Nvidia’s opportunity to profit from exploding growth in artificial intelligence has already caught the eyes of investors. After surprising everybody with jaw-dropping revenue and earnings last summer, shares have catapulted higher on recognition of surging investment in AI research and development.

Over the past year, Nvidia's stock price has increased by a remarkable 209%, including a 72% gain so far in 2024.

The returns are arguably justified by the company's top and bottom-line growth; however, investors are right to wonder whether or not much of the upside from AI spending is already reflected in Nvidia's share price.

That million-dollar question isn't lost on TheStreet Pro's Bruce Kamich. Kamich has analyzed stocks and major markets for over five decades to find winners. Recently, he updated his analysis of Nvidia, resulting in a blunt warning about what could happen to its stock.

Nvidia's sales and profit soars on AI demand

AI may seem like it's new, but the prospect of machines thinking independently has long been considered by scientists, futurists, authors, and movie makers.

For instance, the mathematician and computer scientist Alan Turing researched how to design AI computers in the 1950s, and the lauded research firm Rand Corp created the first AI computer program in 1956. Science-fiction books and movies have contemplated the implications of AI many times. Isaac Asimov wrote "I, Robot" in 1950. Most of us have watched Arnold Schwarzenegger star in at least one of the Terminator movies, the first one released in 1984.

Related: Analyst revises Nvidia stock price target on China update

Despite the concept being well-worn, mainstream use of AI tools only recently became widespread when OpenAI's ChatGPT became the fastest app to reach one million users following its launch in December 2022.

ChatGPT was revolutionary in its ability to help anyone, anywhere, quickly search, parse, and create meaningful content from a simple search bar.

The ability of large language AI models like ChatGPT to generate unique insights from previously siloed data sets has unlocked a torrent of activity across most industries.

Financial institutions like JP Morgan use it to hedge risks and evaluate and price loans. Drugmakers are evaluating if it can create better medicines. Manufacturers are investigating if it can improve quality and production. Retailers are researching its potential to improve inventory levels and stop theft. The U.S. Department of Defense is contemplating how AI may reshape the battlefield.

"While we do not know the full effect or the precise rate at which AI will change our business — or how it will affect society at large — we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing, and the Internet, among others," said JP Morgan CEO Jamie Dimon in April.

Dimon's high praise isn't isolated. So many are convinced that AI is transformational that network infrastructure is struggling to keep up with training and operating all the AI apps under development.

As a result, enterprise and cloud network operators, including hyperscalers like Amazon's AWS, Microsoft's Azure, and Google's Cloud are plowing big money into upgrades, most of which feature next-generation AI chips made by Nvidia (NVDA) .

Nvidia's dominance in graphic processing units, or GPUs, capable of handling AI's heavy workloads has allowed it to capture an estimated 90% market share for sophisticated AI chips.

So many have embraced Nvidia's GPU-powered solutions, including the H100 and H200, that sales and earnings have skyrocketed.

In the fourth quarter, Nvidia's sales jumped 265% to $22.1 billion, marking the third consecutive quarter of triple-digit top-line growth. Nvidia's earnings per share jumped 486% to $5.16 in the quarter.

As we celebrate the first wave of buying this summer, tougher comparisons will likely slow year-over-year growth. Still, estimates of how big this market could continue to climb suggest that Nvidia will enjoy years of demand.

Nvidia's challenges include "frenemies"

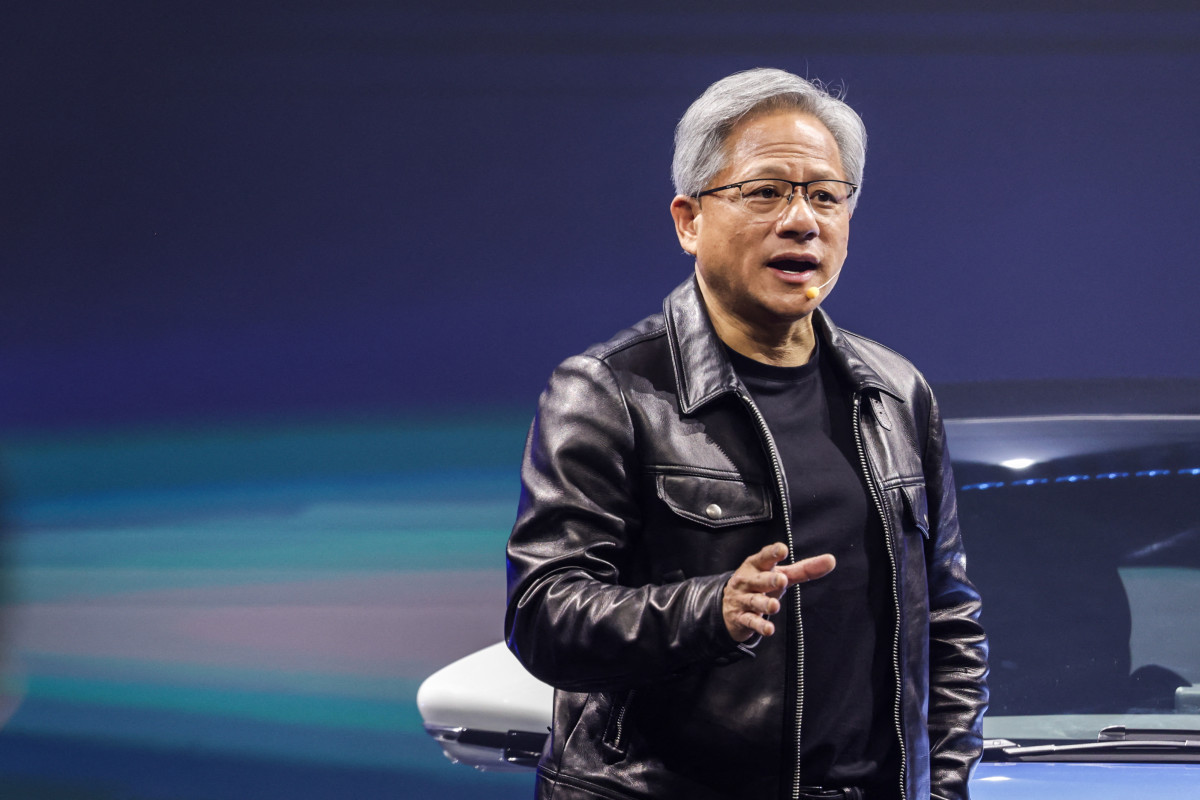

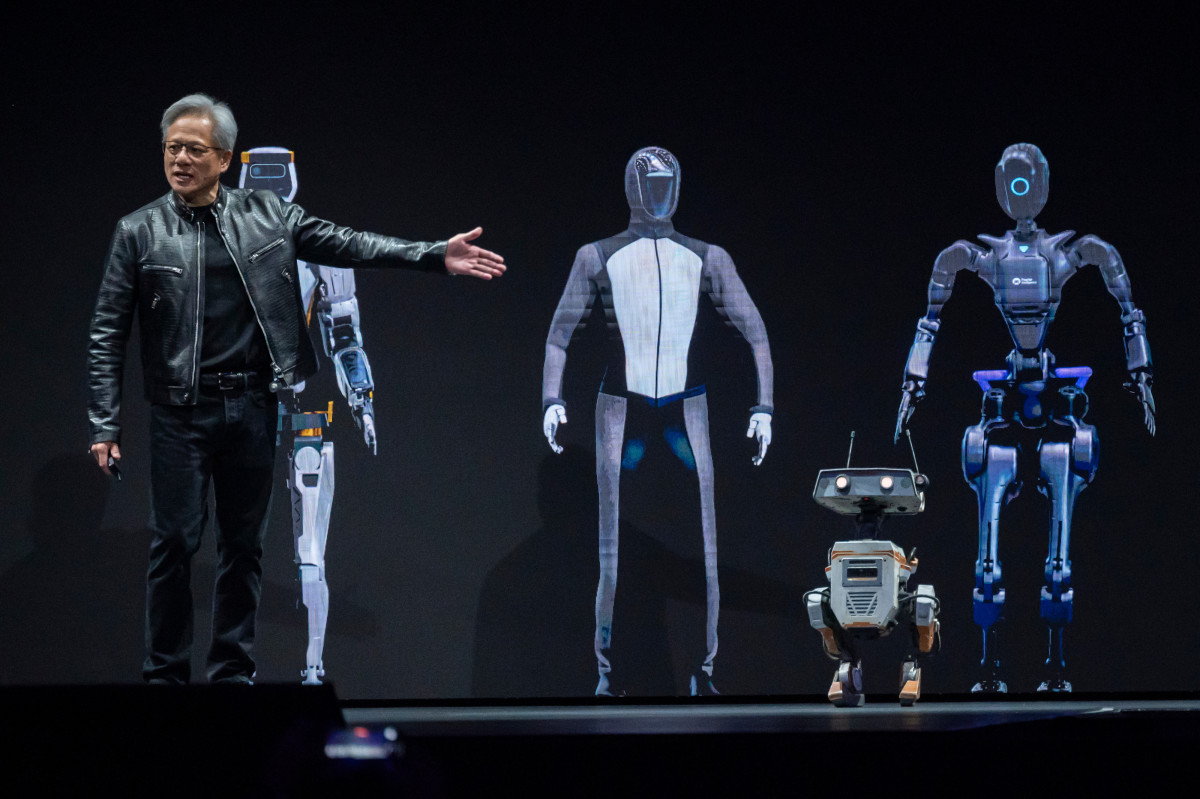

Nvidia's CEO, Jensen Huang, expects the widespread embrace of accelerated computing and generative AI to be a "huge opportunity" for his company.

"We believe these two trends [accelerated computing and generative AI] will drive a doubling of the world's data-center infrastructure installed base in the next five years," said Huang during the company's fourth-quarter earnings conference call.

Related: One of Elon Musk's newer companies is eyeing an $18 billion valuation

Huang pegs the size of that market opportunity at "hundreds of billions of dollars" per year.

Rival Lisa Su, CEO of Advanced Micro Devices, agrees.

AMD launched its first specially designed AI GPUs this year, and Su thinks the AI chip market will reach $45 billion in 2024 and increase to $400 billion by 2027. Su says AMD's sales of MI300X AI GPUs could total $3.5 billion this year

Huang doesn't only face competition from AMD. It may also lose some sales to companies it considers its best customers.

These frenemies, including Amazon and Google-parent Alphabet, are developing their own silicon to reduce their reliance on Nvidia and others.

"I see generative AI as one of the biggest technical transformations in our lifetimes. I think it has the ability to transform virtually every customer experience that we know,” said Amazon's CEO Andy Jassy last summer.

Amazon's Inferentia accelerator chips are being used by AWS to enable deep learning (DL) and generative AI inference applications. Generative AI company Anthropic uses those chips, and Amazon's Trainium chips, to power its foundation model, Claude, a large machine learning model pre-trained on data to accelerate AI applications.

On April 9, Alphabet unveiled a central processing unit (CPU) chip using an Arm Holdings design. The Axion chip is similarly designed to handle AI processes better than traditional CPUs, like Intel's x86 chips. It, alongside Google's tensor processing units (TPUs), made with help from Broadcom, can be used by Google Cloud customers to help them create AI apps.

Nvidia's unveils new, better AI chips

Huang's team presented its latest AI solutions in March at Nvidia's annual GTC Conference.

Related: Veteran analyst unveils Google stock price 'line in the sand'

He said Nvidia's new Blackwell GPUs are 2.5 to 5 times more powerful and efficient than its Hopper platform chips, including the H100 and H200. The B200 will be available later this year and cost between $30,000 and $40,000.

Nvidia's GB200 NVL72, a rack-scale design connecting 36 Grace CPUs and 72 Blackwell GPUs, could be a big catalyst for future sales growth.

KeyBanc analysts John Vinh and Jim Long recently said that GB200 systems with average selling prices of $1.5 million to $2 million could become mainstream configuration next year, resulting in $90 billion to $140 billion in revenues alone.

Nvidia's stock chart reveals warning signs

Nvidia's future is bright, but stocks are forward-looking, and arguably, the rapid advance in Nvidia's shares reflects at least some of the company's future opportunities.

For this reason, Nvidia shares may, at a minimum, be due for a pause.

More AI Stocks:

- Analysts revamp C3.ai stock price targets after earnings

- Analyst overhauls Nvidia stock price target after conference

- AMD stock analysts overhaul price targets after China news

Kamich, a technical analyst, analyzes the market based on his evaluation of price and volume trends. He's used technical analysis to evaluate markets for over 50 years.

In February, Kamich said Nvidia's stock price could reach $757. We significantly eclipsed that target, so Kamich updated his levels last month and more recently in early April.

Kamich's analysis last month suggested that price charts suggested sellers existing at $950, with the risk of additional selling happening if Nvidia's stock price dropped below $915, $875, and $855.

Now that Nvidia's shares are nearly $853, he thinks the risk may have increased.

"[Nvidia's] historic rise may be reversing," wrote Kamich. "The trading volume declined in March and the On-Balance-Volume (OBV) line stalled while prices made new highs. This move to new highs on weaker volume is not a positive development. The turn lower for the Moving Average Convergence Divergence (MACD) oscillator is another problem for the bulls."

On-balance volume is essentially up-minus-down-day volume, while MACD is a momentum indicator. Kamich would like to see OBV climbing and MACD positive as share prices increase.

Kamich's point-and-figure chart price target for Nvidia isn't reassuring, either. Using a daily P&F chart, Kamich calculated a downside price target near $821.

"NVDA was a "leadership" stock on its way north and now it might become a leadership stock on its way south," bluntly warned Kamich. "Don't fight the tape is my best advice."

Related: Veteran fund manager picks favorite stocks for 2024

.png?w=600)