For many people, retirement is imagined as a reward for years of hard work—a time to relax, travel, and enjoy life without financial stress. But for others, the reality can be much different. If you don’t have enough money to get through retirement, the dream can quickly turn into daily anxiety about bills, medical costs, and long-term stability. Understanding what can happen when retirement savings fall short is the first step toward preparing and protecting your future. Here’s what to expect—and what you can do to change course before it’s too late.

The Risk of Outliving Your Savings

One of the most common challenges people face when they do not have enough money to get through retirement is simply running out of funds too soon. Increased life expectancy means that retirees often need savings that can last 20 to 30 years, but many underestimate how long their money must stretch. Once retirement accounts are depleted, individuals often must rely on Social Security alone, which rarely covers full living expenses. This financial strain can lead to difficult choices about housing, healthcare, and lifestyle. Planning for longevity—not just the short term—is essential to avoid this painful reality.

The Strain of Rising Healthcare Costs

Healthcare is one of the biggest financial burdens for those who do not have enough money to get through retirement. Even with Medicare, out-of-pocket expenses for prescriptions, long-term care, and specialized treatments can quickly drain limited resources. Unexpected medical issues often lead retirees to dip into emergency savings or take on debt. Some may even delay essential care or skip medications to save money. Creating a realistic healthcare budget and considering supplemental insurance can make a critical difference in financial stability.

The Challenge of Maintaining Housing and Independence

When you do not have enough money to get through retirement, housing becomes one of the most immediate concerns. Many retirees face the prospect of downsizing, relocating, or relying on family members for help. Rising rent and property taxes can make staying in a longtime home unsustainable. Even for homeowners, maintenance costs and utilities can add up fast. Proactive planning—such as paying off a mortgage early or moving to a lower-cost area—can help preserve independence without sacrificing comfort.

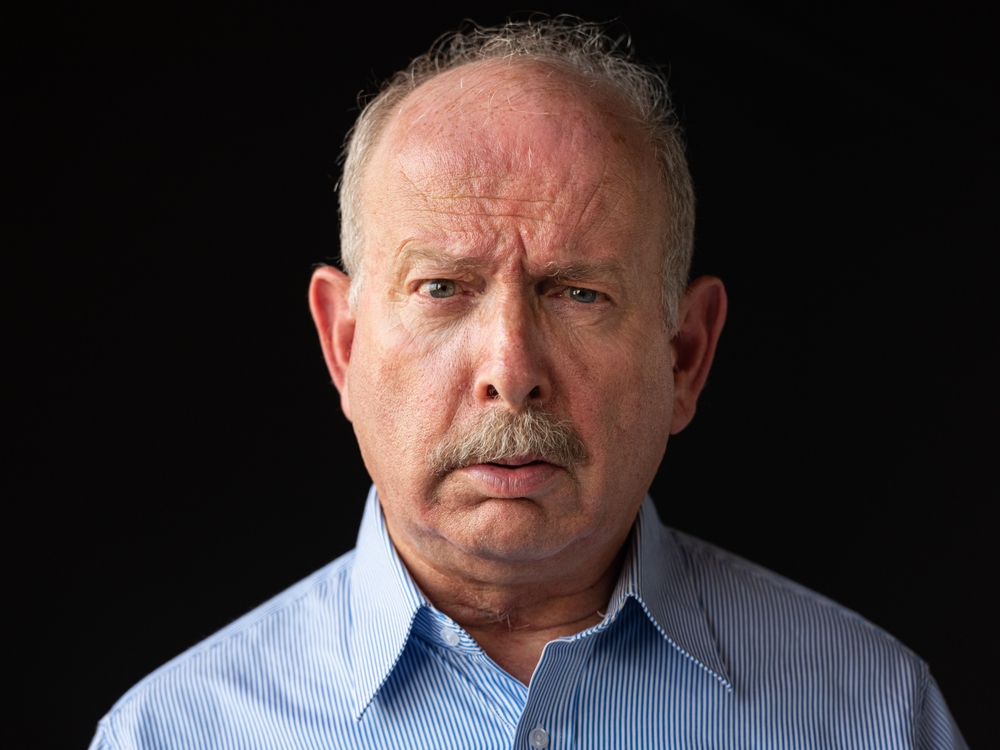

The Emotional Toll of Financial Stress

The financial pressure of realizing you may not have enough money to get through retirement can be emotionally devastating. Worrying about bills, unexpected expenses, or becoming a burden to loved ones can take a serious toll on mental health. Many retirees experience anxiety, guilt, or even depression as financial challenges mount. These feelings are compounded by the sense of losing control after decades of independence. Seeking financial guidance early—and discussing concerns openly—can help reduce stress and create a more confident plan for the future.

The Need to Return to Work After Retiring

A growing number of retirees are reentering the workforce because they do not have enough money to get through retirement. While some enjoy the social and mental benefits of part-time work, others return out of financial necessity. Finding suitable employment can be difficult for older adults facing health issues or age discrimination. However, flexible jobs, consulting roles, and remote work opportunities are becoming more accessible. Earning supplemental income can help bridge the gap while preserving savings and maintaining a sense of purpose.

The Importance of Adjusting Your Lifestyle

When savings fall short, making lifestyle adjustments is often unavoidable. People who do not have enough money to get through retirement may need to cut back on travel, dining out, or entertainment. While these changes can feel discouraging, small adjustments can have a big impact over time. Prioritizing essential expenses and reducing nonessential costs can help stretch available funds further. Financial advisors can help retirees develop sustainable budgets that preserve quality of life without jeopardizing long-term security.

How to Regain Financial Control Before It’s Too Late

Even if you realize you may not have enough money to get through retirement, there are ways to take back control. The first step is to evaluate your current spending, debt, and income sources to identify where adjustments can be made. Consider delaying retirement, maximizing Social Security benefits, or exploring part-time work options to supplement income. Downsizing housing or moving to a lower-cost region can also provide lasting financial relief. The key is to act early and seek professional advice rather than waiting for circumstances to worsen.

Have you considered what would happen if your savings didn’t last through retirement? What steps are you taking now to secure your future? Share your thoughts in the comments below!

What to Read Next…

- 9 Hidden Retirement-Plan Mistakes That Can Cost You Tens of Thousands

- 12 Distinctive Advantages of Self-Directed Retirement Accounts

- Is It Too Late to Start Saving Aggressively for a Comfortable Retirement?

- 13 Secret Worries About Retirement That Keep You Awake at Night

- 7 Surprising Expenses Nobody Expects After Retirement

The post What Happens When You Don’t Have Enough Money To Get Through Retirement appeared first on The Free Financial Advisor.