Electricity is having another Thomas Edison moment of transformation this century, and it’s all thanks to lithium-ion batteries.

Nearly 150 years after the American scientist patented the light bulb and turned on the world’s first commercial power plant in New York City, the way electricity is stored, dispatched and balanced is undergoing its own revolution.

Lithium-ion batteries are increasingly finding use cases far beyond electric cars and consumer electronics. Batteries are stabilizing transmission grids, serving as backup energy storage systems and cushioning the enormous power demands of AI data centers, helping the world shift towards renewable energy and away from fossil fuels.

You can thank the growth of electric vehicles for at least some of this. Electric vehicles account for the largest share of global lithium-ion battery demand, according to the International Energy Agency. That share was pegged at over 950 gigawatt-hours last year and is on track to exceed a terawatt-hour this year, enough to power 12.5 million EVs with an average pack size of 80 kilowatt-hours—about the size of your average Hyundai Ioniq 5, for context.

The idea goes something like this: as demand for EVs increases in the United States, for example, a homegrown battery industry will rise along with it. And as that industry grows, it will feed our other battery-driven energy needs.

However, as EVs grow more slowly amid the Trump administration’s rollback of clean energy programs and tax credits, demand for battery energy storage systems (BESS) is growing rapidly. EV sales grew at 7.3% in the U.S. in 2024, according to Cox Automotive. At the same time, America’s utility-scale battery storage grew at a whopping 66%, the U.S. Energy Information Administration (EIA) reported.

Why is this happening? What exactly are energy storage batteries? How different are they from your EV battery, and how will these two industries dovetail?

Battery Energy Storage Systems, Explained

The U.S. government classifies energy storage batteries into two main categories: small-scale with less than one megawatt-hour of energy storage capacity, and utility-scale, with a capacity of one megawatt-hour or more. Unlike in EVs, where batteries are packed into the flat floor, energy storage batteries resemble large shipping containers.

How they work is not as sexy as an EV battery, but it’s meaningful in critical ways.

“The grid battery is where you’re essentially adding a buffer to the power grid,” said Tristan Doherty, the Chief Product Officer of Korean battery giant LG Energy Solution's energy storage division, Vertech. The company is among the first to bring the production of energy storage lithium-iron phosphate (LFP) batteries to the U.S. as demand for EV batteries reduces.

Doherty said typical LGES customers, like utility companies or power plant developers, buy about 200 of these shipping containers, each of which has the storage capacity equivalent of 50 or 100 EVs. The bigger the battery power plant, the more stored energy utility companies can dispense in times of need.

These power plants or transmission grids often spike, surge, or cause outages. That could happen due to millions of air conditioners turning on simultaneously during a hot afternoon. Or power generation itself could face hiccups at the very source, such as a thermal power plant experiencing technical snags, clouds blocking solar farms, or the wind suddenly dying down.

Such fluctuations can damage appliances and electrical equipment, and also cause significant swings in electricity costs. In such cases, large or small battery storage systems can smooth the output, helping keep the lights on, devices powered and prices more stable, often without the end users even noticing.

“A grid battery is like the battery in a hybrid car,” Doherty said. In a hybrid, the battery seamlessly torque fills, powers auxiliary functions and even drives the wheels purely using electricity for short distances and durations. The grid battery serves a similar role: augment and replace what the fossil-fuel energy system does.

Okay, But What Are The Real World Use Cases?

But battery energy storage systems are well beyond theoretically good at this point.

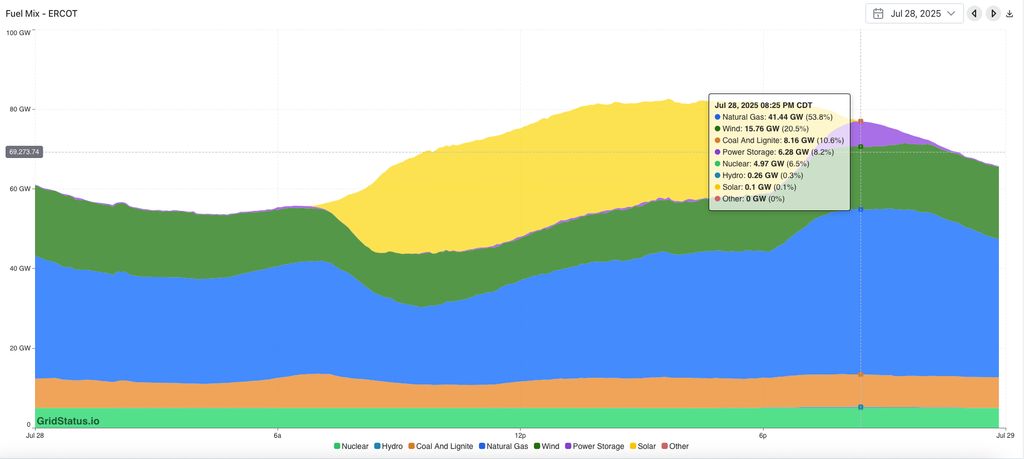

A glaring example of this came in Texas last summer, when solar and batteries stabilized the grid during record heat. Solar met nearly a quarter of the state’s midday power demand between June and August 2024. In the evenings, as solar output dropped, batteries stepped in to cover the gap, according to Gridstatus.io.

The Electric Reliability Council of Texas, the operator of the state's electric grid, estimated the risk of power emergencies at 16% last year, but that fell to less than 1% this year after the state added 9,600 megawatts of new capacity. That's about 3,821 megawatts of it from batteries and the rest from solar.

