The 2025/26 marketing year, June 01 to May 31, for Chicago Soft Red Winter (SRW) wheat shows a mixed supply and demand picture, with harvest occurring from late May to August, primarily in the U.S. South, Great Lakes, and Atlantic regions. The USDA's Economic Research Service projects that U.S. wheat ending stocks for 2025/26 will be the highest since 2019/20, up 10% from 2024/25, driven by larger beginning stocks. U.S. wheat exports are projected to be down by 20 million bushels, constrained by larger projected exports from competitors like the EU, Argentina, and Russia. Demand remains steady but faces headwinds from global competition, as SRW is the world's cheapest wheat, with funds holding net short positions since 2022. This competitive pricing stems from robust U.S. production and improved moisture conditions as crops enter the heading phase, which could keep prices subdued. Speculators should note the potential for volatility tied to inter-market spreads with other grains, while hedgers must monitor export demand and global stock levels to manage risk effectively.

The latest crop progress report indicates that the U.S. winter wheat harvest is 63% complete, slightly behind the 5-year average. Spring wheat is 78% headed, exceeding the average by 3%. The good to excellent condition rating for spring wheat increased by 4% to 54%, with notable improvements in Minnesota, Montana, North Dakota, and South Dakota. This abundance, especially in SRW, could flood the market and cause depressed prices.

A positive event supporting higher prices is continuing weather disruptions in regions like Southern Russia, Ukraine, or Northern Europe, where dryness and frost risks persist. Such events could tighten global supply, boosting SRW demand as a cost-competitive alternative.

The wheat market outlook remains cautious for the upcoming season, with prices likely to stay range-bound to lower unless significant weather shocks disrupt supply. Speculators might find opportunities in short-term weather-driven rallies. At the same time, hedgers may consider locking in prices during potential spikes, given the bearish bias from ample U.S. stocks and global competition.

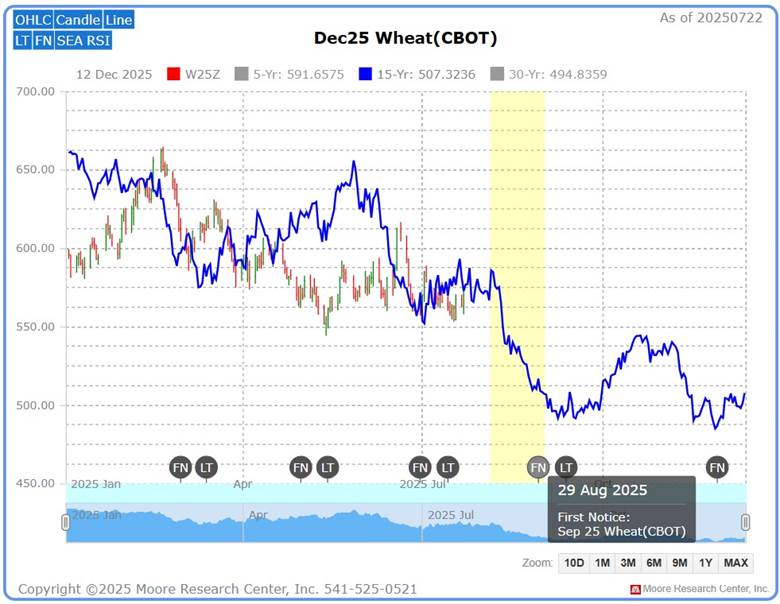

Technical Picture

Source: Barchart

Since the recent peak in February 2025, the 50 simple moving average (SMA) has contained the short-lived price rallies. Price action appears to be trading sideways, but the SMA is still sloping down. The market will be keeping an eye on the 543'6 low from May.

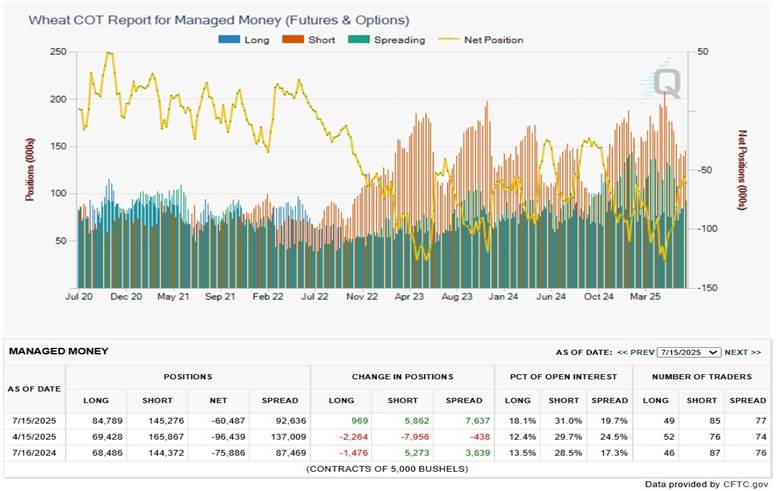

The Commitment of Traders (COT) Report

Source: CME Group Exchange

The managed money traders' COT report shows aggressive selling(red lines) and remaining net short (yellow line) since July 2022. They hold 31% of open short positions, a slight increase from three months ago.

