Match Group, Inc. (MTCH) is an internet and technology company that owns and operates one of the world’s largest portfolios of online dating services, including popular brands such as Tinder, Match.com, Hinge, OkCupid, Plenty of Fish, and others. The company is headquartered in Dallas, Texas, and its platforms are available in over 40 languages, serving millions of users globally. Its market cap is around $7.5 billion.

Shares of this dating app operator have lagged behind the broader market over the past 52 weeks. MTCH has fallen 11.8% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.4%. Moreover, on a YTD basis, the stock is down 3.9%, compared to SPX’s 1.8% uptick.

Narrowing the focus, MTCH has also underperformed the Communication Services Select Sector SPDR Fund’s (XLC) 17.6% return over the past 52 weeks and 1.8% rise on a YTD basis.

Match Group’s stock has been falling largely because investors are concerned about slowing user growth and weaker fundamentals. The company has reported declines in the number of paying users, especially on its core app Tinder, which signals slowing demand. Match has also delivered lower-than-expected earnings in the past few quarters. Additionally, broader industry challenges like market saturation and macroeconomic headwinds on consumer spending have weighed on sentiment.

For the fiscal year 2025, analysts expect MTCH’s EPS to grow 15.3% year over year to $2.57. The company’s earnings surprise history is mixed. It surpassed the consensus estimates in one of the last four quarters, while missing on three other occasions.

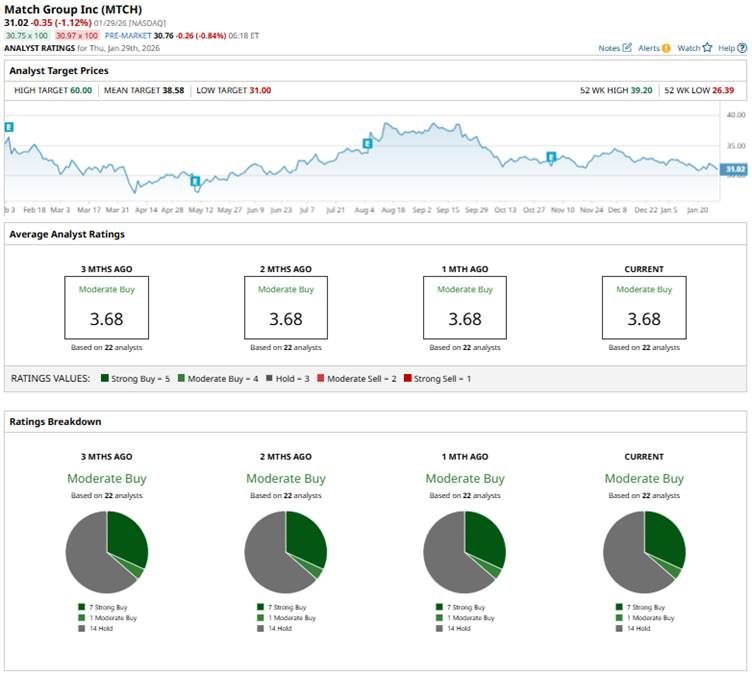

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on seven “Strong Buys,” one “Moderate Buy,” and 14 “Hold” ratings.

The configuration has remained consistent over the past few months.

On Jan. 13, 2026, Morgan Stanley maintained its “Equal-Weight” rating on Match Group but raised its price target to $37 from $34.

The mean price target of $38.58 represents a 24.4% premium from MTCH’s current price levels, while the Street-high price target of $60 suggests an upside potential of 93.4%.