With a market cap of $22.5 billion, Expand Energy Corporation (EXE) is the largest independent U.S. natural gas producer, formed in 2024 through the merger of Chesapeake Energy and Southwestern Energy. Headquartered in Oklahoma City, the company operates major assets in the Appalachian region and the Haynesville Basin.

Shares of EXE have notably outperformed the broader market over the past 52 weeks. EXE has surged 28.8% over this period, while the broader S&P 500 Index ($SPX) has gained 14.3%. However, shares of EXE are down 5% on a YTD basis, compared to SPX’s 9.5% rise.

Looking closer, the company has outpaced the iShares U.S. Energy ETF’s (IYE) 1.3% drop over the past 52 weeks and has surged 3.2% on a YTD basis.

On Monday, Expand Energy shares fell over 2% following Roth Capital Partners’ downgrade of the natural gas sector, citing concerns that oversupply will keep prices depressed.

For the fiscal year ending in December 2025, analysts expect EXE’s adjusted EPS to increase 351.1% year-over-year to $6.36. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the past four quarters while missing on another occasion.

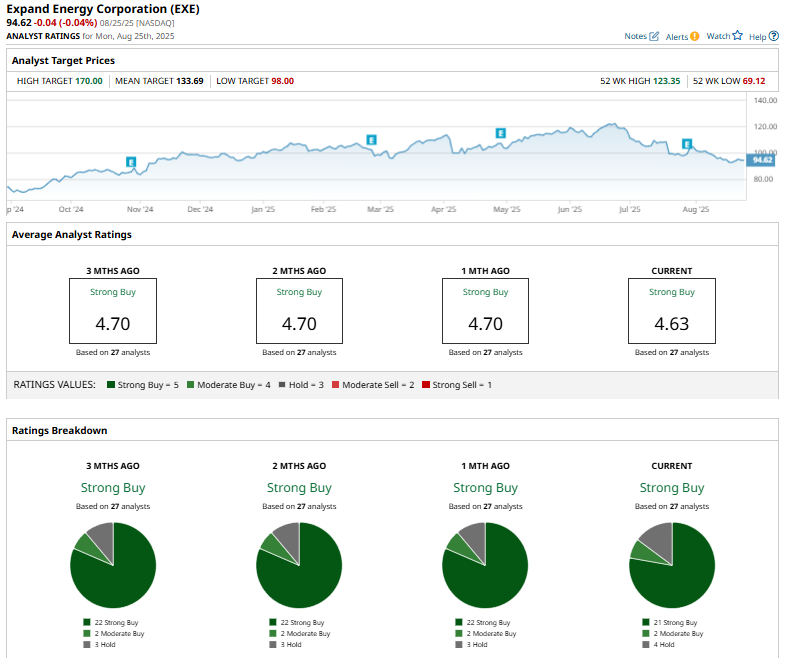

Among the 27 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 21 “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

This configuration is bearish than a month ago, with 22 “Strong Buy” ratings on the stock.

On August 20, UBS analyst Josh Silverstein reaffirmed a “Buy” rating on Expand Energy but lowered the price target to $132 from $145.

Expand Energy’s mean price target of $133.69 implies a 41.3% from the current market prices. The Street-high price target of $170 implies a potential upside of 79.8% from the current price levels.