $21.33 Wednesday afternoon. The stock has a 52-week high of $22.56 and a 52-week low of $10.06.

Read Also: Opendoor Stock Rallies On Expansion And Short Squeeze Hopes

How To Buy RKT Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Rocket Companies’ case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock