/AI%20(artificial%20intelligence)/Hands%20of%20robot%20and%20human%20touching%20on%20big%20data%20network%20connection%20by%20PopTika%20via%20Shutterstock.jpg)

The artificial intelligence (AI) arms race has entered a new phase, this time focused on mergers and acquisitions. According to CNBC, Wedbush Securities analyst Dan Ives believes that the "AI M&A floodgates" are set to open wide as Big Tech and private equity firms compete to buy their way to dominance. Ives predicts that a friendlier regulatory climate under the new administration will pave the way for a surge in dealmaking in the tech sector.

Ives spotlights several smaller, specialized firms being absorbed by deep-pocketed giants seeking to bridge capability gaps. Among them, Ives highlights C3.ai (AI), Sandisk (SNDK), and Tenable Holdings (TENB) as particularly appealing.

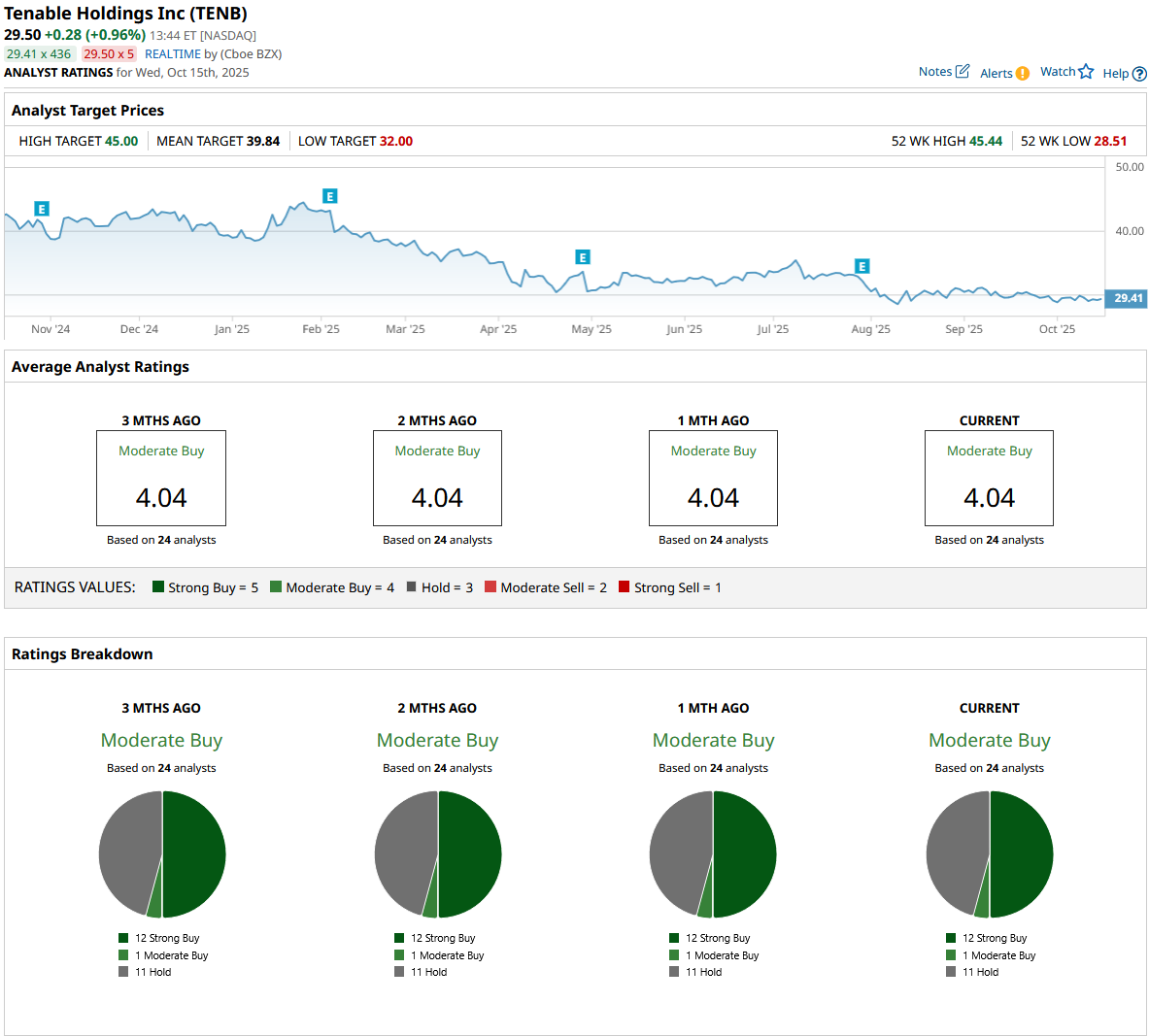

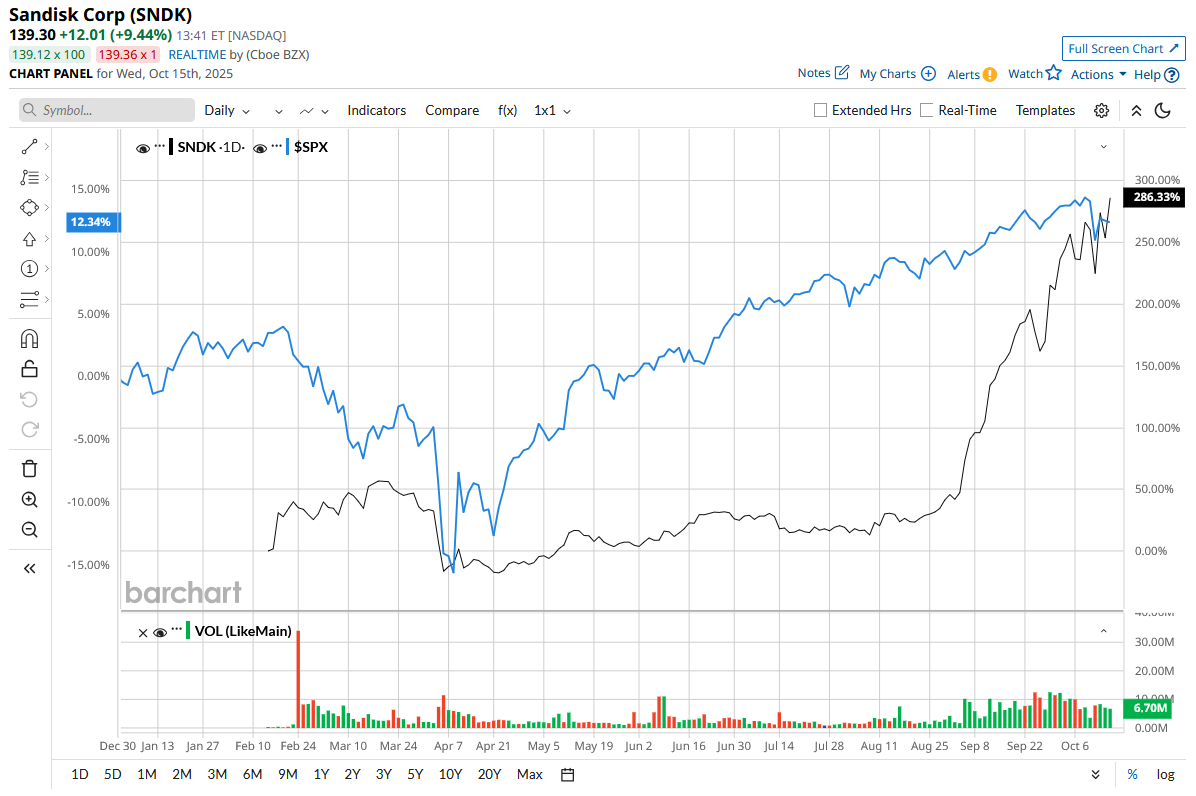

Stock #1: Sandisk (SNDK)

Valued at $18.6 billion, Sandisk is a technology company best known for creating, manufacturing, and distributing flash memory storage systems. These are utilized in various applications, including smartphones, cameras, computers, and data centers.

