What Are Foreign Exchange Reserves?

Foreign exchange reserves are a nation’s holdings of other countries’ currencies that can be converted into its own currency through the foreign exchange market, as well as holdings of foreign assets in government securities, such as bonds, and gold, that can be easily turned into cash.

Foreign exchange reserves are also referred to as foreign currency reserves because they typically include caches of other countries’ currencies held in the vaults or accounts of a nation’s central bank.

Foreign exchange reserves are a part of a nation’s reserve assets and are used to diversify its portfolio of international reserves. Many countries tend to hold the U.S. dollar in addition to a mix of other currencies including euros, yen, Swiss francs, and British pounds sterling as part of their reserves. For example, Japan can draw from its own reserves of the U.S. dollar to buy its own currency, the yen. For the U.S., the largest reserve holdings of foreign currency are euros and yen.

The U.S. Dollar’s Role as the Foreign Exchange Reserve of Choice

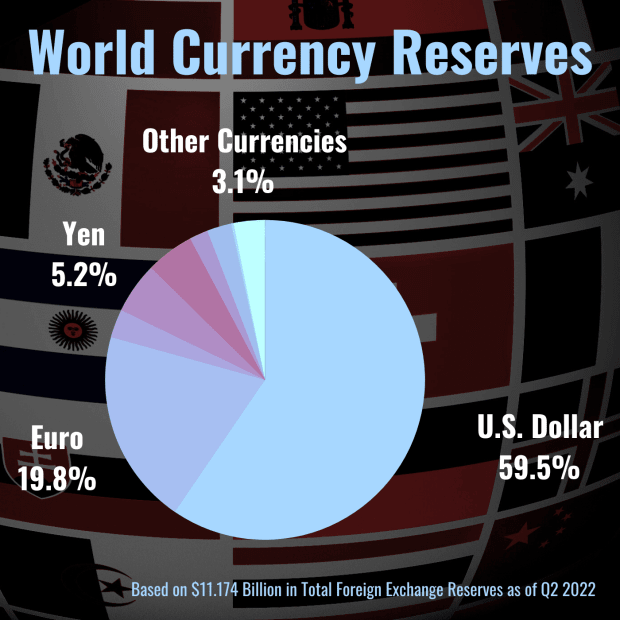

The U.S. dollar is recognized as the foreign reserve currency of choice by many countries, and it tends to represent the largest foreign currency in their holdings in proportion to other currencies such as the euro, the yen, and the pound.

Even before the collapse of the Bretton Woods system in the 1970s, the U.S. dollar was a major currency due to the perceived stability of the U.S. government and its economy. Following the collapse of Bretton Woods, the U.S. dollar remained the currency of choice, even after being devalued, because the U.S. economy was the biggest in the world and many countries were trading with the U.S.

However, according to the International Monetary Fund, since the start of the 21st century, central banks have been reducing the proportion of U.S. dollars as reserves to reduce reliance on a single currency and have been diversifying into currencies of other nations including the Australian dollar and Canadian dollar. In 1999, the average holding of U.S. dollars in countries’ foreign exchange reserves was about 70 percent. As of the second quarter of 2022, that was 59.5 percent, which is roughly $6.6 trillion of the $11 trillion of total reserves globally, according to IMF data.

Why Are Foreign Exchange Reserves Important?

Foreign exchange reserves are important in helping to support a country’s monetary system and exchange rate. Reserves can also be maintained as a means of demonstrating a country’s ability to meet its government’s external debt obligations as well as setting aside money that can be easily converted to meet emergency needs.

A high amount of foreign reserves can also help assure international investors of the nation’s ability to fend off shocks to the system. For example, a country can use its reserves to meet loans to another country, helping to avoid default.

How Does a Country Build Up Its Foreign Exchange Reserves?

A country can build up its reserves if there are more exports than imports. Higher demand for a nation’s goods and services can show that demand for its currency will also increase. A surplus in a nation’s current account—which is the broadest measure of trade in goods and services—indicates that the value of exports is higher than imports.

Why Isn’t China’s Currency a Major Foreign Exchange Reserve?

Despite the renminbi, or yuan, marked by the IMF as a reserve currency, China hasn’t freed up its exchange rate. Investors’ perception of China’s development and institutions not being on par with developed nations hinders its role as a major foreign exchange reserve for many central banks.

Which Country Has the Largest Foreign Exchange Reserves?

China, because of its status as the world’s biggest exporter, has the most reserves of any country in the world. Its biggest trading partner is the U.S., and consequently, China holds more U.S. dollars in its reserves than any other country. As of 2022, China’s central bank, the People’s Bank of China, holds about $3 trillion in U.S. dollars, which is almost half of the $6.6 trillion that is held in reserves globally.

What Happens When a Country Depletes Its Foreign Exchange Reserves?

A country that manages its foreign exchange reserves prudently can gain the support of international investors. But there have been some cases in which central banks have resorted to using up all of their foreign exchange reserves to the detriment of their economic well-being.

Example: The East Asian Financial Crisis of 1997–98

In 1997, Thailand’s currency, the baht, came under attack amid concern that it was overvalued due to slowing economic growth, a large current account deficit, and years of increased foreign investment and borrowing from abroad.

The baht, like many other currencies of countries in Southeast Asia, had benefited from a near peg to the U.S. dollar for many years. But speculators, who believed that the value of the baht should be much lower, began to short the currency. In response, the Bank of Thailand, its central bank, began to draw on its more than $30 billion in reserves of U.S. dollars to defend its currency by buying baht through the foreign exchange market. In a matter of months, almost all of its reserves were depleted, leading to a loss of confidence in the economy and its financial leaders.

Eventually, the baht became unpegged and floated in an almost freefall depreciation. The crisis spread to other countries across Southeast Asia, including the Philippines, Indonesia, and Malaysia (as speculators viewed their economic conditions as similar to Thailand’s), and their central banks followed the Bank of Thailand’s lead to defend their currencies—also resulting in a depletion of their nations’ foreign currency reserves and a loss of confidence from international investors.

To avoid a total economic collapse in countries affected by the contagion, the IMF intervened by loaning billions of dollars with conditions of austerity measures. Within a decade, Thailand and other countries were able to set their economies back on track to growth, but their currencies never recovered to the rates that existed prior to the 1997–98 financial crisis. Their central banks, though, learned that maintaining high levels of foreign exchange reserves was necessary to shore up support by international investors, and their reserves typically exceed pre-crisis levels.