/A%20Klarna%20advertisement%20in%20a%20store%20window%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Klarna (KLAR) is a leading financial technology company specializing in flexible digital payment solutions and “buy now, pay later” (BNPL) services for online shoppers. Klarna has become one of the world’s largest providers in its sector, serving over 100 million consumers and hundreds of thousands of merchants. The company’s platform integrates payments, credit, and shopping tools while recently expanding into banking and digital marketing services.

Founded in 2005, Klarna is headquartered in Stockholm, Sweden, serving more than 26 countries.

About KLAR Stock

Klarna went public on the NYSE in September, raising $1.37 billion at a valuation exceeding $17 billion. KLAR stock is off to a good start despite being 9% down post-IPO. It has experienced a solid 10% gain over the last five days, following some profit booking after its IPO.

Klarna’s Q2 Results

Klarna reported Q2 2025 revenue of $823 million, up 20% year-over-year (YoY), narrowly missing analyst expectations of $840 million. Earnings per share stood at $0.14, with a net loss of $53 million, better than Q2 2024 but short of the anticipated breakeven. Klarna logged its fifth straight quarter of operational profitability, posting an adjusted operating profit of $29 million, as payment performance and consumer repayment rates continued to improve.

Klarna now serves 111 million active consumers and 790,000 merchant partners globally. Gross merchandise volume rose 19% YoY, driven by U.S. market strength and robust merchant collaborations, including key deals with Stripe, Walmart (WMT), and eBay (EBAY). Credit losses were kept in check, with realized losses and delinquency rates continuing to fall.

Free cash flow for Q2 reached $787 million, thanks to capital recycling from major asset sales and a more resilient funding model.

Looking ahead, Klarna forecasts Q3 revenue between $870 million and $920 million, with guidance for continued operational profits and ongoing growth in U.S. lending and merchant network expansion. Management remains focused on driving scale, disciplined credit underwriting, and deepening strategic partnerships, positioning Klarna for sustainable growth despite sector volatility.

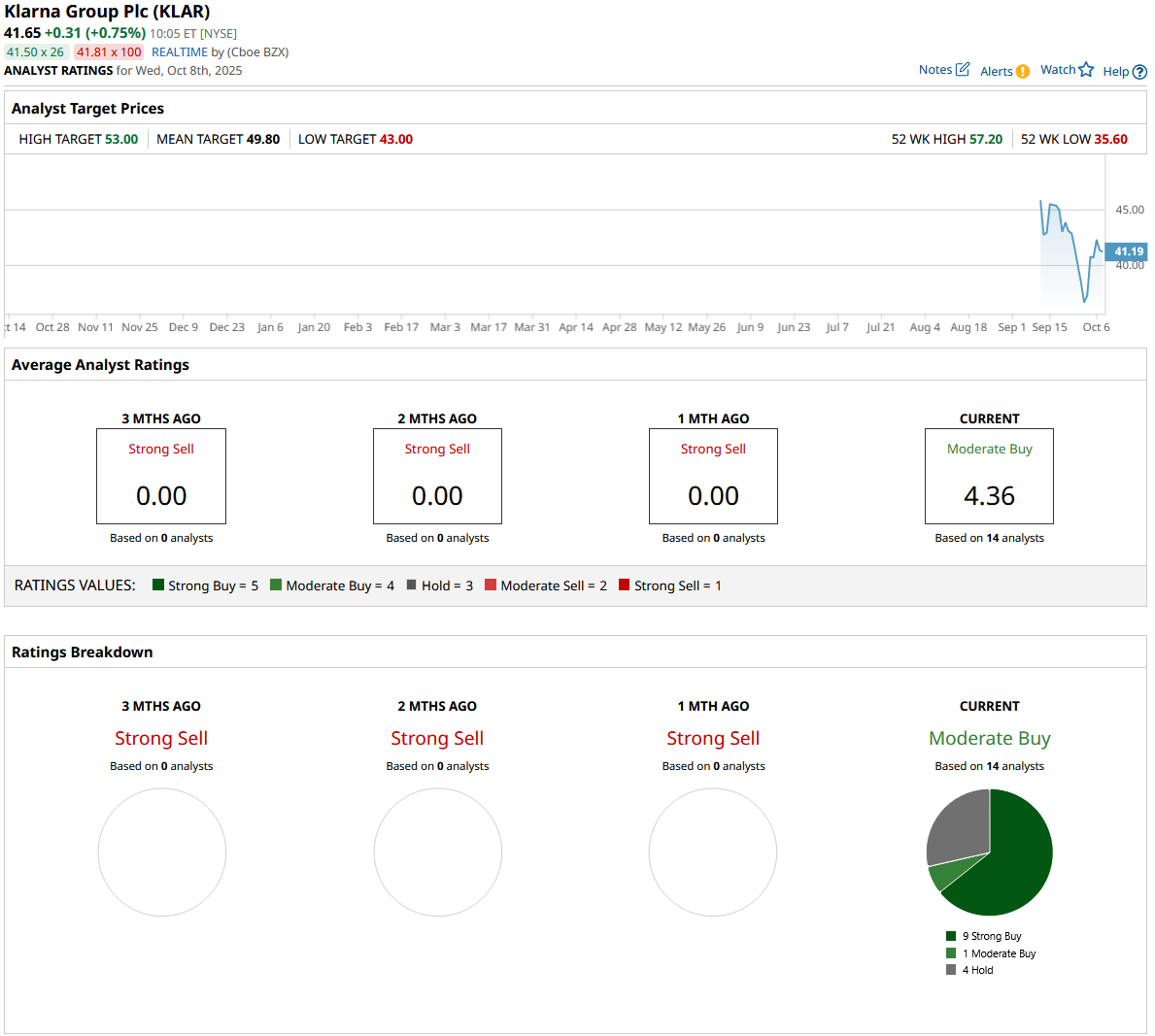

Klarna Receives Wall Street Verdict

Wall Street analysts have begun rating Klarna after the company’s IPO quiet period ended, and sentiment is largely bullish on the stock. J.P. Morgan with an “Overweight” rating and a $50 price target with 20% upside. Wedbush with “Outperform,” a $50 price target with 20% upside. Citi with “Buy” and a $50 price target with 20% upside. KBW with “Outperform” and a $52 price target with 25% upside. Deutsche Bank with “Buy” and a $48 price target with 15% upside. And lastly, Goldman Sachs with a “Buy” and $55 price target with 32.5% upside. These bullish takes are driven by Klarna’s U.S. expansion, new merchant deals, vertical growth, and AI-powered product enhancements.

These analysts expect Klarna’s “Fair Financing” products, new consumer touchpoints, and deeper global partnerships to fuel operating income growth and margin expansion through FY26.

Citi notes temporary margin pressure due to increased loan provisioning but expects a recovery as Klarna scales in the U.S. and newer markets. Goldman Sachs forecasts major partnership wins will propel Klarna’s U.S. market share, emphasizing upside from higher-ticket financing volumes. KBW points to Klarna’s global brand and distribution advantages that support market penetration and operating leverage over rivals. Deutsche Bank highlights Klarna’s diversified fintech ecosystem and new revenue streams from products like Klarna Card, Klarna Balance, and Klarna Media.

More cautious voices include Bernstein with a “Market Perform” and $45 price target with 8.5% upside. Morgan Stanley with an “Equal Weight” and $43 price target with 3.5% upside. These more bearish analysts express concerns over Klarna’s execution in U.S. credit markets and competitive positioning while acknowledging the company’s durable revenue potential if risks are managed successfully.

Should You Bet on KLAR?

As Wall Street analysts lay their bets, KLAR stock has a consensus “Moderate Buy” rating with a mean price target of $49.80, reflecting an upside potential of 20% from the market rate.