Rocket Companies, Inc. | (NYSE:RKT)

The securities lending volatility indicator is produced by Tidal Markets, in partnership with Benzinga Insights. Securities lending primarily serves the purpose of providing liquidity to short sellers. When unusual activity occurs in the securities lending markets, it acts as an upstream indicator to what is likely to occur downstream in the regular stock market.

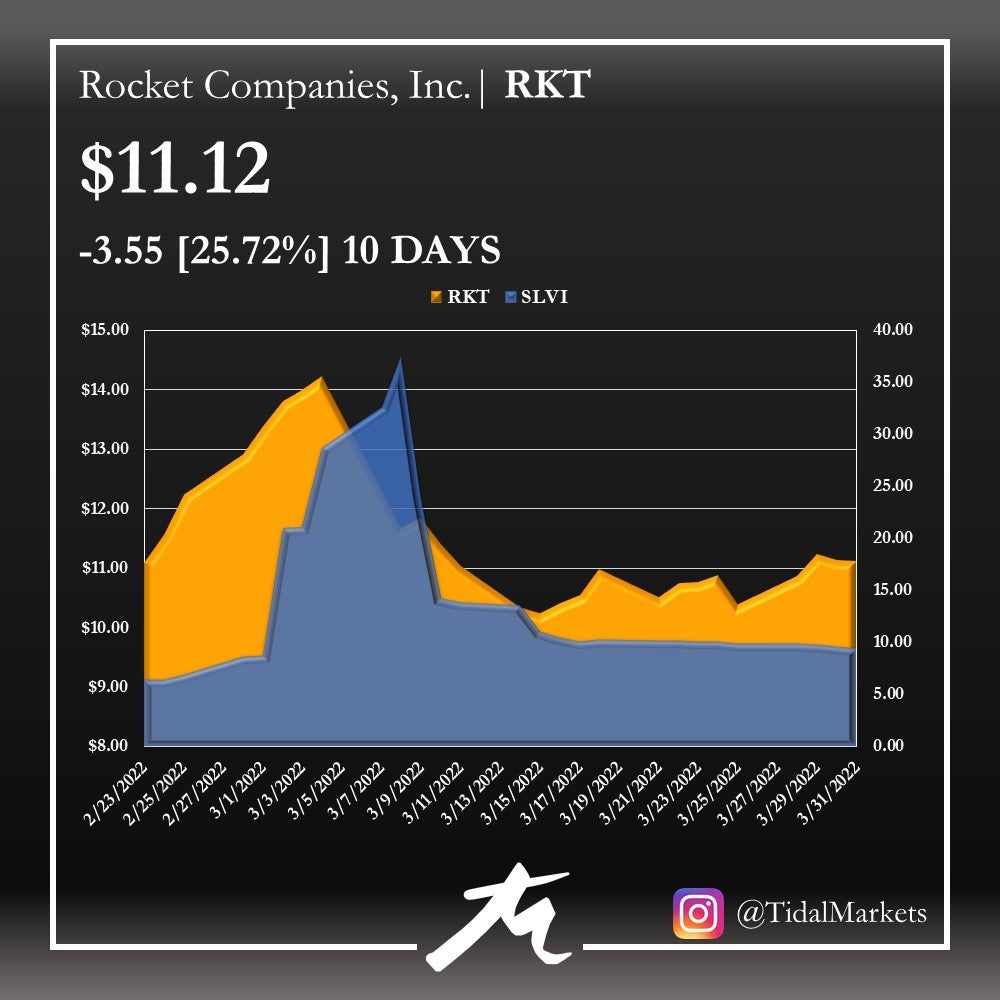

To demonstrate the use of the SLVI as a stock market indicator, we show how changes in the SLVI predicted a -25.72% decline in Rocket Companies, Inc. over 10 trading days in the early part of March 2022.

Rocket Companies, Inc. engages in tech-driven real estate, mortgages, and e-Commerce in the United States and Canada. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; Rocket Auto, an automotive retail marketplace that provides centralized and virtual car sales support to online car purchasing platforms; and Rocket Loans, an online-based personal loans business.

Throughout the month of February, RKT was a moderately steady stock, fluctuating between $11 and $13 per share. Overall, real estate in the last 2 years had seen significant price appreciations in most parts of the country. But as the lingering months of winter went on, everyone was keeping a close watch on the Federal Reserve and how the potential rate hikes might hit the mortgage industry.

Entering into February, SLVI values of RKT were relatively muted with volatility levels 10 bps above their 4Q21 average of 6.66 – a sign of share price neutral performance. But during the early days of March, RKT volatility rapidly increased, signifying a decline in price was on the horizon.

On the beginning day of our analysis, 2/23/2022, the SLVI reflected a volatility rate of 6.51 which was consistent throughout the entire month thus far. But as March came around, we saw the share price drive up rapidly in the first few trading days, increasing over $3.14 per share or 28.34%. But just as we saw RKTs share price rise from February 23rd to its peak on March 4th, we saw exponential increases in the SLVI indicator values, quadrupling during the same period; whereby reaching an SLVI high of 37.47 by March 8th.

Between March 4th and 15th, Rocket Companies, Inc. lost -25.72%, or $3.55 per share, over a ten day stretch. Meanwhile, the SLVI saw the volatility of RKT both rally over 475% to levels over 37, before falling in volatility as the share price of RKT quickly descended and plateaued off.

As we continue to watch SLVI values of RKT into the latter parts of April, we’ve seen volatility sustain levels between 9 and 10, which is slightly higher than usual. Unless the SLVI of RKT cools off back to pre-February levels, be on the lookout for stagnating growth, and potential further price declines.