Bloom Energy Corp (NYSE:BE) shares are trading marginally lower Thursday morning after the company announced a proposed $1.75 billion convertible senior notes offering due 2030.

The capital raise comes just two days after a blockbuster third-quarter earnings report sent the stock skyrocketing to an all-time high. The company’s stock soared following a blockbuster third-quarter earnings report that exceeded analyst expectations.

- BE stock is showing notable weakness. Check the full analysis here.

What Else: The rally was fueled by strong demand from data center developers and key partnerships with major players like Oracle and Brookfield Asset Management. Bloom reported third-quarter revenue of over $519 million, a 57.1% increase year-over-year, and adjusted earnings of 15 cents per share, beating estimates of 9 cents.

The strong performance led to a wave of analyst upgrades. JPMorgan raised its price target to $129, Susquehanna increased its target to $157, and BTIG raised its target to $145.

The company’s long-term forecast remains positive, with expected fiscal 2025 revenue of about $1.88 billion and fiscal 2026 revenue of roughly $2.32 billion.

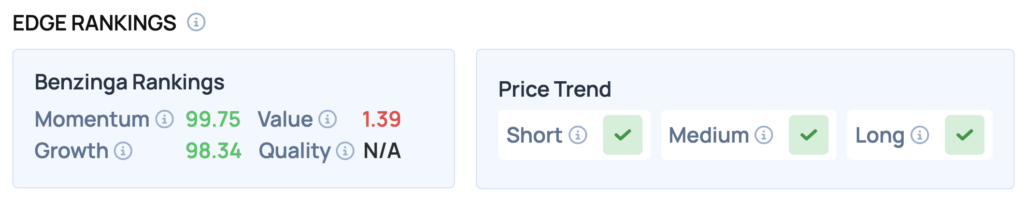

Benzinga Edge Rankings: Supporting its recent performance, Benzinga Edge stock rankings highlight the company’s exceptional strength, assigning it a Momentum score of 99.75 and a Growth score of 98.34.

BE Price Action: Bloom Energy shares were down 2.11% at $130.98 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Trump Hints At Potential ‘Very Large Scale’ Alaska Oil And Gas Deal With China

How To Buy BE Stock

By now you're likely curious about how to participate in the market for Bloom Energy – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock