/Viatris%20Inc%20logo%20on%20building-by%20SSKH-Pictures%20via%20Shutterstock.jpg)

Viatris Inc. (VTRS), headquartered in Canonsburg, Pennsylvania, operates as a healthcare company. With a market cap of $10.3 billion, the company produces medicines for patients across a broad range of major therapeutic areas spanning both noncommunicable and infectious diseases.

Shares of this global healthcare giant have considerably underperformed the broader market over the past year. VTRS has declined 24.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.4%. In 2025, VTRS stock is down 28.2%, compared to the SPX’s 7.6% rise on a YTD basis.

Narrowing the focus, VTRS’ underperformance looks less pronounced compared to the iShares U.S. Pharmaceuticals ETF (IHE). The exchange-traded fund has declined 1% over the past year. Moreover, the ETF’s 3.4% gains on a YTD basis outshine the stock’s double-digit losses over the same time frame.

Viatris' performance has been impacted by a setback in its generics segment due to an FDA import alert on its Indore facility, which has restricted product shipments. The company is actively working with the FDA to resolve the issue.

Viatris shares rose 5.7% on May 8 after the company reported Q1 earnings that beat expectations. Despite an 11.2% year-over-year decline in revenue to $3.3 billion, the figure topped consensus estimates. The company's adjusted EPS of $0.50, although down 25.4% from the previous year, also beat analyst expectations by 2%.

For the current fiscal year, ending in December, analysts expect VTRS’ EPS to decline 15.1% to $2.25 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

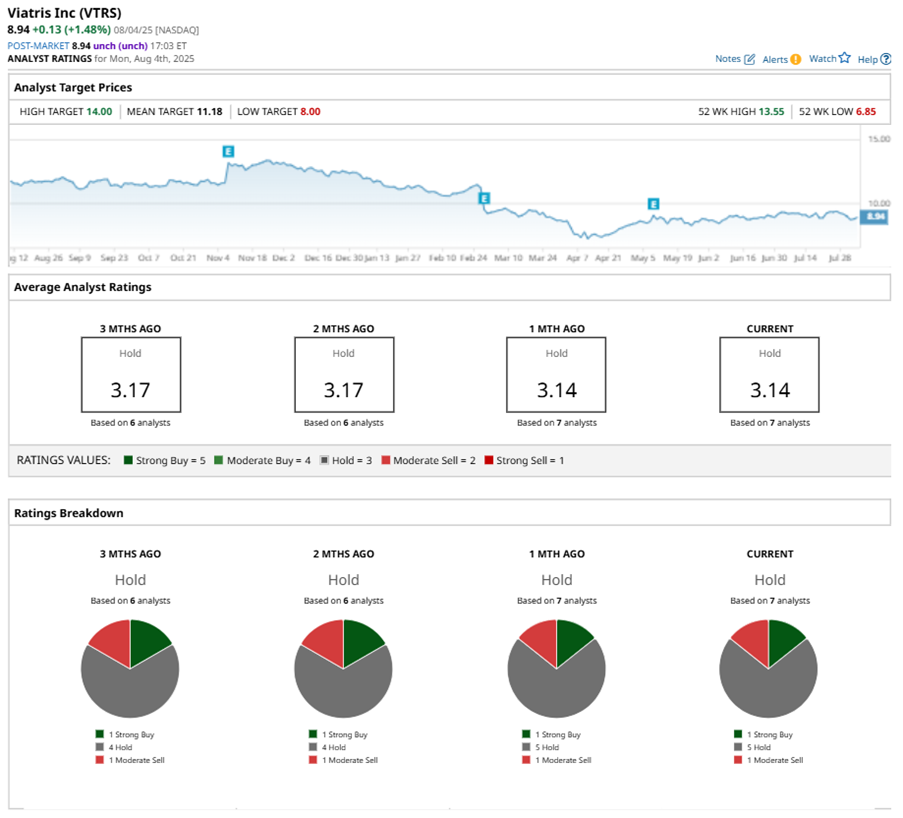

Among the seven analysts covering VTRS stock, the consensus is a “Hold.” That’s based on one “Strong Buy” rating, five “Holds,” and one “Moderate Sell.”

The configuration has been reasonably stable over the past three months.

On Jul. 15, The Goldman Sachs Group, Inc. (GS) analyst reiterated a “Hold” rating on VTRS and set a price target of $10, implying a potential upside of 11.9% from current levels.

The mean price target of $11.18 represents a 25.1% premium to VTRS’ current price levels. The Street-high price target of $14 suggests a notable upside potential of 56.6%.