Sandisk's relisting under the SNDK ticker earlier this year has been one of the most incredible comeback stories in tech. Since February, the stock has risen by more than 288%, driven by increased demand for high-performance data storage solutions required for AI workloads.

AI models demand massive storage and memory capacities, and Sandisk's next-generation flash technology may make it an appealing target for Big Tech firms developing or expanding AI data centers. For the full fiscal year 2025, Sandisk reported a 10% increase in revenue to $7.3 billion. The company also reported a profit of $2.99 per share compared to a loss of $3.46 per share in fiscal 2024.

Analysts expect Sandisk’s revenue to climb by 22% to $8.9 billion, with earnings increasing by 119% to $6.55 per share, respectively. The competitive landscape, however, remains fierce, with Micron (MU) dominating this space in both the NAND and DRAM markets. Flash memory manufacturing is capital-intensive and highly sensitive to pricing swings. Even little fluctuations in demand or supply can have a long-term impact on profitability.

Overall, Wall Street rates Sandisk stock a consensus “Moderate Buy.” Out of the 18 analysts who cover SNDK, 11 recommend a “Strong Buy,” six recommend a “Hold,” and one suggests a “Strong Sell.” The stock has surpassed its average analyst price target of $94.28. However, the high price estimate of $150 implies an upside potential of 8% over the next 12 months.

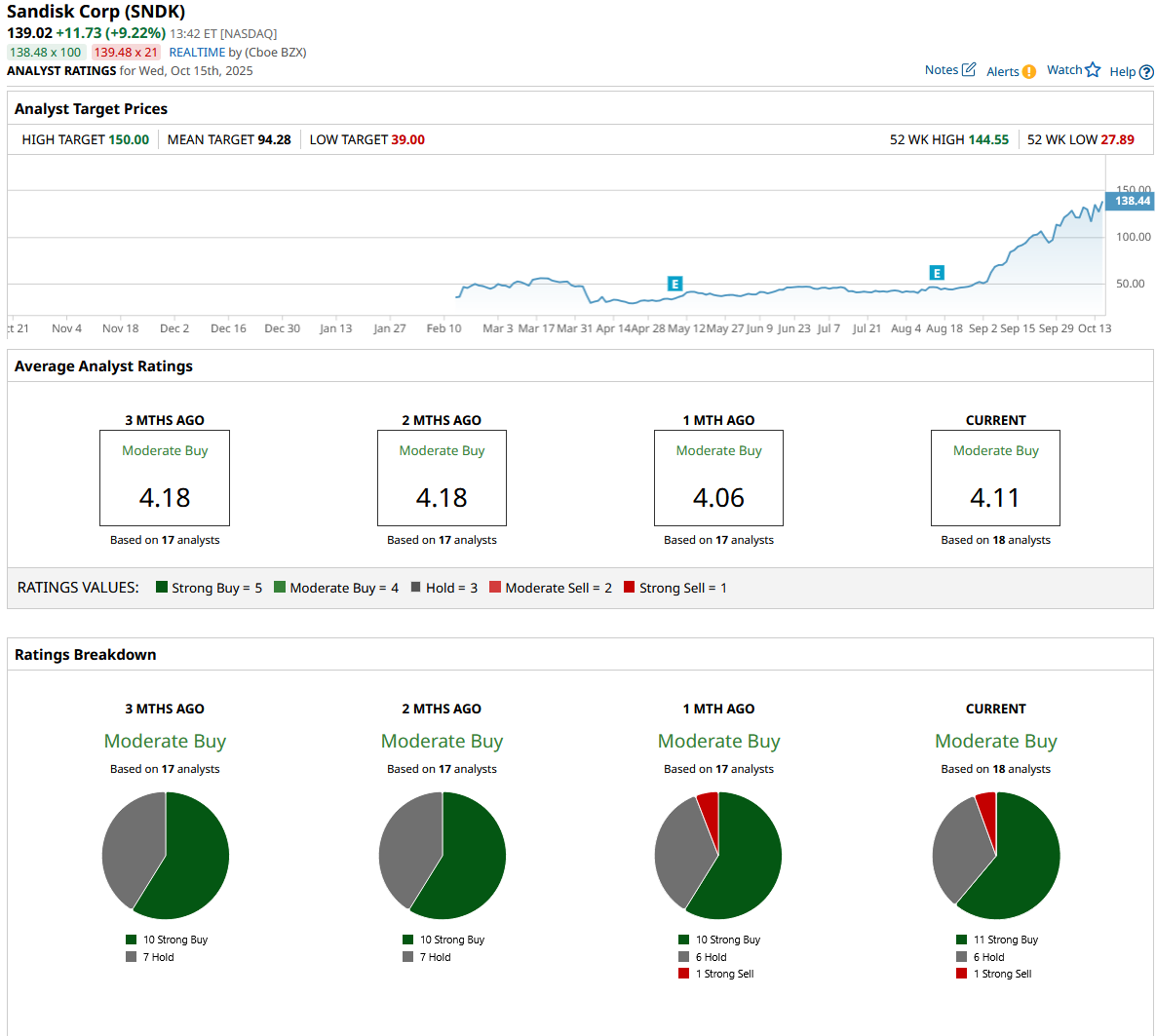

Stock #2: C3.ai (AI)

C3.ai has long been a prominent name in enterprise AI. According to Ives, it could be one of the most sought-after targets in this upcoming AI M&A wave. The company offers software that enables enterprises to use AI at scale, including predictive analytics, automation, and data-driven insights in industries such as defense, energy, and manufacturing.

The stock has fallen 45% year-to-date (YTD), as the company faces significant operational issues despite its early-mover advantage.

In the first quarter of fiscal 2026, revenue declined 19% year-over-year (YoY) to $70.3 million, signaling a troubling slowdown just as AI adoption accelerates globally. The primary concern, however, remains profitability. C3.ai reported a net loss of $49.8 million, or $0.37 per share, with negative free cash flow of $34.3 million. Despite having more than $711 million in cash reserves, the company continues to lose capital each quarter, raising concerns about how long it can continue operations without significant improvements in efficiency or revenue momentum.

Management cited poor sales execution and internal discord as the key causes of the decline and stated that the company is restructuring to address its situation. Analysts predict that the company will continue to lose money for the next two years, despite its expanding portfolio of more than 131 enterprise AI applications.

Ives believes C3.ai would be an attractive acquisition target for firms such as Apple (AAPL), IBM (IBM), and Oracle (ORCL), all of which are looking to expand their AI infrastructure and enterprise integration capabilities.

C3.ai’s struggles have not gone unnoticed on Wall Street. Overall, AI stock is rated as a “Hold.” Out of the 15 analysts who cover the stock, three rate it a “Strong Buy,” six rate it a “Hold,” two say it is a “Moderate Sell,” and four say it is a “Strong Sell.” The stock has surpassed the mean target price of $16.67. The Street-high estimate of $40 implies upside of 110% over the next 12 months.

