The investing game is full of active players both big and small. And while it’s true that hedge funds, corporations, and institutions tend to dominate the market, there’s another class of investor whose influence cannot be swept under the rug—the retail investor.

What Is a Retail Investor?

A retail investor—also known as an individual investor—is a non-professional or “amateur” investor who buys and sells securities like stocks using their own money. In other words, those who invest, but for whom investing is not a profession, are retail investors.

Some retail investors barely pay attention to the market, investing passively in index funds through an IRA or 401(k) retirement account. Others are highly active market-watchers who buy and sell individual stocks (and even derivative securities like options contracts) on a weekly or even daily basis.

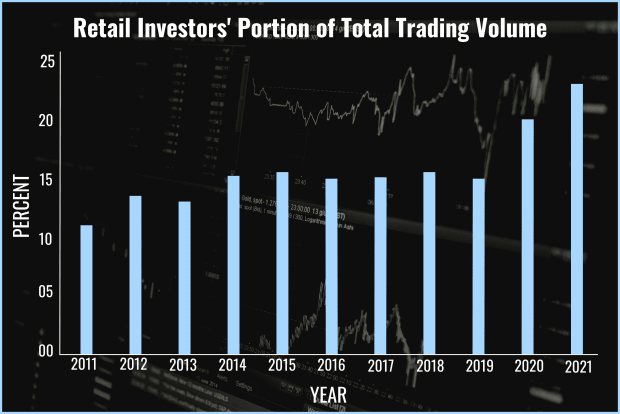

If you own a stock, bond, or ETF, but you’re not a financial professional, you’re a retail investor—and there are more of you than ever. According to a study by Bloomberg Intelligence, the percentage of traded shares accounted for by retail investors nearly doubled from 2010 to 2020. During the first month or so of 2023, retail investors injected an average of $1.5 billion into the stock market each day, according to VandaTrack data, and this was despite high volatility, looming inflation, and economic uncertainty.

How Large Is the Retail Investor Market?

The retail investor market, while once an afterthought to Wall Street’s major players, has become a force to be reckoned with. Retail investors’ share of total trading volume rose from just above 10% in 2011 to over 22% in 2021, according to Bloomberg Intelligence. As of early 2023, the individual investor market reached $7.2 trillion in size, according to data from IBISWorld.

In the modern day, investing is both accessible and popular, and with the ubiquity of information in the internet age, anyone can become an informed investor with a bit of research. But it wasn’t always this way.

What Factors Are Responsible for the Rise of the Individual Investor?

Retail investors have more market influence than ever for a variety of reasons. So what catalyzed the drastic increase in the number of retail investors in the market and their collective influence?

Fee-Free Trading Apps and Fractional Shares

Perhaps the most instrumental factor in the explosion of amateur trading was the introduction of fee-free stock-trading services, many of which allow for the trading of fractional shares, enabling individuals to buy stocks with as little as $1.

In the past, investors had to pay a brokerage fee for every trade (or at least a monthly fee for the ability to trade) and could only trade whole shares, some of which cost hundreds or even thousands of dollars.

This system posed a barrier to entry for many younger, less-experienced investors who didn’t have piles of expendable income to play with. Those who wanted to get into the market but could only afford to throw $5 to $50 into stocks at any given time didn’t find traditional brokerages worth the expense.

With the fee-free, fractional-share trading offered by easy-to-use apps like Robinhood, anyone could begin investing their spare change in their spare time. As the old adage goes, “if you build it, they will come.” And come they did.

Robinhood eliminated trading fees in 2019, and other, more established trading platforms like Schwab and Fidelity followed suit to retain market share. A barrage of new, user-friendly FinTech trading apps like SofFi, WeBull, and TradeStation also ramped up efforts to take advantage of the wave of new retail traders flocking the market now that brokerage fees were a thing of the past. By 2020, anyone with a smartphone, an internet connection, and a few extra dollars could start investing for free.

Pandemic Downtime and Stimulus Money

In early 2020, the COVID-19 pandemic shocked economies worldwide, and many middle-income Americans were either laid off or began to work from home. Between unemployment benefits and pandemic stimulus checks, millions of Americans had both money to spend and free time to kill.

