Valued at a market cap of $35.1 billion, Targa Resources Corp. (TRGP) is a leading midstream energy infrastructure company that owns and operates a vast network of assets across North America. Headquartered in Houston, Texas, it operates through its Gathering & Processing and Logistics & Transportation segments.

Shares of this energy company have slightly lagged behind the broader market over the past 52 weeks. Targa Resources has rallied 14.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.4%. Moreover, on a YTD basis, the stock is down 8.6%, compared to SPX’s 9.7% rise.

Narrowing the focus, TRGP has outpaced the Energy Select Sector SPDR Fund’s (XLE) 5.5% drop over the past 52 weeks.

TRGA shares gained 2.4% after the company released its second-quarter earnings on Aug. 7. Total revenues surged 20% to approximately $4.26 billion, buoyed by higher NGL volumes and natural gas prices. Net income attributable to common shareholders surged to $629.1 million, up from $298.5 million a year earlier. Adjusted EBITDA climbed 18% year-over-year to $1.163 billion, driven by record Permian volumes and NGL transportation.

Targa reaffirms its full-year 2025 adjusted EBITDA guidance of $4.65–$4.85 billion, underpinned by anticipated growth across its Permian G&P operations, which is expected to deliver record volumes in Permian production, NGL pipeline transportation, fractionation, and LPG exports, surpassing the records set in 2024.

For the fiscal year, which ends in December, analysts expect Targa's EPS to grow 30.8% year over year to $7.51. The company’s earnings surprise history is mixed. It surpassed the Wall Street estimates in two of the last four quarters while missing on two other occasions.

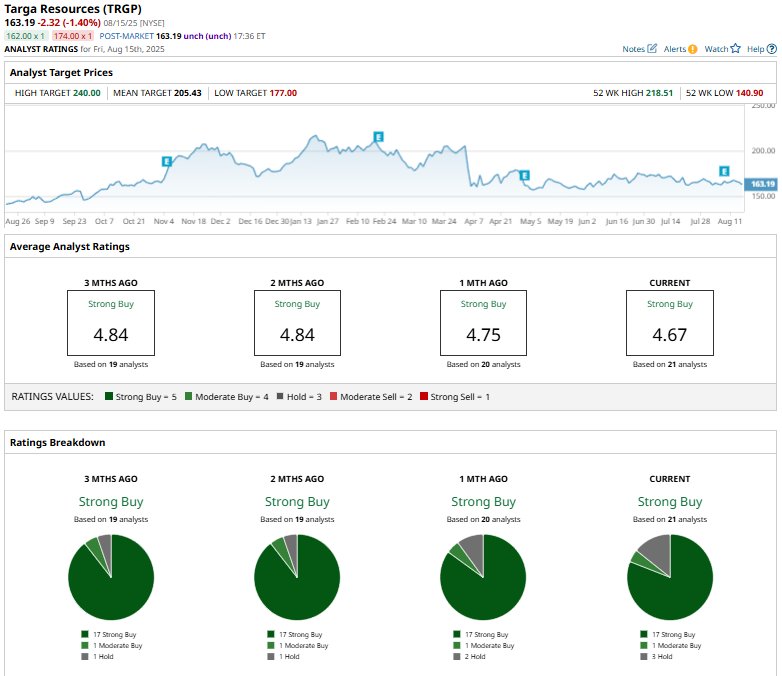

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy,” which is based on 17 “Strong Buy,” one “Moderate Buy,” and three “Hold” rating.

This configuration has remained stable over the past few months.

On Aug. 14, Scotiabank raised its price target on Targa Resources from $201 to $204 while maintaining an “Outperform” rating. The firm noted that while Q2 earnings across the U.S. midstream sector were mixed, gas-levered companies like Targa could benefit from shale well dynamics and hydrocarbon streams, even amid slower production growth.

The mean price target of $205.43 represents a 27.9% upside from Targa’s current price levels, while the Street-high price target of $240 suggests an upside potential of 55.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.