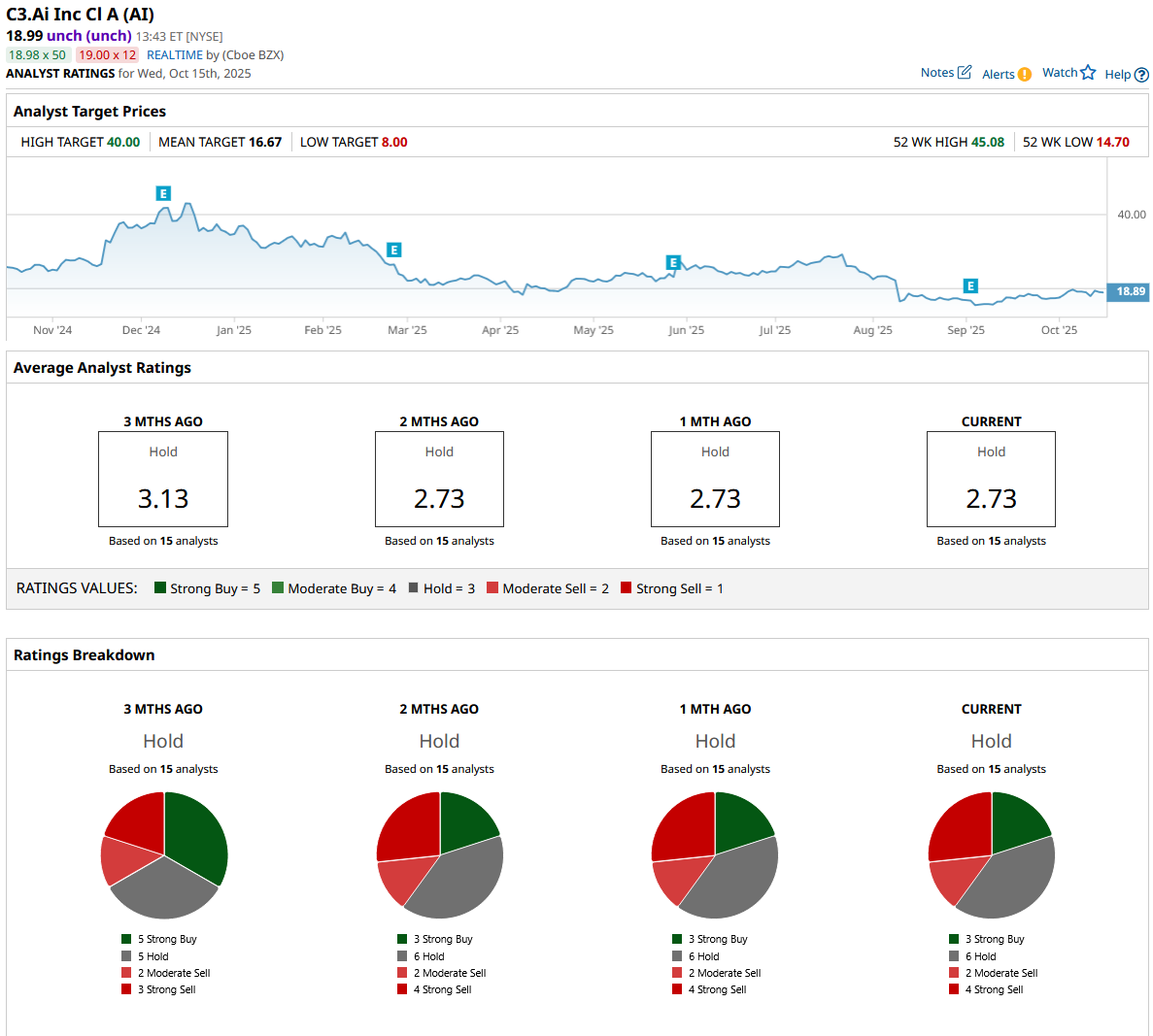

Stock #3: Tenable Holdings (TENB)

With cybersecurity becoming inseparable from AI, Tenable Holdings represents another logical acquisition opportunity. The company specializes in exposure management and vulnerability assessment, which entails assisting organizations in identifying, measuring, and mitigating security threats before they are exploited.

Although Tenable's stock is down 25% YTD, its strong client base and recurring revenue model make it a reliable long-term asset.

In the second quarter, Tenable reported revenue of $247.3 million, up 12% YoY, and non-GAAP operating income of $47.7 million, reflecting a 19% operating margin. Management emphasized that the company’s growth was driven by the increasing adoption of its Tenable One platform, which offers companies a unified view of their attack surface and enables them to manage security threats more proactively.

During the quarter, free cash flow totaled $44.3 million. Tenable also increased its existing stock repurchase program by $250 million, signaling confidence in its long-term growth prospects.

The company has also been expanding its customer base, gaining 367 new enterprise platform customers and 76 net new six-figure accounts during the quarter. Larger cybersecurity and cloud infrastructure providers may see Tenable as a way to broaden their AI-powered threat detection capabilities.

Overall, Wall Street rates TENB stock a consensus “Moderate Buy.” Out of the 24 analysts who cover TENB, 12 recommend a “Strong Buy,” one recommends a “Moderate Buy,” and 11 rate it a “Hold.” The average analyst price target of $39.84 represents a potential 35% increase from current levels. Furthermore, the high price estimate of $45 implies an upside potential of 52% over the next 12 months.