Source: Barchart

The continuous weekly nearest contract wheat chart shows the price action since managed money traders went net short in 2022 and have remained with that sentiment.

The wheat market has been holding support at the 506'0 to 514'0 level. However, the rallies from these levels appear weaker with each attempt failing to get any traction or sentiment change from the trend-following managed money traders.

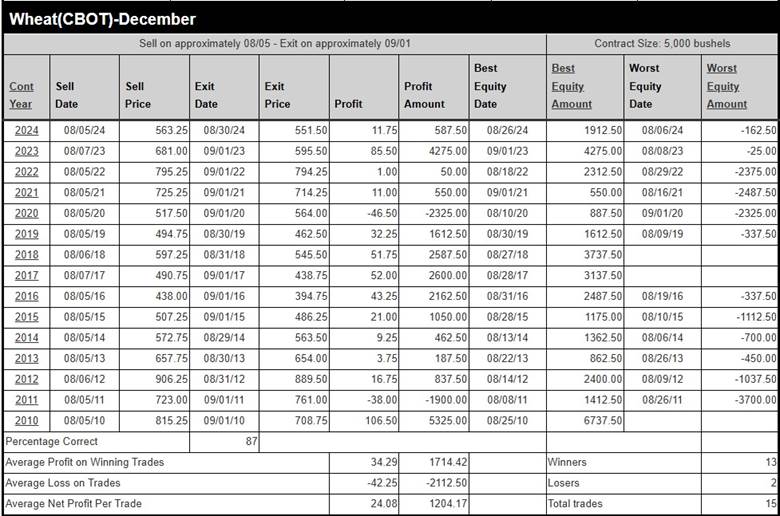

Seasonal Pattern

Source: Moore Research Center, Inc. (MRCI)

MRCI seasonal research often finds patterns tied to the expiration or delivery of a futures contract. The upcoming seasonal window (yellow box) correlates to the September wheat contract's First Notice Day (FND), as prices historically have declined into this period. The reasons may be the convergence of the futures to spot prices at expiration, storage, and carry cost, as the premium may erode as expiration approaches, or just the new supply coming to the latest market year that started in June.

With the technical picture showing weak levels off of the May lows and the bearish sentiment remaining in the managed money traders' camp, the upcoming seasonal sell may be the catalyst to lower prices.

Source: MRCI

MRCI research has found that over the past 15 years, the December wheat contract has closed lower on approximately September 01 than on August 05 for 13 years, with an 87% occurrence rate. In addition, three of the years never had a daily closing drawdown. Based on hypothetical testing, the average net profit has been 24 cents or $1,204 per standard-sized 5,000 bushel wheat contract.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

Assets to Trade the Wheat Market

- Wheat futures are traded on the CME Group Exchange: The standard-size contract (ZW) and the mini-size contract (XW).

- Options on the wheat futures at the CME Group Exchange are also available.

- Equity traders may find that the exchange-traded fund (ETF) (WEAT) offers opportunities in their equity accounts without opening futures trading accounts.

In Closing…..

The 2025/26 marketing year for Chicago Soft Red Winter (SRW) wheat, spanning June 01 to May 31, presents a complex supply and demand landscape for speculators and hedgers. Harvested from late May to August across the U.S. South, Great Lakes, and Atlantic regions, SRW faces bearish pressures from a projected 10% increase in U.S. wheat ending stocks, the highest since 2019/20, driven by robust production and larger beginning stocks, according to the USDA. Global competition from the EU, Argentina, and Russia caps U.S. exports, down 20 million bushels. At the same time, SRW's position as the world's cheapest wheat fuels record net short positions by managed money traders since 2022. Improved crop conditions, with 54% of spring wheat rated good-to-excellent and the U.S. winter wheat harvest 63% complete, signal an ample supply that could depress prices further. However, weather disruptions in Southern Russia, Ukraine, or Northern Europe could tighten global supply, potentially lifting SRW demand and prices. The market's technical picture underscores bearish sentiment, with prices trading sideways below a declining 50 SMA and weak rallies off the 506'0–514'0 support.

Seasonal patterns add another layer, with Moore Research Center (MRCI) data indicating an 87% chance of December wheat futures closing lower by September 01 compared to August 05, possibly driven by annual futures-to-spot convergence, storage costs, and new supply. The Commitment of Traders report confirms managed money traders' aggressive selling, holding 31% of open short positions, reinforcing a bearish outlook. Speculators can target short-term weather-driven rallies, while hedgers should lock prices during potential spikes to manage downside risk. The challenge is clear: Will you act on the bearish seasonal window and technical weakness, or wait for a weather shock to shift sentiment? Use assets like CME wheat futures (ZW, XW), options, or the WEAT ETF to position strategically, but don't rely solely on seasonal patterns—integrate technicals, fundamentals, and risk management to navigate this volatile market.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.