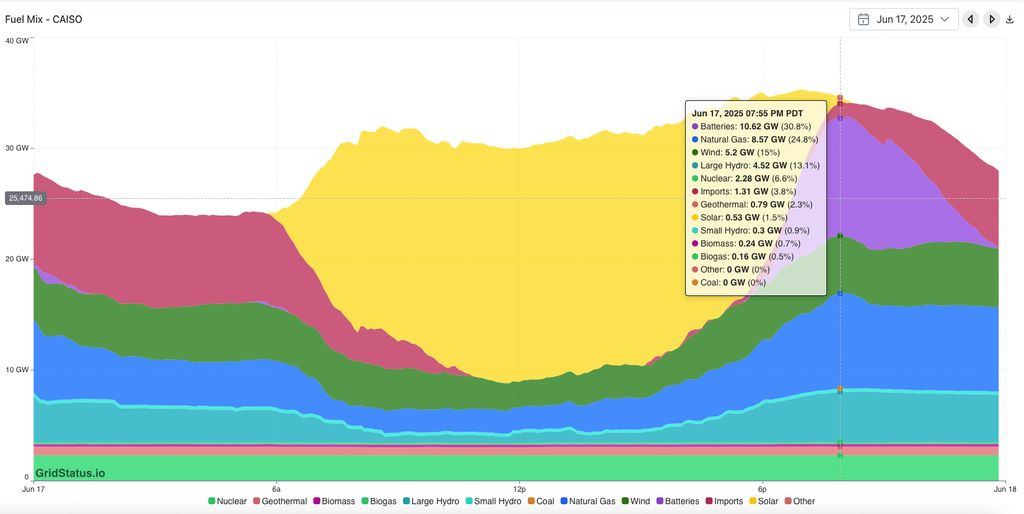

California has gone even further with battery storage. The state accounts for half of all U.S. utility-scale installations and leads the nation with 8.6 gigawatts of capacity, more than twice that of Texas. The state has the largest battery installations outside of China. Batteries kick in after sunset, releasing surplus renewable energy when demand peaks around 8 p.m., according to Gridstatus.io.

At times, producers in the California Independent System Operator (CAISO) market use batteries to supply up to 30% of the state’s electricity during peak hours, as demonstrated in the chart above. With a mix of wind, solar and other renewable sources, the California Energy Commission reported that the state’s main grid reached 100 percent clean energy (for some portion of the day) on 138 out of 151 days, or 91% of days through May.

Batteries also allow systems to go off-grid and become completely independent. Tesla opened its soon-to-be world’s largest Supercharger in Lost Hills, California, in July.

The automaker claims the station, which will have 168 fast charging stalls when fully complete by the end of 2025, isn’t connected to the grid at all. The station is fully powered by solar, with 10 Megapack batteries on site storing a maximum of 39 megawatt hours of energy, allowing hundreds of charging cycles daily, all harnessing the power of the sun to allow fully sustainable, zero-emission driving.

And then there are also residential use cases, which have existed for years now. These home-sized versions of batteries also store electricity, often from rooftop solar panels or during off-peak hours, and release it later when demand is higher, electricity is more expensive, or if there’s power outage.

A typical Tesla Powerwall can store about 13.5 kWh of electricity—enough to run an average home’s essentials overnight.

How Are They Different From EV Batteries?

As EV demand cools in the U.S., more battery companies and automakers are shifting towards stationary energy storage systems. In theory, this would let automakers like General Motors scale up their battery manufacturing operations and actually have a new use for those batteries (not to mention a new revenue stream), while EV demand hopefully picks up over time. After all, with batteries still being the most expensive component on an EV, they can't afford to sit that race out.

But it doesn’t mean they can just transition overnight from producing EV batteries to energy storage batteries.

“You can’t just produce the same thing and put it in an ESS container,” Isshu Kikuma, Energy Storage Analyst at BNEF, told InsideEVs. “There are complicated changes and retrofits involved that require time and also require some capital.”

They can use the same chemistries found in EV batteries, such as nickel manganese cobalt (NMC) or lithium iron phosphate (LFP). But LFP is increasingly becoming the default choice for energy storage thanks to its durability and endurance. They’re designed to sustain full charges to 100% and full discharges to 0% every single day for 20-odd years.

The production techniques are similar, so they go through similar electrode manufacturing, cell assembly and formation processes. But the smaller steps vary; the cells have lower energy densities; the coating and mixing processes can be different and production lines themselves may need some retooling.

The storage containers, however, are temperature-controlled, so the energy storage batteries aren’t exposed to the same variety of weather and driving conditions as EV batteries.

EV batteries live a harder life. They're subjected to temperature swings, different charging speeds and varying driving styles. They deal with impacts from the road and all the other rigors involved with daily drivers. Grid operators prefer durability and predictability, so energy storage batteries are tuned for a longer cycle life. EV makers prioritize range and performance, which pushes chemistries harder and shortens lifespans (comparatively).

Still, Challenges Persist

The technology for energy storage batteries is locked in, BNEF says; the newer installations all use the LFP chemistry across applications. LFP technology was invented in the U.S., but successfully commercialized and rapidly advanced by Chinese battery makers.

Today, more than 90% of global LFP production is still concentrated in China, meaning the U.S. has a long road ahead before these batteries are made domestically in large volumes and at competitive prices.

Still, efforts to onshore LFP production—by companies like LGES and Tesla—promise to benefit both EVs and energy storage systems, Doherty said. In the meantime, tariffs and trade disruptions under the Trump administration are driving up project costs and slowing growth, BNEF notes. Yet Doherty praised the Trump administration’s decision to preserve the production tax credits for batteries.

“It was an admission and a realization by the administration that batteries are really strategically important to build out the power grid,” he said. To use that to the country's full advantage, domestic production was key, he added. “Battery technology, writ large, needs to come back to the U.S. It is core not only for transportation, but also energy, which is much more pivotal and vital to the future of the country.”

Have a tip? Contact the author: Suvrat.kothari@Insideevs.com