Plug Power Inc (NASDAQ:PLUG) shares are trading flat Monday morning, finding some footing after a turbulent week that saw the stock fall around 20%. Investors last week reacted to a capital-raising announcement.

- PLUG is delivering impressive returns. Watch the momentum here.

What To Know: Last week’s decline was largely attributed to a warrant inducement agreement to raise $370 million, priced at $2.00 per share, which overshadowed several positive operational updates.

Investors are weighing this dilution against the company’s long-term initiatives. Last week, Plug announced a strategic partnership with Edgewood Renewables to build a new renewable fuels facility in North Las Vegas, Nevada.

The plant will process waste biomass feedstocks to produce sustainable aviation fuel, renewable diesel and biomethanol. Plug will provide engineering, key product supply, and project oversight.

This news followed the successful first delivery of hydrogen to Germany’s H2CAST project, highlighting the company’s continued European expansion.

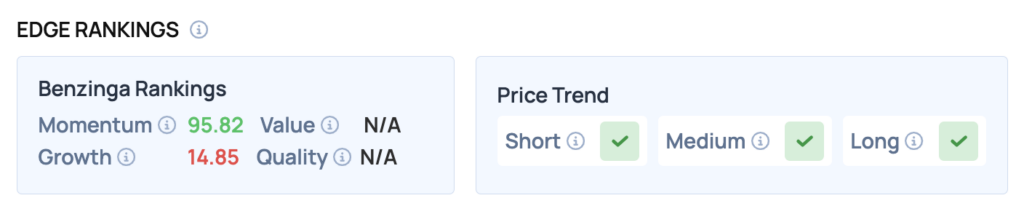

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock displays very strong Momentum with a score of 95.82.

PLUG Price Action: Plug Power shares were roughly flat at $2.98 at the time of publication on Monday, according to Benzinga Pro data.

Read Also: Palantir Locks In Poland — And Maybe Its Next All-Time High

How To Buy PLUG Stock

By now you're likely curious about how to participate in the market for Plug Power – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Plug Power, which is trading at $2.98 as of publishing time, $100 would buy you 33.6 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

.png?w=600)