Robinhood Markets Inc (NASDAQ:HOOD) shares are trading higher on Thursday following the announcement of a suite of new products aimed at active traders. Here’s what investors need to know.

What To Know: The company unveiled its plans at the F1 Grand Prix Plaza in Las Vegas, revealing a new social trading platform, “Robinhood Social,” and an advanced browser-based platform, “Robinhood Legend,” featuring AI-powered tools.

The new offerings are part of CEO Vlad Tenev's vision to create a "financial superapp." In a move to attract more sophisticated investors, Robinhood will also introduce short-selling capabilities, which one analyst called the filling of a “glaring product gap.” Additionally, the company is expanding its futures trading options and adding new features like overnight index option trading.

Analysts have responded positively to the developments. Mizuho raised its price target on Robinhood to $145, while Piper Sandler maintained its Overweight rating and $120 price target, noting that the new features could help with customer acquisition. Robinhood Social is expected to launch by invitation early next year.

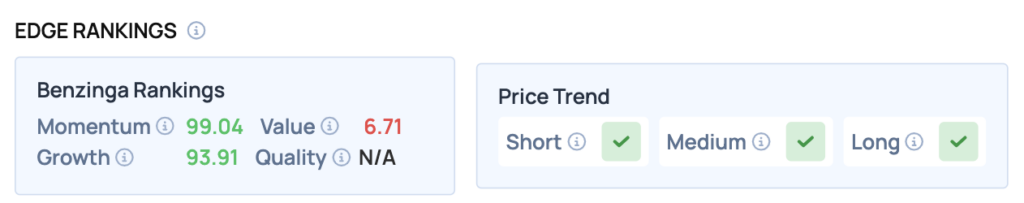

Benzinga Edge Rankings: According to Benzinga Edge proprietary rankings, the stock exhibits exceptional strength with a Momentum score of 99.04 and a Growth score of 93.91.

Price Action: According to data from Benzinga Pro, HOOD shares are trading higher by 2.9% to $120.91 Thursday morning. The stock has a 52-week high of $123.44 and a 52-week low of $20.67.

Read Also: From Meme Stock To Must-Own: Robinhood’s S&P 500 Inclusion Lights Up ETF Plays

How To Buy HOOD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Robinhood Markets’ case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock