/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Tada%20Images%20via%20Shutterstock.jpg)

California-based Palo Alto Networks, Inc. (PANW) provides cybersecurity solutions worldwide. With a market cap of $143.5 billion, Palo Alto Networks offers firewall appliances and software, and Panorama, a security management solution for the global control of network security platforms.

The cybersecurity giant has outpaced the broader market in 2025, but slightly lagged behind over the past 52 weeks. PANW stock prices have surged 17.2% in 2025 and 16.4% over the past year, compared to the S&P 500 Index’s ($SPX) 15.6% gains on a YTD basis and 17.5% returns over the past year.

Zooming in further, PANW has also outpaced the industry-focused Amplify Cybersecurity ETF’s (HACK) 14.4% gains in 2025, and underperformed HACK’s 21.2% surge over the past year.

Palo Alto Networks’ stock prices gained 3.1% in the trading session following the release of its impressive Q4 results on Aug. 18. The company’s focus on providing integrated security solutions has hit a chord with its customers. Given that modern cybersecurity threats are evolving at a rapid pace, Palo Alto Networks’ integrated solutions have proven to be far superior as compared to fragmented defense, as its platforms are designed to work in harmony and create synergy, which provides real-time outcomes and efficiency for customers.

This has led to strong demand for the company’s products, proven by the solid 15.8% year-over-year growth in revenues to $2.5 billion, beating the Street’s expectations by 1.5%. Further, its adjusted EPS soared 26.7% year-over-year to $0.95, surpassing the consensus estimates by 8%.

For fiscal 2026, ending in July, analysts expect PANW to deliver an adjusted EPS of $3.80, up 13.9% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

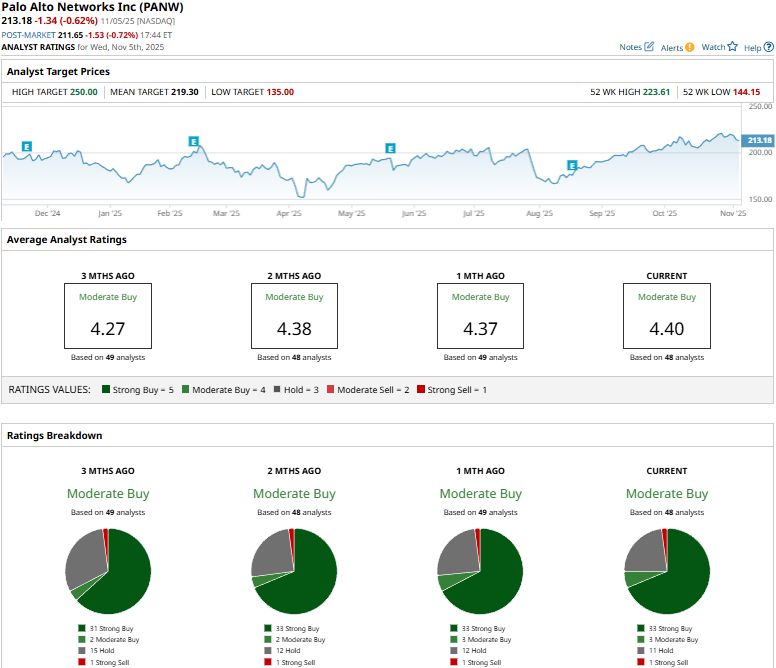

Among the 48 analysts covering the PANW stock, the consensus rating is a “Moderate Buy.” That’s based on 33 “Strong Buys,” three “Moderate Buys,” 11 “Holds,” and one “Strong Sell.”

This configuration is notably more optimistic than three months ago, when 31 analysts gave “Strong Buy” recommendations and only two analysts gave “Moderate Buy” suggestions.

On Oct. 17, Oppenheimer analyst Ittai Kidron reiterated an “Outperform” rating on PANW and raised the price target from $225 to $245.

PANW’s mean price target of $219.30 represents a modest 2.9% premium to current price levels. Meanwhile, the street-high target of $250 suggests 17.3% upside potential.