Shares of Lithium Americas Corp (NYSE:LAC) are trading flat Monday, following a surge last week on news of a landmark agreement with the U.S. Department of Energy (DOE) and General Motors. Here’s what investors need to know.

What To Know: The deal announced last week advances a $435 million first draw on a previously announced $2.26 billion DOE loan to develop the Thacker Pass lithium project in Nevada.

This strategic partnership is being hailed by some analysts as a “game changer” for the company and the domestic lithium supply chain. Wedbush analyst Dan Ives raised his price target on the stock from $5 to $8, maintaining a Neutral rating. The agreement gives the DOE a 5% equity stake in Lithium Americas and a 5% stake in the joint venture with GM.

The move is seen as a significant step in onshoring large-scale lithium production, a critical component for electric vehicle batteries. While JPMorgan analyst Bill Peterson does not currently have a rating on the stock, the analyst believes the deal solidifies the government’s commitment to securing a domestic supply of essential minerals.

Lithium Americas investors appear to be digesting recent gains with the stock up more than 200% over the past month.

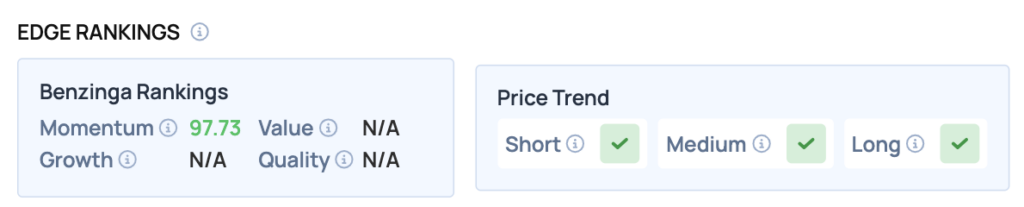

Benzinga Edge Rankings: Despite the flat trading session, Benzinga Edge rankings highlight the stock’s powerful underlying momentum with a score of 97.73.

LAC Price Action: Lithium Americas shares were down 0.28% $9.02 at the time of publication Monday, according to Benzinga Pro. The stock is trading near its 52-week highs.

The stock is significantly above its 50-day moving average of $3.50, indicating strong upward momentum over the medium term. Key support is likely around the 200-day moving average at $3.05, while resistance may be encountered near the recent high.

Read Also: Kratos Defense Stock Is Moving Higher Monday: Here’s Why

How To Buy LAC Stock

By now you're likely curious about how to participate in the market for Lithium Americas – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock