The meme stock phenomenon, once primarily seen as a retail-led market rebellion, is being swiftly absorbed by hedge funds and Wall Street institutions.

What Happened: On the Prof G Podcast on Monday, Ed Elson says, “40% of hedge funds are now using social sentiment analytics for their trading strategies in 2025 compared to 3 years ago when it was 10%.”

That fourfold increase marks a dramatic shift in how institutional players approach meme-driven volatility. Hedge funds are no longer dismissing Reddit, Twitter, and Google search trends as noise.

See Also: Meme Stock Traders Pounce On Familiar Targets As Opendoor Technologies Stock Continues To Rip

“The other thing you have to keep in mind now is that a lot of institutions are in on the meme thing,” Elson said. “They're hiring people who are tracking Google search and tracking Twitter, and tracking Reddit.”

The rise of social sentiment analytics is part of a broader acknowledgment that meme stocks are here to stay. “This is just a systemic part of the market now,” he says. “And we’re seeing this resurgence that really hit kind of a boiling point this week.”

Why It Matters: Elson is referring to a string of stocks that experienced a rally over the past week, such as Opendoor Technologies Inc. (NASDAQ:OPEN), which is up 314% over the past month, Kohl’s Corp. (NYSE:KSS), up 51% and Krispy Kreme (NASDAQ:DNUT) by 41%.

Fund manager Eric Jackson, who kickstarted Opendoor’s rally, however, is distancing himself from the “meme” stock tag, saying that “it’s a real business,” and that its true value and fundamentals will eventually reflect in its price.

Price Action: Shares of Opendoor were down 7.87% on Monday, trading at $2.34, and are up 1.71% after hours.

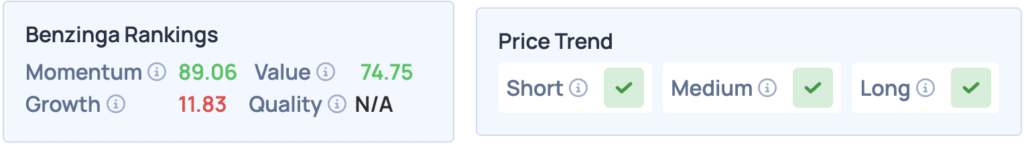

Shares of Opendoor score high on Momentum and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

!["[T]he First and Fifth Amendments Require ICE to Provide Information About the Whereabouts of a Detained Person"](https://images.inkl.com/s3/publisher/cover/212/reason-cover.png?w=600)