With a market cap of $24.3 billion, Williams-Sonoma, Inc. (WSM) is an omni-channel specialty retailer of premium home products. The company operates multiple brands, including Williams Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham, and others, offering a wide range of cookware, furnishings, décor, and personalized goods.

Shares of the San Francisco, California-based company have outperformed the broader market over the past 52 weeks. WSM stock has surged 45.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied over 15%. However, shares of the company have gained 5.6% on a YTD basis, lagging behind SPX’s over 10% rise.

Looking closer, Williams-Sonoma stock has outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 25.6% return over the past 52 weeks.

Williams-Sonoma shares fell marginally on Aug. 27 despite reporting better-than-expected Q2 2025 EPS of $2 and revenue of $1.8 billion. The company disclosed merchandise inventories up 17.7% year-over-year to $1.4 billion from a strategic pull-forward to offset tariffs, highlighting exposure to significant incremental tariff costs (China 30%, India 50%, Vietnam 20%, steel/aluminum 50%, copper 50%) that could erode future profitability.

For the fiscal year ending in January 2026, analysts expect WSM’s EPS to decrease 2.8% year-over-year to $8.54. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

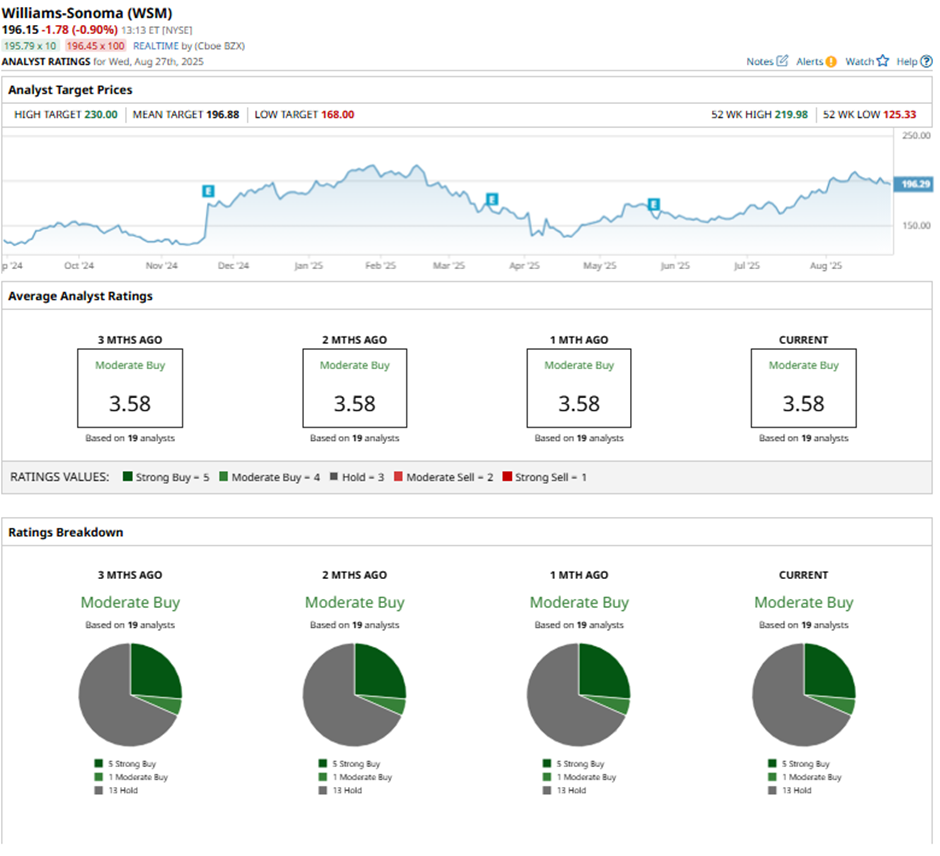

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” and 13 “Holds.”

On Aug. 25, KeyBanc analyst Bradley Thomas raised Williams-Sonoma’s price target to $230 while maintaining an “Overweight” rating.

The mean price target of $196.88 represents a marginal premium to WSM’s current price levels. The Street-high price target of $230 suggests a 17.3% potential upside.