At the beginning of the pandemic, stocks plummeted in value, but the crash was short-lived. After hitting a low of around $2,300 in March of 2020, the S&P 500 quickly rebounded and surpassed its previous high by August of the same year. This bull market attracted a new wave of young and plugged-in investors with free time and unspent cash. Retail investors were excited about the stock market and the technology sector in particular, and stocks seemed to have nowhere to go but up.

According to Charles Schwab, up to 15% of the retail investing population may have invested for the first time in 2020.

2021’s Social Media-Fuled Meme Stock Frenzy

In early 2021, the messageboard called r/WallStreetBets on the popular social network/forum Reddit exploded in popularity as users began to band together to buy a variety of so-called “meme stocks.” GameStop, a brick-and-mortar video game retailer, was at the center of this collective effort.

A user called u/DeepFuckingValue posted that they believed the heavily-shorted stock was undervalued and that they had been purchasing call options on it. As it turned out, more shares of GME had been sold short by hedge funds than actually existed, so when r/WallStreetBets’ online army of retail investors banded together to buy shares, they drove the price up significantly, causing hedge funds to purchase shares to cover their short positions. This action caused the price of GME to skyrocket, and more funds had to buy shares to cover their positions, and so on.

In less than half a month, shares went from around $17 to a high of about $483, and hedge funds lost an estimated $6 billion collectively. This retail investor-led short squeeze was big news, and the publicity ignited a new wave of interest in the stock market among young, social-media-savvy individuals. r/WallStreetBets has since been the locus of discussion for many other potential short squeezes and meme stock rallies, and as of March 2023, the community boasted 13.7 million members.

How Much Influence Do Retail Investors Have in the Stock Market?

According to data from Morgan Stanley, individual investors account for around 10% of trading volume in the stock market on any given day. Even so, it's difficult to quantify how influential the trades of retail investors are in moving the overall market or even individual stocks, as each retail investor moves relatively independently and may make decisions based on different types of media, data, and analysis.

On one hand, it is possible that the influence of different retail investors’ trades could cancel one another out and have a net-neutral effect on markets as compared to the mass buy and sell orders executed constantly by massive players like hedge funds and institutions.

That being said, the meme stock saga of 2021 (and beyond) did, however, make it clear that, at least in some cases, retail investors can cause major moves in the price of individual stocks by using social media to catalyze mass buying actions.

What Other Types of Investors Are There?

Institutional investors, high-net-worth individuals, hedge funds, corporations, angel investors, banks, and venture capitalists have roles to play on Wall Street, and together, they move far more money than retail investors. That being said, individual investors have more influence and access than ever before.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions that come up about retail investors.

What Stocks Are Popular Among Retail Investors?

According to VandaTrack, the 10 most traded stocks among individual investors (as of mid-February, 2023) were mostly household names, and two popular ETFs also made the cut:

- Tesla (TSLA)

- SPDR S&P 500 ETF (SPY)

- Amazon (AMZN)

- Apple (AAPL)

- NVIDIA (NVDA)

- Invesco QQQ ETF (QQQ)

- Alphabet (GOOG/L)

- AMD (AMD)

- Meta (META)

- Microsoft (MSFT)

What Industries and Sectors Are Most Popular Among Retail Investors?

According to a report by Morgan Stanley, the most popular types of stocks traded by individual investors are those in the communication, technology, and consumer discretionary industries.

Are Retail Investors More Likely to Make Money or Lose Money?

According to most sources, the bulk of retail investors lose money on an annual basis.

Many pundits claim that 76% of retail investors lose money, citing eToro, a popular stock trading platform for the statistic. In reality, this claim doesn’t come from eToro itself; it comes from a 2019 post on eToro’s “Discover” section, in which a user called @ishfaaqpeerally states that “76% of traders on eToro using CFDs lose money” then goes on to claim that, “On average, 90% of traders lose money.”

Since this post is not recent and doesn’t include sources for the data, it should be taken with a grain of salt.