Beyond Meat Inc (NASDAQ:BYND) shares are trading lower Monday morning. The stock has seen marked weakness following the release of preliminary third-quarter results that have left investors concerned about the company’s financial health.

- BYND stock is showing notable weakness. See the full story here.

What To Know: The plant-based meat producer announced late last week that it anticipates third-quarter revenue of approximately $70 million, which is consistent with prior guidance, but shows signs of stagnant growth.

Adding to investor anxiety, the company projected gross margins between 10% and 11%, impacted by $1.7 million in costs from shutting down its China operations. Additionally, Beyond Meat has signaled a significant non-cash impairment charge, indicating a reduction in the book value of its long-term assets.

Analysts are forecasting a loss of 43 cents per share when official third-quarter results are announced on Nov. 4. The stock has recently experienced extreme volatility, drawing comparisons to meme-stock phenomena, with significant short interest.

However, the company’s latest financial disclosures suggest ongoing restructuring challenges and continued pressure on profitability, fueling the current downturn in its stock price as investors weigh these fundamental concerns.

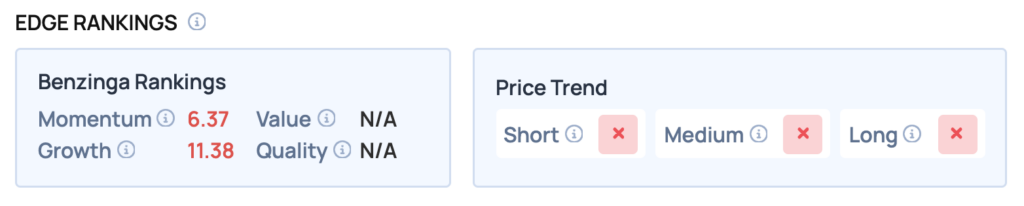

Benzinga Edge Rankings: Underscoring the downward pressure, Benzinga Edge rankings show the stock’s price trend is negative across short, medium and long-term periods.

BYND Price Action: Beyond Meat shares were down 0.46% at $2.17 at the time of publication on Monday, according to Benzinga Pro data.

Read Also: Rate Cuts, Meltups, And Market Euphoria — Ed Yardeni Says It’s 1999 All Over Again

How To Buy BYND Stock

By now you're likely curious about how to participate in the market for Beyond Meat – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock